The Standing Committee of the National Assembly recently provided feedback and suggestions for revisions to the draft Law on Value-Added Tax (VAT) Amendments. Most National Assembly deputies agreed that VAT should be imposed on fertilizers to protect domestic producers. However, some deputies disagreed with this proposal, expressing concerns about its potential impact on farmers’ production.

THE “TAX EXEMPTION” THINKING HURTS FARMERS

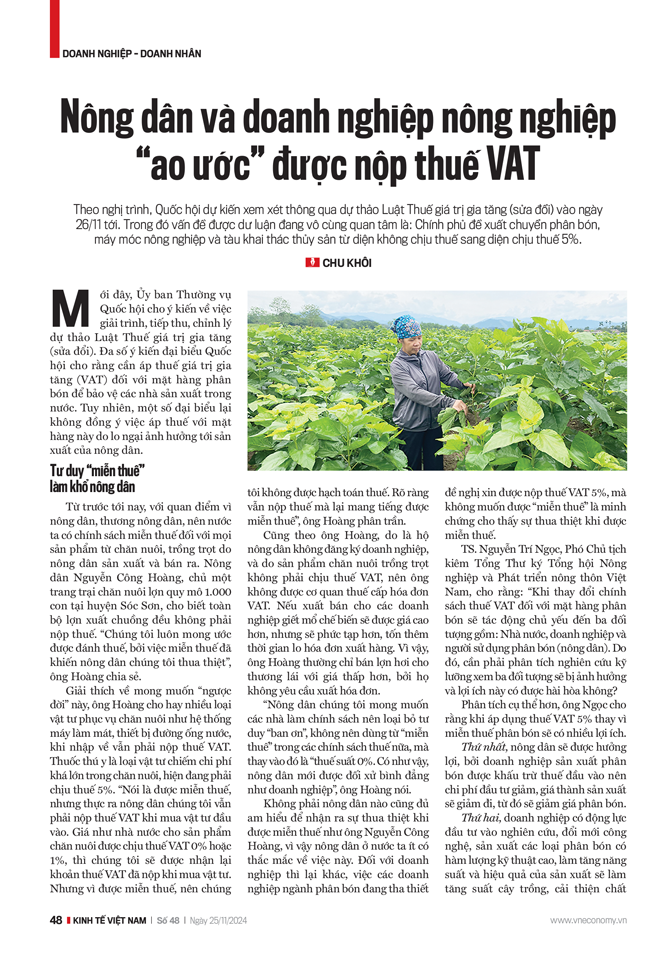

Up until now, with a perspective of supporting and prioritizing farmers, Vietnam has had a tax exemption policy for all agricultural products from farming and animal husbandry sold by farmers. Farmer Nguyen Cong Hoang, owner of a 1,000-pig farm in Soc Son district, shared that his farm is not subject to any taxes. “We always wish to be taxed because this tax exemption has put us at a disadvantage,” Mr. Hoang said.

Explaining this “contradictory” wish, Mr. Hoang stated that many materials and equipment used in farming, such as cooling systems and water pipelines, are still subject to VAT when imported. Veterinary drugs, which account for a significant portion of farming costs, are currently taxed at 5%. “We are said to be exempt from taxes, but in reality, we still pay VAT when purchasing inputs. If the state could apply a VAT rate of 0% or 1% on agricultural products, we would be able to recoup the VAT paid on inputs. But because we are exempt, we cannot account for taxes. It’s clear that we are still paying taxes, yet we are labeled as exempt,” Mr. Hoang explained.

“We, the farmers, hope that policymakers will abandon the ‘granting favor’ mindset and stop using the term ‘tax exemption’ in tax policies. Instead, they should use the term ‘zero tax rate.’ Only then will farmers be treated equally as enterprises.”

Farmer Nguyen Cong Hoang, owner of a pig farm in Soc Son, Hanoi.

Mr. Hoang also mentioned that because he is a household farmer and not a registered enterprise, and because agricultural products are not subject to VAT, he cannot obtain a VAT invoice from the tax authorities. Selling to slaughtering and processing enterprises would fetch higher prices, but it would also be more complicated and time-consuming due to the need for invoices. Therefore, Mr. Hoang usually sells live pigs to traders at lower prices, as they do not require invoices.

Not all farmers are as knowledgeable as Mr. Nguyen Cong Hoang to realize this disadvantage of tax exemption. Hence, Vietnamese farmers rarely question this policy. However, enterprises in the fertilizer industry eagerly requesting to pay a 5% VAT instead of being “exempt” from it is a testament to the disadvantages of tax exemption. Mr. Nguyen Tri Ngoc, Vice Chairman and General Secretary of the Vietnam Agriculture and Rural Development Association, stated: “Changing the VAT policy for fertilizers will mainly affect three entities: the state, enterprises, and fertilizer users (farmers). Therefore, it is necessary to thoroughly analyze and consider whether the interests of these three entities can be harmonized.”

Providing a more detailed analysis, Mr. Ngoc believed that applying a 5% VAT on fertilizers instead of exempting them would bring about several benefits.

Firstly, farmers would benefit because fertilizer-producing enterprises could deduct input taxes, reducing investment costs and, consequently, production costs. This would lead to lower fertilizer prices.

Secondly, enterprises would be motivated to invest in research and technology innovation, producing fertilizers with higher technical content. This would increase crop yields and improve product quality, thereby enhancing the effectiveness of farming practices sustainably.

Thirdly, the state would collect taxes from fertilizers, providing additional funds for scientific research and other activities to improve farmers’ productivity per unit area and enhance the competitiveness of domestic agricultural products.

A 5% VAT ON FERTILIZERS WOULD INCREASE STATE BUDGET REVENUE BY VND 1,541 BILLION

From a tax expert’s perspective, Mr. Nguyen Van Duoc, a permanent member of the Vietnam Tax Consultancy Association, affirmed the necessity of transitioning to a 5% VAT on fertilizers. This aligns with scientific perspectives, economic interests, and the harmonious interests of all parties involved. Mr. Duoc analyzed that exempting fertilizers from VAT would lead to several inconsistencies. Since VAT on inputs cannot be deducted and must be included in the enterprise’s costs, profits would decrease, forcing them to add this non-deductible VAT to the product’s selling price. As a result, farmers would indirectly bear the tax burden, suffering a “double loss” from fake and high-priced fertilizers, while the state might also face tax losses.

“Currently, the value-added tax on inputs for fertilizer production is about 10%. When output VAT is applied, enterprises will be able to deduct input VAT, reducing investment pressure and creating more favorable conditions for machinery and equipment maintenance, as well as investment in new and environmentally friendly technologies.”

Dr. Tran Thi Hong Thuy, Expert of the USAID IPSC Project.

On the other hand, importers of fertilizers benefit from not having to pay VAT on imports of semi-finished or finished fertilizer products. They are also not subject to output VAT, so their profits are not affected by tax policy changes.

Quantitatively analyzing the impact of applying a 5% value-added tax on fertilizers, Dr. Tran Thi Hong Thuy, an expert from the USAID IPSC Project, found that there is room to reduce the production cost of urea fertilizer by 2.0%. This is because urea producers will be able to deduct 9.3% of the input VAT. For NPK fertilizer producers, the deductible input VAT is 6.4%, but the selling price of the finished product may increase by 0.09%.

For DAP fertilizer producers, the selling price of the finished product has room to decrease by 1.13% due to an input VAT deduction of 8.1%. For phosphate fertilizer producers, the selling price of the finished product can be reduced by 0.87%, as they can deduct 7.7% of the input VAT.

Analyzing the quantitative impact on the state, Dr. Thuy said that applying a 5% value-added tax would increase state budget revenue by VND 1,541 billion. This is calculated by considering the output VAT of VND 6,225 billion and input VAT deduction of VND 4,713 billion.

“Before 2015, fertilizers were subject to a 5% tax rate. At that time, with the desire to reduce production costs and improve competitiveness against imported fertilizers, fertilizer producers petitioned the government to reduce the VAT rate to 0%. Since 2015, fertilizers have become a ‘tax-exempt’ item. We were happy at that time because we thought that ‘tax exemption’ meant ‘zero tax.’ However, when it was implemented, we realized it was not the case. Many raw materials for fertilizer production are still subject to VAT. If a ‘zero tax’ policy were applied, enterprises could get a refund for the VAT paid on raw materials. But because of the ‘tax exemption,’ the entire VAT accounting and settlement process has been abolished, and fertilizer production and trading enterprises are not allowed to declare and refund VAT. As a result, fertilizer producers have to adjust their selling prices upward, leading to higher fertilizer prices for consumers.”

“Meanwhile, the preferential import tax rate for fertilizers from countries with free trade agreements with Vietnam is currently 0-6% (depending on HS codes), with SA fertilizer at 0%, potassium chloride fertilizer at 0%, MAP fertilizer at 0%, and so on. This gives foreign producers an advantage when exporting fertilizers to Vietnam and severely affects domestic producers. Unreasonable tax policies have led to a significant increase in fertilizer imports in recent years. In 2022, Vietnam imported 3.39 million tons of fertilizers worth $1.62 billion. In 2023, imports reached 4.12 million tons, valued at $1.41 billion. In the first six months of 2024, we imported 2.5 million tons of fertilizers, with a value of over $838 million.”

https://postenp.phaha.vn/chi-tiet-toa-soan/tap-chi-kinh-te-viet-nam

Helping Hands: PVCFC Builds Homes of Hope in Lai Chau

The humble shack, made of old, rotting wooden planks and bamboo, and covered with tattered tarpaulins, is home to four sisters, the youngest being just 14 years old. Located in the remote village of Bản Phiêng Chạng, in the Sìn Hồ district of Lai Châu province, this humble abode is set to be replaced by a sturdy new home, thanks to the generosity of Công ty CP Phân bón Dầu khí Cà Mau (PVCFC). The company is sponsoring the construction of a new house, providing a safe and secure environment for the sisters.

“The Fertilizer Industry’s Plea: Remove the 5% VAT or Risk Our Decline and Halt Production.”

The latest amendments to the Value-Added Tax Law fail to address the long-standing issue faced by the domestic fertilizer industry. As a result, this vital sector continues to be discriminated against, excluded from the scope of value-added tax applicability. This exclusion puts the industry at risk of reverting to the decline and stagnation witnessed during 2015-2020, threatening its very survival.

“Handy Techniques: Overcoming Challenges with Ease” with Ca Mau Fertilizer

In the wake of the devastating floods that wreaked havoc in Northern Vietnam, the Ca Mau Petroleum Fertilizer Joint Stock Company (PVCFC – Ca Mau Fertilizer) swiftly mobilized a range of practical support initiatives to aid affected farmers in recovering from this tragedy. The company’s immediate response reflected its commitment to standing by the side of the resilient farming community as they navigated through these challenging times, working towards rebuilding their livelihoods and regaining stability in their lives.

Ending Unofficial Exports to China by 2030

As of January 1st, 2030, goods will only be cleared for import and export at designated international border gates and checkpoints. This streamlined approach will ensure efficient and secure trade practices, facilitating a seamless flow of goods and strengthening our economic foundations.