80% of Stocks in the VN30 Enter Long-Term Uptrend

In the first trading session after the holiday (September 4th), concerns about the US economic outlook caused the market to gap down, with the VN-Index closing at 1,275.8 points (-8.07 points). Following the frustrating sideways trading sessions last week, these new movements are contributing to heightened caution among investors.

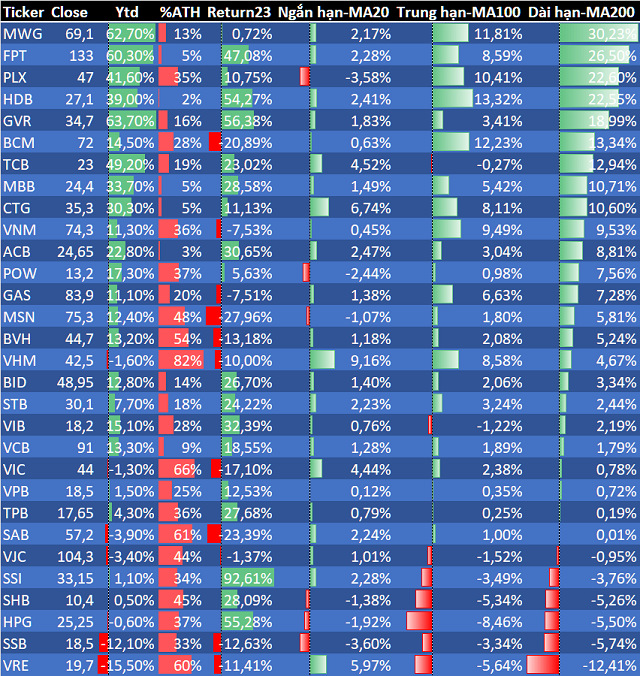

However, a statistic from the VN30 group of large-cap stocks indicates strong support from these stocks over the past year. Specifically, since the trading session on August 28th, 24 out of 30 stocks in the VN30 basket have been in a long-term uptrend (above the 200-day moving average), equivalent to a ratio of 80%.

As of September 4th, 80% of VN30 stocks remain in a long-term uptrend

|

The last time the VN30 basket achieved an 80% ratio of stocks in a long-term uptrend was in June 2024, when the VN-Index failed to hold the 1,300-point mark, managing to stay above it for only two trading sessions on June 12th and 13th.

In the previous attempts to breach the 1,300-point level in March and July of this year, the VN30 basket recorded less than 70% of stocks in a long-term uptrend.

This indicates that the large-cap stocks in the VN30 basket are currently providing the strongest support to the market in the past year. If stocks that are close to the threshold of a long-term uptrend, such as SSI, VJC, and HPG, improve their price performance, the ratio of supportive stocks could be even higher.

It is worth noting that in the most recent period when this ratio exceeded 80%, from July to September 2023, the stock market witnessed some of the most exciting movements of that year.

Fundamental Factors Supporting the Market’s Conquest of the 1,300-Point Level

Regarding the market outlook after the National Day holiday, Mr. Nguyen The Minh, Director of Individual Customer Analysis at Yuanta Vietnam Securities, maintained a positive view. According to Mr. Minh, the VN-Index will soon surpass the 1,300-point threshold.

There are three main reasons for investors to be optimistic in the coming period. Firstly, the exchange rate has cooled down significantly this time, unlike the previous instances when it remained high as the market approached the 1,300-point mark. Currently, the selling price of USD has returned to around VND 25,000/USD.

In addition to positively impacting the economy, the exchange rate has also reduced the selling pressure on foreign investors.

Secondly, the valuations of the market, especially the banking and securities groups, have become more attractive. Currently, the price-to-earnings ratios of these two groups are hovering around 1.5 times, indicating further upside potential.

Last week, the banking group received additional support from the State Bank’s decision to allow banks that have achieved at least 80% of their announced credit growth targets for 2024 to expand their credit growth limits. Moreover, banks are also poised to improve their non-performing loan ratios and net interest margins in the final quarter of the year.

For the securities group, the implementation of pre-funding solutions and the positive assessment from FTSE have provided a boost. Although the official upgrade may be postponed until next year, it still contributes to a subtle positive sentiment among securities stocks.

Lastly, the recovery of the real estate group suggests that the risks in this sector are gradually fading. The Vingroup stocks are currently leading the sector, and the laws that came into effect after August 1st are gradually resolving the difficulties and obstacles that emerged in 2022. According to Mr. Minh, while the real estate industry has shown positive signs, it still needs more time to enter a new cycle.

Quan Mai