Market liquidity decreased compared to the previous trading session, with the VN-Index‘s matched trading volume reaching over 530 million shares, equivalent to a value of more than 12.6 trillion VND; the HNX-Index reached over 53 million shares, equivalent to a value of more than 879 billion VND.

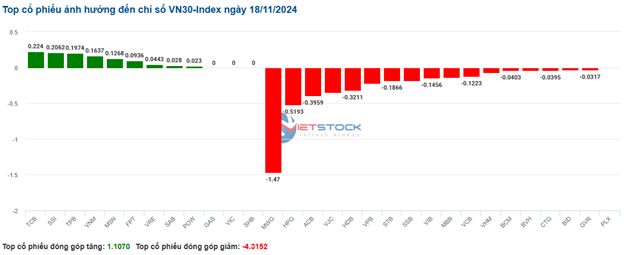

The VN-Index opened the afternoon session with buying demand returning, helping to pull the index back towards the reference level, but it still closed in the red. In terms of impact, VCB, MWG, BID, and KBC were the most negative stocks, taking away more than 2.9 points from the index. On the other hand, VHM, TPB, CTG, and GAS were the most positive stocks, contributing more than 1.3 points to the overall index.

| Top 10 stocks with the strongest impact on the VN-Index on November 18, 2024 |

In contrast, the HNX-Index had a rather optimistic performance, with positive impacts from stocks such as MBS (+3.77%), CEO (+1.42%), TMB (+8.73%), and BVS (+3.23%)…

|

Source: VietstockFinance

|

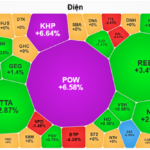

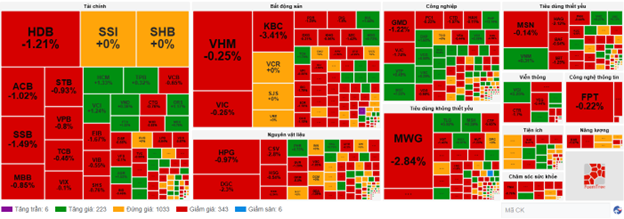

The non-essential consumer goods sector saw the biggest decline in the market, falling by -0.7%, mainly due to MWG (-1.67%), GEX (-1.9%), DGW (-1.7%), and PLX (-1.82%). This was followed by the healthcare and energy sectors, which decreased by 0.41% and 0.18%, respectively. On the other hand, the industrial sector witnessed the strongest recovery in the market, rising by 0.95% with green signals from VTP (+0.41%), VCG (+0.29%), MST (+7.55%), and CII (+1.08%).

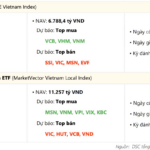

In terms of foreign trading, they continued to net sell over 1,213 billion VND on the HOSE exchange, focusing on SSI (264.92 billion VND), VHM (235.89 billion VND), HDB (145.39 billion VND), and MSN (104.56 billion VND). On the HNX exchange, foreigners net sold more than 17 billion VND, focusing on SHS (20.43 billion VND), IDC (3.34 billion VND), DTD (2.2 billion VND), and TNG (2.06 billion VND).

| Foreigners’ buying and selling activities |

Morning session: Continuing to find the bottom

The red color still dominated the main indices, and the pessimistic sentiment made buyers hesitant to enter the market, even though selling pressure was no longer strong. At the end of the morning session, the VN-Index temporarily fell to 1,207.89 points, a decrease of 0.88%; the HNX-Index decreased by 0.75%, reaching 219.87 points. The market breadth inclined towards the sell side, with 436 declining stocks and 205 advancing stocks.

Liquidity returned to low levels, with the VN-Index‘s matched trading volume in the morning session reaching over 234 million units, equivalent to a value of more than 5.7 trillion VND. The HNX-Index recorded a matched trading volume of nearly 26 million units, with a value of over 388 billion VND.

In terms of impact, MWG, VCB, and GVR were the most negative stocks, causing the VN-Index to lose more than 2 points. On the other hand, the positive side did not include the usual large-cap stocks, so the impact was insignificant. The 10 most positive stocks contributed less than 0.4 points to the overall index, led by HCM, TLG, and NVL.

Selling pressure dominated most industry groups. Among them, 4 out of 11 groups decreased by more than 1% at the end of the morning session, including non-essential consumer goods, energy, materials, and real estate. Many large-cap stocks continued to fall deeply, typically MWG (-4.51%), PLX (-1.56%), FRT (-1.57%); BSR (-1.57%), PVS (-2.06%); HPG (-1.16%), GVR (-1.77%), DGC (-2.56%), VGC (-3.2%); VHM (-1.12%), BCM (-2.06%), KBC (-6.3%), IDC (-3.58%), KDH (-1.53%),…

On the other hand, the industrial and telecommunications sectors were the only two industries that maintained a positive performance, thanks to the significant contributions of ACV (+1.72%), MVN (+2.44%), VEF (+2.62%), and VGI (+1.2%). The remaining stocks mostly could not escape the general downward trend.

In the financial sector, banking and insurance stocks remained in negative territory, while securities stocks were turning quite positive, notably HCM (+1.33%), VCI (+0.77%), FTS (+0.99%), BSI (+1.15%), CTS (+1.03%), AGR (+1.22%),…

Foreigners continued to net sell strongly in the context of weak liquidity, putting significant pressure on the index. The net sell value exceeded 957 billion VND on the HOSE exchange in the morning session alone, with the most sold-off stocks being HDB (-155.95 billion VND), SSI (-134.39 billion VND), VHM (-120.95 billion VND), and MWG (-119.44 billion VND). On the HNX exchange, foreigners also net sold more than 23 billion VND, focusing on IDC and SHS stocks.

| Top 10 stocks with the strongest foreign buying and selling in the morning session of November 18, 2024 (as of 11:30 am) |

10:45 am: VN-Index valuation at the lowest level in a year

The pessimistic trading sentiment continued, causing the main indices to remain weak and below the reference level. As of 10:40 am, the VN-Index decreased by 7.32 points, trading around 1,211 points. The HNX-Index decreased by 0.8 points, trading around 220 points.

The red color continued to dominate the stocks in the VN30 basket. Among them, MWG, HPG, ACB, and VJC had the most negative impact on the VN30-Index, taking away 1.47 points, 0.52 points, 0.39 points, and 0.35 points from the overall index, respectively. Conversely, TCB, SSI, TPB, and VNM were among the few stocks that remained in positive territory, but their impact was not significant.

Source: VietstockFinance

|

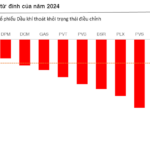

Currently, the market valuation has reached the lowest level in the past year, with the VN-Index‘s PE ratio standing at 12.06 times. Additionally, the VN-Index‘s performance has only achieved a return of over 6% since the beginning of the year.

Source: VietstockFinance

|

The energy sector witnessed the sharpest decline in the market, along with strong divergence. Selling pressure mainly focused on stocks such as BSR, which fell by 1.57%, PVS decreased by 1.18%, PSB dropped by 3.45%, and CST fell by 0.46%…

Following closely was the non-essential consumer goods sector, which also experienced a significant decline along with strong divergence. Selling pressure mainly focused on large-cap stocks such as MWG, which fell by 2.17%, GEX decreased by 2.17%, PNJ dropped by 0.22%, and TCM fell by 1.29%… Only a small portion of stocks managed to stay in positive territory, including MSH, GIL, VPG, and STK, but their gains were modest.

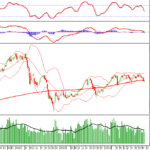

However, within the non-essential consumer goods sector, TLG stood out as a stock that surged in the early morning session of November 18, 2024, accompanied by a significant increase in trading volume, and continued to trade above its 20-session average volume. This indicated the presence of optimistic sentiment among investors. Moreover, the stock’s price continued to closely follow the upper band of the Bollinger Bands and reached a new high since its listing, while the MACD continued to rise and stayed above the zero line, providing a buy signal that further reinforced the long-term upward trend of TLG.

Source: https://stockchart.vietstock.vn/

|

On the opposite side, the telecommunications sector maintained a relatively positive recovery, with buying demand appearing in stocks such as VGI, which increased by 3.13%, TTN rose by 1.73%, MFS climbed by 3.31%, and VTK gained 1.59%….

Compared to the beginning of the session, the market witnessed a tug-of-war between buyers and sellers, with the latter slightly gaining the upper hand. There were 343 declining stocks and 223 advancing stocks.

Source: VietstockFinance

|

Opening: Tug-of-war from the beginning of the session

As of 9:30 am, the VN-Index slightly decreased, with cautious sentiment prevailing as it continuously fluctuated around the reference level. However, the index received positive contributions from the telecommunications and industrial sectors.

Large-cap stocks such as VHM, VNM, VIC, and VRE led the market, contributing more than 0.5 points to the index. On the other hand, stocks such as MWG, EIB, BCM, and VPB weighed on the market, causing a decrease of nearly 1 point.

Market Beat 25/11: Indecisive Sentiment Prevails, VN-Index Struggles to Break Out

The market ended the session on a positive note, with the VN-Index climbing 6.6 points (0.54%) to reach 1,234.7; while the HNX-Index gained 0.96 points (0.43%), closing at 222.25. The market breadth tilted in favor of gainers, with 423 advancing stocks against 288 declining ones. The large-cap stocks in the VN30 basket painted a similar picture, as 18 stocks added value, 5 declined, and 7 remained unchanged, resulting in a predominantly green sentiment.

“Unleashing the Power of Words: Vietstock Weekly 25-29/11/2024: Navigating Through Hidden Risks”

The VN-Index has staged a strong recovery since last week’s sharp decline. However, trading volume remains below the 20-week average, indicating that investors are still cautious. At present, the MACD indicator is signaling a sell, and it could potentially drop to the zero threshold. If it does breach this level, the risk of a short-term correction increases.

The Market Pulse: Adjustment Pressures Linger

The VN-Index closed with a slight decline amid a volatile session that saw significant fluctuations. The index also formed a High Wave Candle pattern, indicating investor indecision. The Stochastic Oscillator and MACD indicators continue to trend downward after generating sell signals, suggesting that the short-term outlook remains bearish.