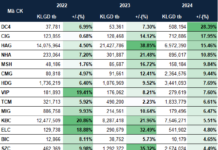

| VN-Index sees consecutive strong rebounds |

|

Source: VietstockFinance

|

The stock market witnessed a strong rebound in the afternoon session, with the VN-Index continuously gaining points from the 1,217 level. At the close, the VN-Index reached 1,228.33, up 11.79 points (0.97%), marking the second consecutive significant rebound.

Also on a positive note, the HNX-Index increased by 0.47 points (0.21%) to 221.76, while the UPCoM-Index rose by 0.41 points (0.45%) to 91.5.

The market was flooded with green as 476 stocks advanced (20 hitting the ceiling), far outpacing 231 declining stocks (11 hitting the floor), while 902 stocks remained unchanged.

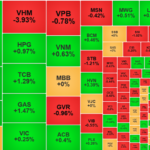

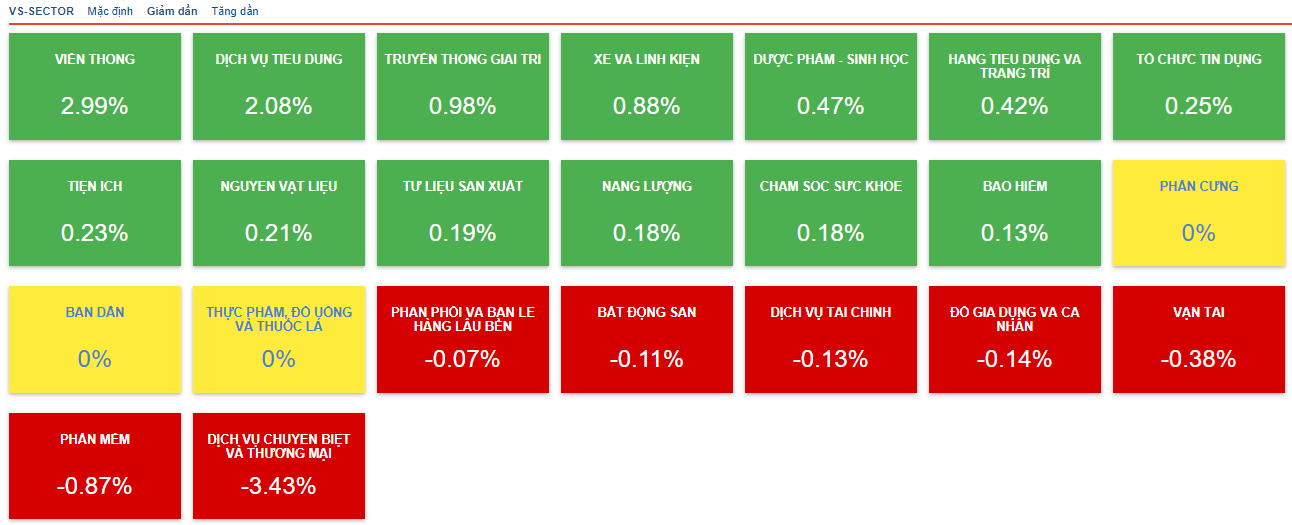

Looking at the market map in terms of transaction value, it can be seen that large-cap sectors attracted a significant amount of capital inflows, contributing to today’s gains. This is evident as the VN30-Index rose by 1.17%, outperforming the VN-Index.

The top stocks positively impacting the VN-Index included several banks such as CTG with over 1.3 points, VPB with nearly 1 point, TCB with 0.6 points, MBB with nearly 0.6 points, BID with almost 0.5 points, and ACB with nearly 0.4 points. Additionally, other large-cap stocks like MWG, HVN, GVR, and HPG also made positive contributions to the overall score.

| Top stocks influencing the VN-Index |

Despite the strong market gains, liquidity seemed to be missing today, in line with investors’ expectations of a futures expiry session. As a result, only about 550 million shares were traded, corresponding to a value of nearly VND 13,445 billion.

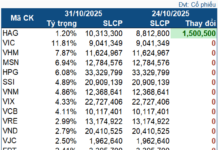

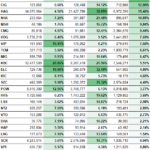

In this context, foreign investors’ trading volume also narrowed compared to previous sessions, with a buying value of over VND 1,397 billion and a selling value of over VND 2,330 billion. However, the final outcome of net selling of nearly VND 933 billion is still a relatively large figure.

Today’s net selling pressure was concentrated in VHM, with more than VND 587 billion, far surpassing other stocks that also experienced strong net selling, including SSI with over VND 123 billion, HPG with over VND 110 billion, and KBC and MWG both approaching VND 100 billion.

| Top 10 stocks with the strongest foreign net buying/selling on November 21, 2024 |

Overall, the market continued its “positive recovery” from the 1,200-point support level, and the developments in the coming sessions remain highly anticipated.

Morning session: Investors remain on the sidelines after bottom-fishing?

At the end of the morning session, the indices turned green but only slightly above the reference level. The market did not see many stocks with dramatic movements.

VN-Index edged up 1.21 points to 1,217.75. The market breadth tilted slightly towards the buy side, with 292 gainers (9 hitting the ceiling) and 254 losers (9 hitting the floor), while 1,064 stocks remained unchanged.

The gains were relatively evenly distributed, with no significant movements in large-cap stocks. Many large-cap stocks in the banking, steel, and retail sectors posted slight increases. Similarly, on the downside, the declines were not too deep, creating a balanced state.

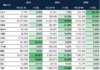

Currently, the top two performing sectors are telecommunications (2.99%) and consumer services (2.08%), while all other sectors rose by less than 1%. Notably, sectors with significant market capitalization also saw modest gains, such as credit institutions up by 0.25%, materials up by 0.21%, and insurance up by 0.13%…

In the group of declining sectors, specialized services and commerce fell by 3.43%, creating a significant gap with the rest. Among the few declining sectors in the morning session, real estate stood out with a decrease of 0.11%, and financial services fell by 0.13%.

Source: VietstockFinance

|

During the futures expiry, the futures indices also exhibited slight fluctuations. Investors are expecting more definitive trends to emerge in the afternoon session.

10:40 am: Continued tug-of-war, liquidity “pressure drop”

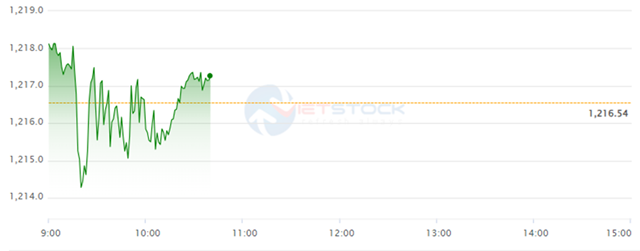

The market continued to fluctuate between green and red in the first half of the morning session, but the trend seemed positive as subsequent lows were higher than previous lows.

|

VN-Index fluctuated

Source: VietstockFinance

|

As of 10:40 am, the VN-Index temporarily rose by 0.59 points (0.05%) to 1,217.13, the HNX-Index increased by 0.13 points (0.06%) to 221.42, and UPCoM climbed by 0.34 points (0.37%) to 91.43.

Liquidity “pressure drop” occurred as predicted by most investors in the futures expiry session, with just over 132 million shares traded, corresponding to a value of more than VND 2,841 billion.

There were 15 advancing sectors, outnumbering the 5 declining sectors and 3 unchanged sectors.

Telecommunications led the gains, surging by 3.14%, driven by VGI (+3.65%), FOX (+1.45%), CTR (+1.12%), and SGT (+2.07%). This was followed by the consumer services sector, which rose by 2.66% thanks to the strong performance of DSP (+13.64%), HOT (+14.19%), PDC (+4%), VLA (+4.17%), and TSD (hitting the ceiling).

On the other hand, specialized services and commerce posted the steepest decline, falling by nearly 2% as VEF dropped by 2.21% and VGV plunged by 6.82%…

Foreign investors continued to net sell, with a net selling value of nearly VND 410 billion up to the present. This was mainly due to net selling pressure in VHM of nearly VND 118 billion, as well as net selling in HPG of nearly VND 45 billion, SSI of nearly VND 40 billion, and FPT of nearly VND 37 billion…

Opening: Fluctuations at the start, what’s next after the rebound?

After rebounding by more than 11 points yesterday, the VN-Index entered November 21 with fluctuations, alternating between green and red. Today’s movements are closely watched by investors, especially as it is a futures expiry session.

|

VN-Index fluctuated at the start of November 21

Source: VietstockFinance

|

As of 9:30 am, the indices were hovering slightly below the reference level after several ups and downs. Specifically, the VN-Index decreased by 0.68 points (0.06%) to 1,215.86, while the HNX-Index rose by 0.42 points (0.19%) to 221.71, and UPCoM climbed by 0.13 points (0.15%) to 91.23. The market breadth showed 258 gainers, 149 losers, and 1,203 unchanged stocks.

Market liquidity was not too vibrant, with over 41 million shares traded, corresponding to a value of nearly VND 683 billion. Point fluctuations and liquidity are keenly watched during futures expiry sessions, and the usual scenario involves unpredictable index movements and cautious liquidity.

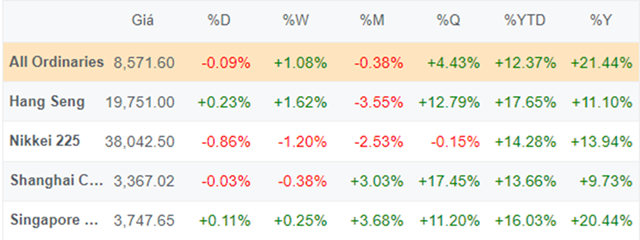

Asian markets opened mostly lower, with the Nikkei 225 down 0.86% to 38,042.5, the Shanghai Composite dipping 0.03% to 3,367.02, while the Hang Seng and Singapore Straits Times edged up 0.23% and 0.11% to 19,751 and 3,747.65, respectively.

|

Opening movements of Asian markets

Source: VietstockFinance

|

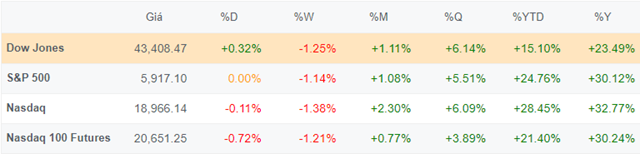

Last night, US stock markets were mostly flat, with the S&P 500 remaining nearly unchanged at 5,917.11 points, while the Dow Jones gained 139.53 points (equivalent to 0.32%) to 43,408.47 points. The Nasdaq Composite lost 0.11% to 18,966.14 points.

All eyes are on Nvidia, a favorite AI company. Its earnings report could be more meaningful than some key economic reports, given the company’s market capitalization of $3.6 trillion. Its results could shape the market trend for the rest of the week.

|

S&P 500 remained flat ahead of Nvidia’s earnings report

Source: VietstockFinance

|

The Ultimate Guide to Profiting from the Stock Market: Catching Bottom Fishers and Riding the Wave of Real Estate Stocks

The morning’s tug-of-war continued into the afternoon session, with the market cautiously awaiting the reaction of bottom-fishing funds. The T+ day witnessed a market decline, breaching the 1200-point level. In a surprising turn of events, foreign investors turned net buyers in the latter part of the day, reversing the net trading position from the entire session.

The Art of Trading: Navigating the Stormy Seas of Short-Term Risks

The Asean stock market is expected to witness short-term rebounds in the coming sessions. However, investors are advised to remain cautious and avoid a buying frenzy or panic-selling in their short-term trades.