|

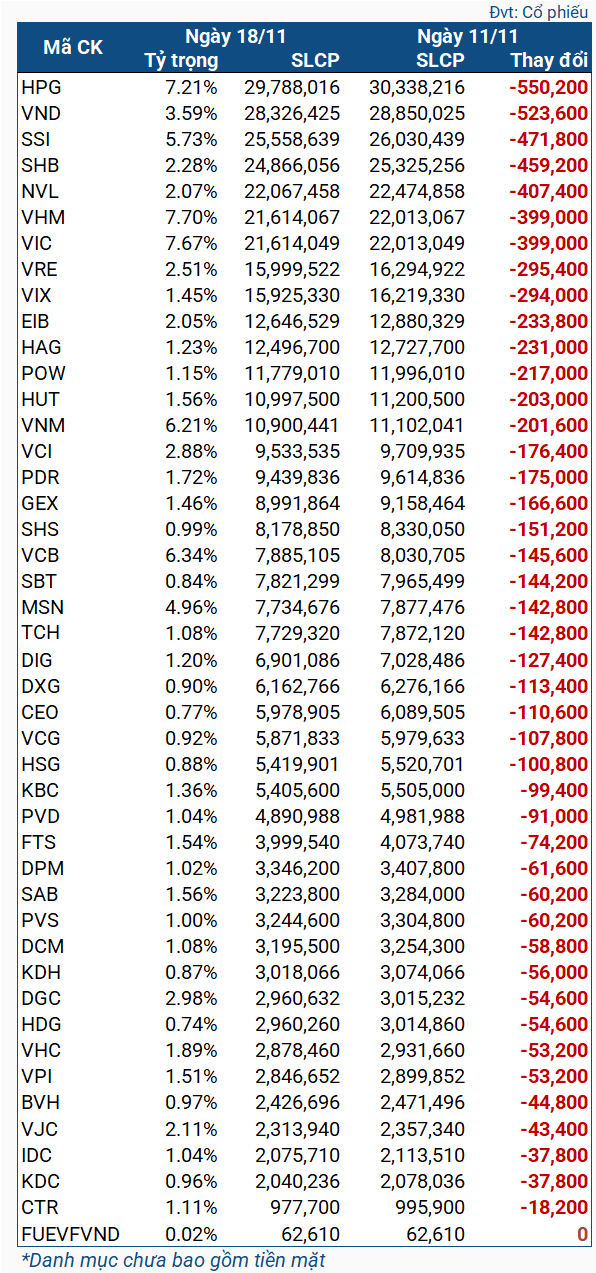

VNM ETF Stock Changes from 11-18/11

|

VNM ETF has offloaded its entire stock portfolio, with HPG experiencing the most significant sell-off, exceeding 550,000 shares. VND followed closely with 524,000 shares sold. SSI, SHB, and NVL also stood out with sales of over 400,000 shares each. Additionally, two Vin Group stocks, VIC and VHM, were each sold off at 399,000 shares.

The Fund’s sell-off aligns with the offloading trend observed among foreign investors, marking their 26th consecutive session of net selling, with a value of nearly VND 1,500 billion. The selling spree showed no signs of abating, as foreign investors continued to offload their holdings in the following two sessions.

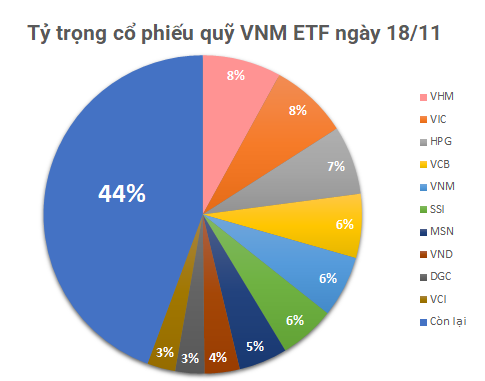

As of November 18, VNM ETF’s net asset value stood at nearly $434 million, a decrease from the $460 million recorded on November 11. The entire portfolio comprises Vietnamese stocks distributed across 45 stock codes and one fund certificate. The top holdings by weight were VHM (8%), VIC (7.93%), HPG (6.98%), VCB (6.51%), VNM (6.25%), and SSI (5.65%).

Chau An

The Ultimate Guide to Profiting from the Stock Market: Catching Bottom Fishers and Riding the Wave of Real Estate Stocks

The morning’s tug-of-war continued into the afternoon session, with the market cautiously awaiting the reaction of bottom-fishing funds. The T+ day witnessed a market decline, breaching the 1200-point level. In a surprising turn of events, foreign investors turned net buyers in the latter part of the day, reversing the net trading position from the entire session.

The Inheritance: Chairman Nguyen Hung Cuong Accepts Over 11 Million DIG Shares

As of the trading session’s close on November 19, 2024, Mr. Nguyen Hung Cuong, Chairman of the Board of Directors of DIC Corp, had just inherited over 11 million DIG shares.