On November 20, many customers with payment accounts at the Bank for Investment and Development of Vietnam (BIDV) were upset to receive SMS notifications of balance changes, with the content “BSMS Service Fee for October 2024” with the fee for October being several times higher than in previous months.

Sharing on social media, Ms. Nguyen Thi H., owner of a flower shop in Hanoi, was surprised: “Wow, BIDV charged 1.1 million VND for the BSMS fee? It used to be only 9,000 VND (9,000 VND/month – PV).”

Similarly, Ms. Do Thi V., an online seller in Hai Duong, said that she received a notification deducting 622,000 VND from her BIDV account for the “BSMS Service Fee for October 2024”. She was shocked by the sudden increase in the service fee for October.

Speaking to the media, a BIDV representative said that since September 2024, the bank has been notifying customers about the new fee policy through various channels such as the bank’s website, app, SMS, and email.

“BIDV has also instructed customers on how to receive balance change notifications through the app, which is very convenient, safe, and free of charge,” the representative added.

On September 15, BIDV announced an increase in BSMS service fees starting from October. The bank explained that the fee adjustment was made to align with the telecommunication providers’ SMS fee structure and market practices.

BIDV announces changes to BSMS fee structure from October 1, 2024. Screenshot. |

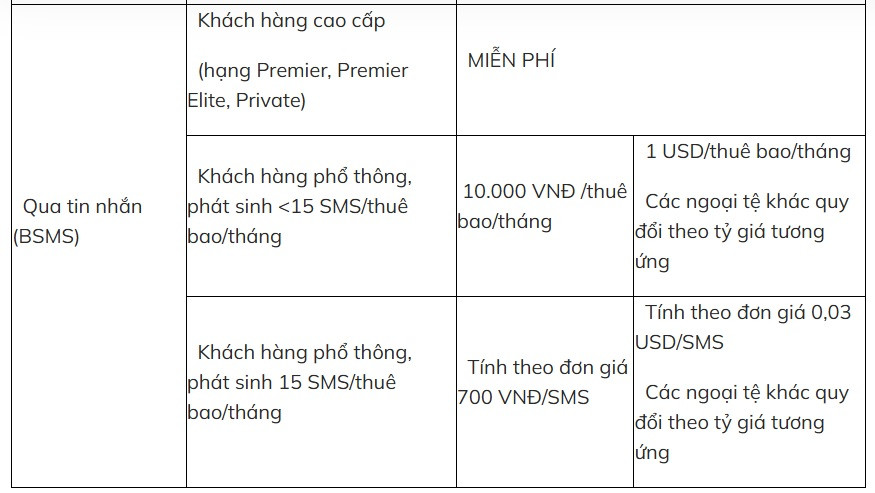

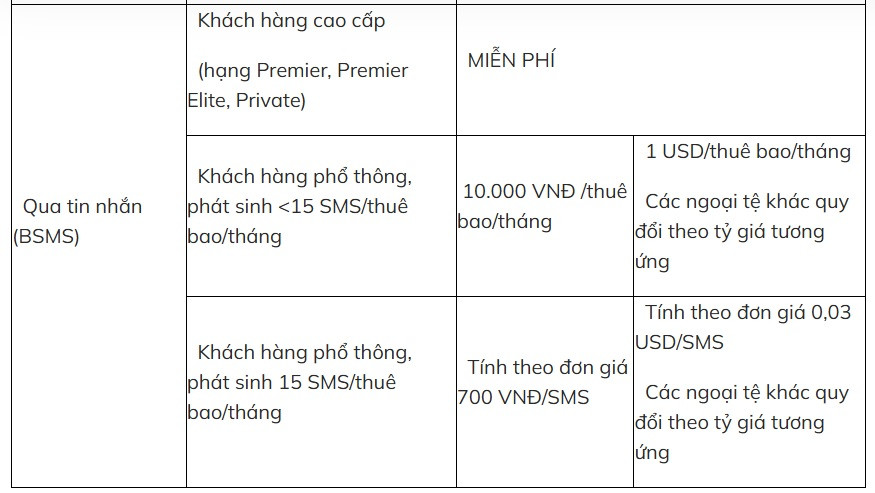

According to the new policy, from October 1, regular customers with less than 15 SMS notifications/subscription/month will be charged a fixed fee of 10,000 VND/month.

Regular customers with 15 or more SMS notifications/subscription/month will not be charged the above fixed fee. Instead, BIDV will charge based on the actual number of notifications at a rate of 700 VND/SMS.

The new policy could result in monthly fees of up to one million VND for sellers with a high volume of transactions, such as Ms. H. and Ms. V. mentioned above. To avoid paying a high fee for this service, customers can cancel the balance change notification service by logging into the BIDV SmartBanking app, going to the “Balance Changes” section, and selecting “Cancel Subscription.”

To monitor balance changes, customers can opt for free notification services on digital banking applications (OTT messages).

The bank stated that it would only send SMS notifications for balance changes for transactions of 30,000 VND and above.

BIDV is not alone in adjusting SMS banking fees; several commercial banks, including Vietcombank, ACB, VietinBank, Agribank, Sacombank, VPBank, Nam A Bank, OCB, and Eximbank, have also changed their SMS banking fee structures since the beginning of this year. Most banks now charge based on the actual number of messages sent.

The fee for SMS notifications of balance changes in deposit and payment accounts is a service provided and charged by third-party telecommunication providers. In the past, banks subsidized a portion of this fee to encourage the use of electronic payments. However, with the increasing trend of cashless payments, banks are now bearing heavier losses for these subsidies.

In addition to adjusting SMS banking fees to match the actual number of messages sent by each customer and reduce SMS charges, another important reason for the change is to prevent fraud, deception, and theft of personal and account information.

Previously, from March 2, 2022, commercial banks and telecommunications enterprises had agreed on a fixed package fee of 11,000 VND/month (including VAT) with unlimited messages for using cashless payment services. However, recently, banks have stopped applying this policy, and the change has caught many customers off guard, resulting in unexpected balance change notification fees of up to millions of Vonds.

Tuân Nguyễn

The Ultimate Banker: Techcombank and Another Private Bank Make the Top 10 Cut Across Key Metrics, Including Total Assets, Market Capitalization, CASA, ROA, ROE, and Asset Quality.

“While size may matter, it’s not the be-all and end-all when it comes to banking efficiency. Statistical data reveals that bigger isn’t always better – larger banks don’t necessarily equate to top-tier operational performance.”

A Real Estate Company Owes Bad Debt of Over 5.7 Trillion VND at BIDV

The collateral for the loan includes a renowned real estate project in Ho Chi Minh City, once dubbed the “tropical paradise” of South Saigon.

The Race to Reach a Capital Ownership Milestone: Vietnam’s Next Trillion-Dong Bank

As of the end of September, six Vietnamese banks boasted equity capital of over VND 100,000 billion: Vietcombank, Techcombank, VPBank, VietinBank, BIDV, and MB. These financial powerhouses have solidified their standing as the country’s preeminent lenders, each with a formidable war chest that underscores their dominance in the industry.