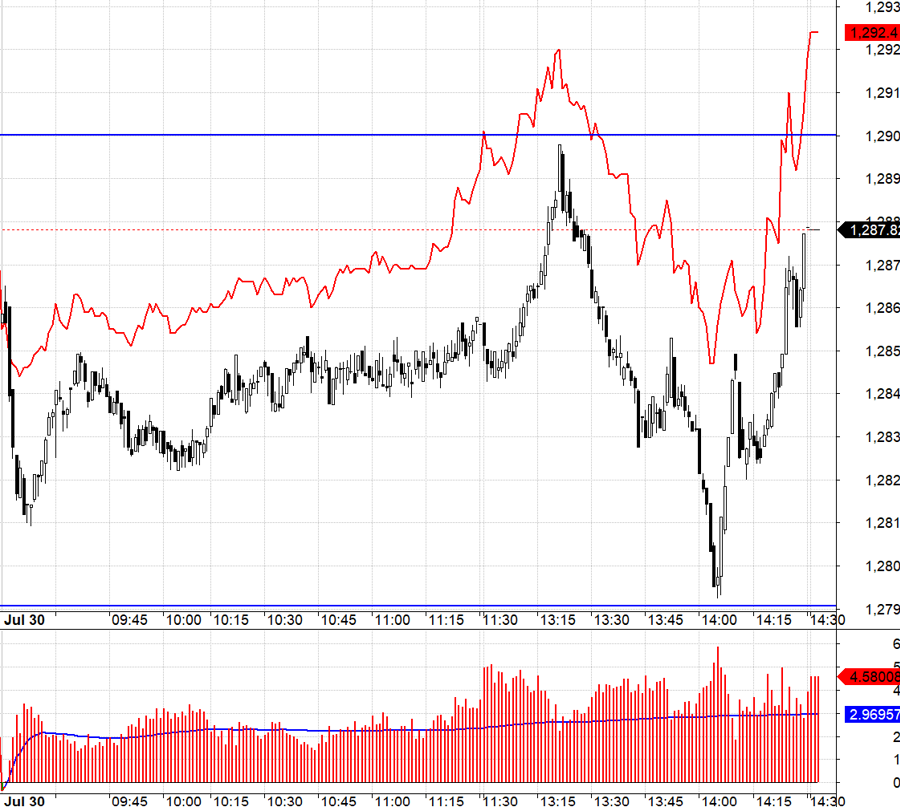

The VN-Index witnessed a mild recovery attempt, but the green hue was not strong enough to motivate the market during the afternoon trading session, resulting in a sharp decline. This has been a recurring pattern in the stock market over the past few days.

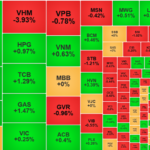

At the close of the trading session on November 19, the VN-Index plunged to 1205.15, a loss of 11.97 points from the previous session. The market breadth tilted towards negativity, with 16 out of 18 sectors witnessing declines. Among them, the information technology sector experienced the steepest drop.

VN-Index is predicted to retreat to the 1,180-point level in the next few sessions.

In the preceding days, the VN-Index had also been falling, consistently breaching support levels as forecasted by securities companies, and plummeting towards the 1,200-point mark.

The foreign transaction was particularly negative, and no one could predict when the net selling would end. On November 19, both HSX and HNX continued their net selling streak.

“The trading session on November 19 witnessed a significant downward trend, indicating that the reversals seen on the previous day were not yet trustworthy. If the support range of 1200-1190 is not maintained, the VN-Index may continue to fall further, testing more distant support levels (around 1180 points),” assessed the Joint Stock Commercial Bank for Investment and Development of Vietnam Securities Company (BSC).

BSC’s weekly market report, released on November 18, also presented a dismal statistic: Foreign investors maintained a high net sell-off, reaching 157 million USD compared to 136 million USD in the previous week. This prompted several securities companies to advise investors to trade cautiously in the coming sessions, especially given the VN30’s immersion in red during most trading sessions; market liquidity decreased.

BSC also opined that if buying force increases at the support zone, the market might witness a short-term technical rebound. However, a sustainable upward trend would only occur with significant improvements in liquidity and market sentiment.

The trading value on the HoSE floor during the previous session reached approximately 13,248.1 billion VND, a 14.84% decrease compared to the previous session. The proprietary trading groups followed the net selling trend of foreign investors, offloading a large volume of stocks worth around 193.3 billion VND. The pressure to take short-term profits and the perspective of the Chairman of the US Federal Reserve Board seemed to dampen the enthusiasm from the US stock market, spreading to many other countries, and this sentiment is likely to persist until the end of this week.

Given these indices and realities, today’s trading session (November 20) does not present many positive signals in the stock market, except for some sporadic information, such as: Novaland’s shares surged as the Aqua City project overcame legal obstacles.

The Optimistic Outlook: Can We Expect a Positive Shift?

The VN-Index surged amidst a recent spate of losses, indicating a strong rebound. Accompanying this rise was a surge in trading volume, surpassing the 20-day average, signifying a return of liquidity to the market. The Stochastic Oscillator, a key technical indicator, has now entered oversold territory and is signaling a buy. Should this indicator continue to climb, we can expect a further positive shift in market sentiment.

The Market Beat: A Resilient Market Bounces Back, Easing Traders’ Concerns.

The market is finally showing signs of recovery, with a rebound of over 20 points in the last two sessions, offering a glimmer of hope after a challenging period of consistent losses. However, this recovery is not without its concerns, as trading volume has noticeably dropped, indicating a potential lack of conviction in the market’s upward trajectory.

The Ultimate Guide to Profiting from the Stock Market: Catching Bottom Fishers and Riding the Wave of Real Estate Stocks

The morning’s tug-of-war continued into the afternoon session, with the market cautiously awaiting the reaction of bottom-fishing funds. The T+ day witnessed a market decline, breaching the 1200-point level. In a surprising turn of events, foreign investors turned net buyers in the latter part of the day, reversing the net trading position from the entire session.