Technical Signals of VN-Index

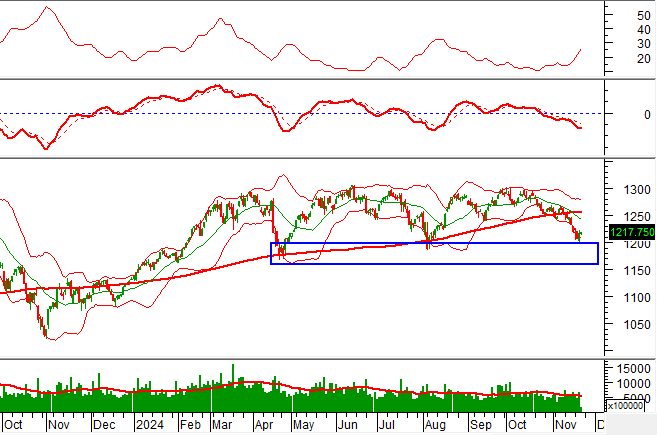

In the trading session on the morning of November 21, 2024, the VN-Index rose, and a Doji candlestick pattern emerged, with a slight drop in trading volume in the morning session, indicating investors’ hesitation.

Additionally, the ADX indicator is moving in the gray area (20 < adx < 25), suggesting a lack of trend strength and potential range-bound movement.

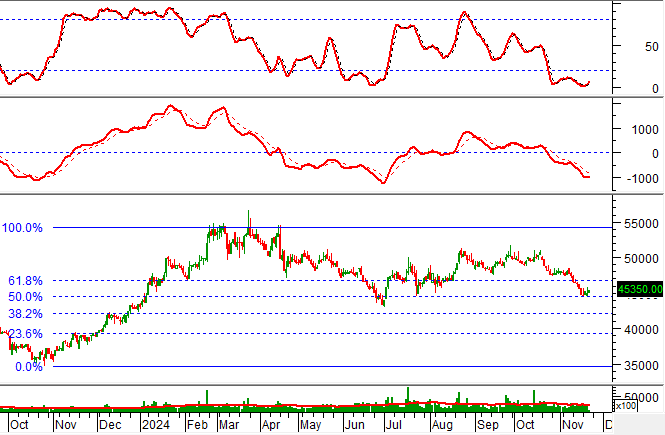

Technical Signals of HNX-Index

On November 21, 2024, the HNX-Index witnessed a slight increase, forming a Doji candlestick pattern, while trading volume significantly dropped in the morning session, reflecting investors’ cautious sentiment.

Currently, the Stochastic Oscillator indicator gives a buy signal, indicating that the situation has become less pessimistic.

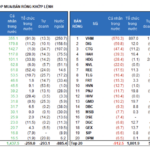

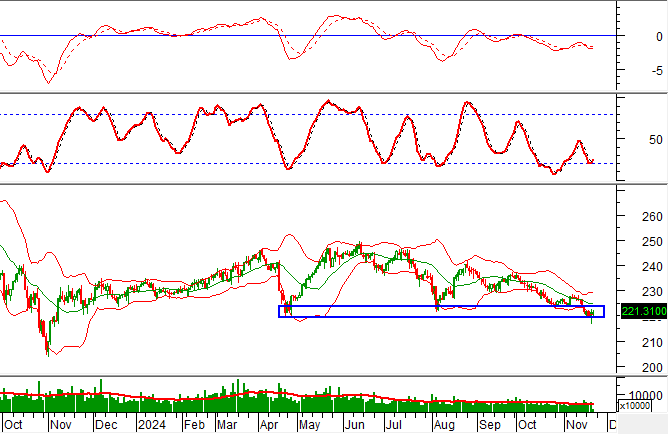

BID – Joint Stock Commercial Bank for Investment and Development of Vietnam

On the morning of November 21, 2024, BID witnessed a price increase, while trading volume significantly dropped, indicating investors’ caution. The Stochasitc Oscillator indicator now gives a buy signal in the oversold region, suggesting that short-term prospects have become less pessimistic.

At the moment, the stock price is retesting the 50% Fibonacci Projection level (corresponding to the 43,500-45,500 range) while the MACD indicator is gradually narrowing the gap with the signal line. If a buy signal reappears, a recovery scenario may unfold in the upcoming sessions.

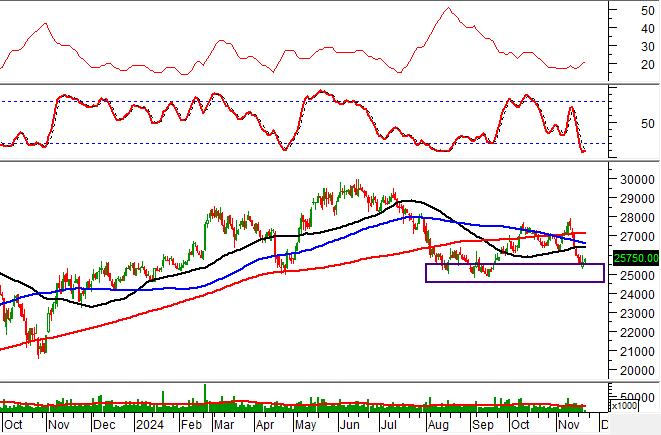

HPG – Hoa Phat Group Joint Stock Company

On November 21, 2024, HPG witnessed a price increase, while trading volume significantly dropped in the morning session, indicating investors’ caution. The stock price is witnessing a tug-of-war as it retests the old bottom from September 2024 (corresponding to the 24,500-25,500 range) while the ADX indicator moves in the gray area (20 < adx < 25), suggesting a lack of trend strength.

Technical Analysis Department, Vietstock Consulting Department

The Ultimate Guide to Profiting from the Stock Market: Catching Bottom Fishers and Riding the Wave of Real Estate Stocks

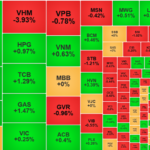

The morning’s tug-of-war continued into the afternoon session, with the market cautiously awaiting the reaction of bottom-fishing funds. The T+ day witnessed a market decline, breaching the 1200-point level. In a surprising turn of events, foreign investors turned net buyers in the latter part of the day, reversing the net trading position from the entire session.

The Capital is Crumbling: VN-Index Plunges Towards the 1200-Point Region

The large-cap stocks’ plunge today erased the gains from yesterday’s bargain hunting session. VN-Index fell sharply by nearly 12 points to 1205.15, as foreign investors offloaded a net sell of VND 1,658 billion. To make matters worse, the trading volume on the HoSE plunged to a two-week low.