The fertilizer industry is currently exempt from VAT taxation, which benefits end-users but does not allow fertilizer producers to claim tax refunds. Raw materials account for approximately 50-80% of the total production cost, with natural gas, coal, and phosphate ore being the primary inputs for fertilizer production.

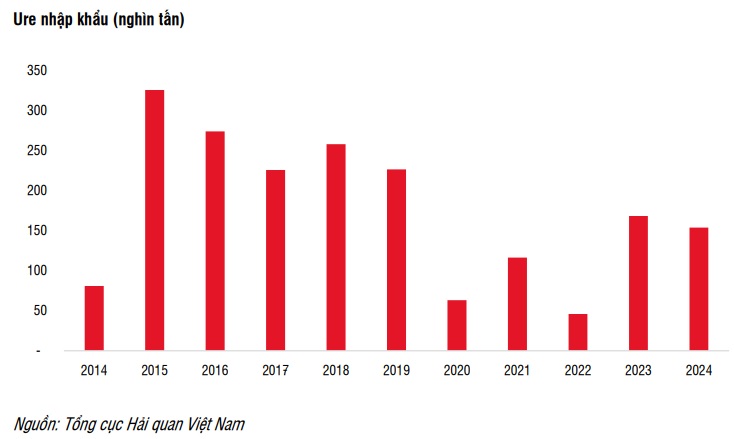

Since January 2015, domestic fertilizer producers have been unable to claim tax deductions, resulting in higher production costs and reduced competitiveness compared to imported fertilizers. Foreign fertilizer manufacturers, on the other hand, can claim VAT refunds for their production costs in their respective countries.

To protect the domestic fertilizer market, ensure food security, and reduce reliance on imports, a proposal to amend the VAT tax regulation (from tax exemption to a 5% VAT rate) for fertilizer companies was presented to the National Assembly in June 2024 and further discussed in the November 2024 meeting.

According to SSI Research, during the National Assembly’s 8th session in November 2024, most voters expressed their desire to protect the domestic fertilizer market from intense competition from imported products, which translates to supporting the proposed change in VAT tax regulation.

SSI Research analyzes that shifting from “VAT exemption” to “5% VAT” will lead to higher fertilizer prices. However, the two leading fertilizer producers, Đạm Phú Mỹ (HOSE: DPM) and Đạm Cà Mau (also known as Phân bón Cà Mau, HOSE: DCM), believe that in the context of fierce competition between domestic and imported fertilizers, local enterprises may opt to reduce selling prices before adding the 5% VAT. This would provide some support to farmers.

Consequently, the actual increase in domestic fertilizer selling prices will be lower than that of imported fertilizers, encouraging farmers to use domestically produced fertilizers.

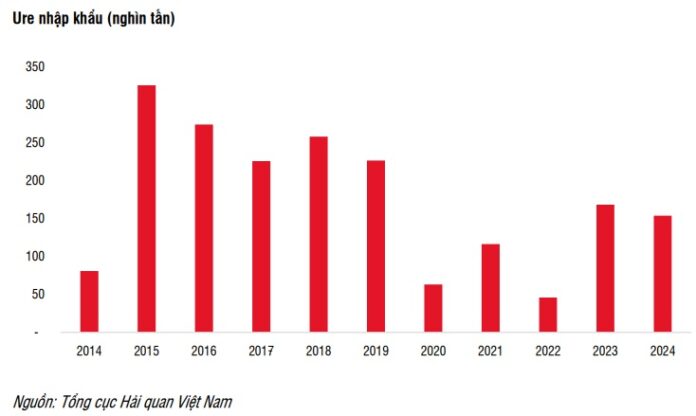

Regarding the manufacturing companies, SSI Research argues that the legal change will enhance the competitiveness of domestic fertilizers, supporting the growth of consumption volume. Currently, imported fertilizer prices are 3-5% lower than domestic ones. In the event of intense competition with imports, as witnessed during 2015-2019, domestic fertilizer producers, after being refunded for VAT, may opt to reduce selling prices before adding the tax. This would narrow the price gap with imports and incentivize farmers to choose domestic fertilizers.

Additionally, manufacturers can claim VAT refunds on production costs, primarily benefiting ure and DAP producers, as they are natural resource-based (natural gas, coal, and phosphate ore). Meanwhile, the impact on NPK manufacturers is considered insignificant, as their primary raw material is single fertilizers (ure, single superphosphate, and potash), making VAT’s effect on NPK production costs negligible.

Profit Increase Potential

Given the discussions at the 8th National Assembly session in November 2024, where most voters expressed their desire to protect the domestic fertilizer market, SSI Research anticipates that the government will amend the VAT tax regulation. The new regulation is expected to come into effect from July 2025.

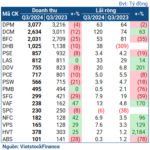

Leading fertilizer companies such as DPM and DCM are poised to benefit from this regulatory change. According to SSI, in the first nine months of 2024, both DPM and DCM witnessed a recovery in profits from the 2023 lows due to rising urea prices, improved margins in proprietary fertilizer segments, and reduced depreciation expenses.

Looking ahead to 2025, SSI Research expects the recovery in urea prices and proprietary fertilizer margins to continue, albeit at a slower pace. If the VAT tax regulation is amended, these two industry leaders could potentially increase their profits by VND 259 billion and VND 200 billion, respectively, resulting in profit growth of 50% and 29% year-over-year.

“The Fertilizer Industry’s Plea: Remove the 5% VAT or Risk Our Decline and Halt Production.”

The latest amendments to the Value-Added Tax Law fail to address the long-standing issue faced by the domestic fertilizer industry. As a result, this vital sector continues to be discriminated against, excluded from the scope of value-added tax applicability. This exclusion puts the industry at risk of reverting to the decline and stagnation witnessed during 2015-2020, threatening its very survival.

‘Harvesting’ Dividends from Subsidiaries, Minh Phu – the ‘Shrimp King’ Reports a Windfall Third-Quarter Profit

Minh Phu reports a remarkable post-tax profit of over 198 billion VND for Q3 2024, a significant improvement from the 13.3 billion VND loss incurred in the same quarter last year. This impressive growth is largely attributed to the dividends received from its subsidiary companies, showcasing the strength and diversity of their business portfolio.

Presenting an Enticing Offer: BAF Proposes the Sale of 65 Million Shares at VND 15,500 Each

The amount of VND 1,007.5 billion raised will be used to purchase feed, additives, and materials for pig farms, totaling VND 557.5 billion. Additionally, VND 450 billion will be allocated to buying piglets, weaners, and breeding pigs. The disbursement of these funds is planned to take place from the fourth quarter of 2024 through to the fourth quarter of 2025.