The trading session on November 25, 2024, ended with the VN-Index up 0.54%, closing at 1,234.70 points, while the matched transaction value reached 9,251.5 billion VND, a decrease of 11.9%, accounting for 77.4% of the total trading value.

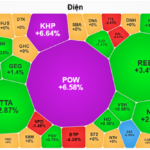

In terms of industries, liquidity declined across the board, notably in Banking, Chemicals, Securities, Information Technology, and Steel. In contrast, it increased in Electricity Production & Distribution, Textiles, and Food industries. Regarding price movements, Retail, Warehousing, and Mining industries witnessed a decline, while the remaining sectors gained compared to the previous week’s closing session.

Foreign investors recorded a net buy position of 116.2 billion VND, with a net buy position of 189.1 billion VND in matched transactions.

The main sectors where foreign investors net bought on the matched transactions were Real Estate, Food & Beverage, and Consumer Staples. The top stocks net bought by foreign investors included MSN, FPT, CTG, VHM, TCM, VIC, VCI, CTR, DGC, and TCB.

On the sell side, foreign investors net sold Retail stocks in matched transactions. The top stocks in this category were VCB, HDB, CMG, FRT, DGW, MWG, DCM, HDG, and VIB.

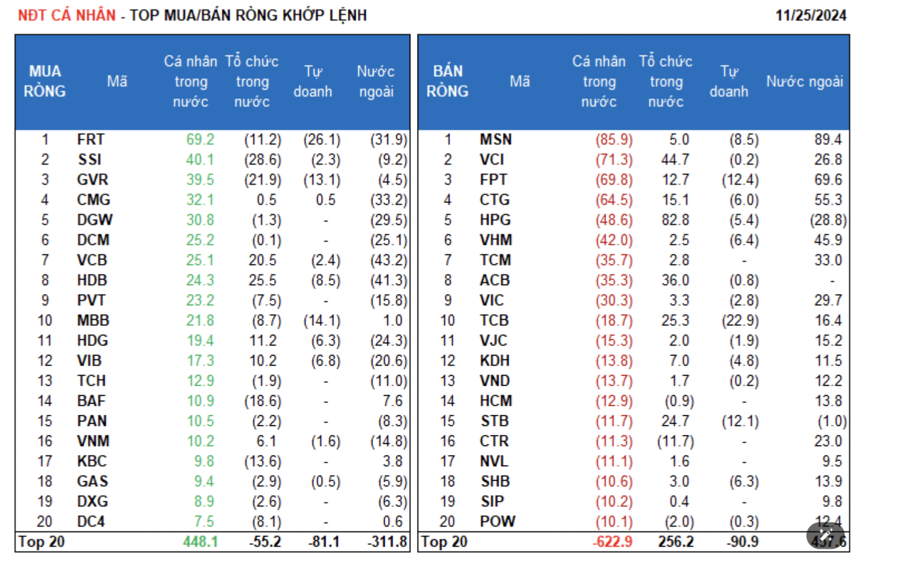

Individual investors net sold 99.6 billion VND, with a net sell position of 185.2 billion VND in matched transactions.

In matched transactions, they net bought in 5 out of 18 sectors, mainly in the Retail industry. The top stocks net bought by individual investors included FRT, SSI, GVR, CMG, DGW, DCM, VCB, HDB, PVT, and MBB.

On the sell side, they net sold in 13 out of 18 sectors, primarily in Real Estate and Financial Services. The top stocks in this category were MSN, VCI, FPT, CTG, HPG, VHM, ACB, VIC, and TCB.

Proprietary trading recorded a net buy position of 13.1 billion VND, while in matched transactions, they net sold 244.5 billion VND.

In matched transactions, proprietary trading did not net buy in any sector. The top stocks net bought by proprietary trading included SBT, GEX, NT2, PHR, CMG, DGC, E1VFVN30, VRE, FUESSVFL, and FUEVN100.

The main sector where proprietary trading net sold was Banking. The top stocks in this category were FRT, VPB, TCB, MWG, MBB, GVR, FPT, REE, STB, and MSN.

Domestic institutional investors recorded a net buy position of 31.1 billion VND, with a net buy position of 240.6 billion VND in matched transactions.

In matched transactions, domestic institutions net sold in 7 out of 18 sectors, with the highest value in the Construction and Materials sector. The top stocks net sold included SSI, GVR, BAF, DGC, KBC, CTR, FRT, MBB, OCB, and DC4.

The sector with the highest net buy value was Banking. The top stocks in this category were HPG, VCI, MWG, ACB, HDB, TCB, STB, VCB, CTG, and FPT.

Today’s negotiated transactions reached 2,843.3 billion VND, an increase of 11.9% compared to the previous session, contributing 21.8% of the total trading value.

Notable transactions today included those between individual investors in FPT and VHM, as well as various bank stocks (LPB, STB, MSB, TCB, SSB, etc.). Additionally, there were negotiated transactions between domestic institutions in BWE.

The allocation of money flow increased in Real Estate, Food & Beverage, Textiles, Aviation, Rubber & Plastics, and Electricity Production & Distribution sectors, while it decreased in Banking, Securities, Construction, Steel, Chemicals, Agriculture & Seafood, Retail, Software, Warehousing, and Logistics sectors.

In matched transactions, the money flow allocation increased in mid-cap (VNMID) and small-cap (VNSML) sectors, while it decreased in large-cap (VN30) stocks.

The Market Beat: Low-End Buyers Return, but VN-Index Stays in the Red

The market ended the session on a negative note, with the VN-Index shedding 2.24 points (-0.18%) to close at 1,250.32. The HNX-Index also dipped, losing 0.02 points (-0.01%) to finish at 226.86. The market breadth was relatively balanced, with 321 decliners against 343 advancers. The large-cap VN30-Index painted a similar picture, as 19 stocks fell, 10 rose, and 1 remained unchanged, tilting the index towards the red.

Vietstock Daily: Can the Bulls Keep the Momentum Going?

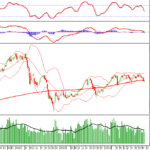

The VN-Index extended its upward momentum following a strong previous session. To solidify this upward trend, trading volume needs to surpass the 20-day average. Notably, the Stochastic Oscillator has already signaled a buy in the oversold region. If the MACD indicator also flashes a similar signal, the short-term outlook will turn even more optimistic.

The Market Beat, November 18th: A Tug of War Persists, VN-Index Stuck in the Red

The market closed with the VN-Index down 1.45 points (-0.12%) to 1,217.12, while the HNX-Index climbed 0.26 points (+0.12%) to 221.79. The market breadth tilted in favor of gainers with 368 advancing stocks against 340 declining ones. Meanwhile, the VN30-Index presented a relatively balanced picture, with 14 decliners, 12 advancers, and 4 unchanged stocks.

Market Beat 25/11: Indecisive Sentiment Prevails, VN-Index Struggles to Break Out

The market ended the session on a positive note, with the VN-Index climbing 6.6 points (0.54%) to reach 1,234.7; while the HNX-Index gained 0.96 points (0.43%), closing at 222.25. The market breadth tilted in favor of gainers, with 423 advancing stocks against 288 declining ones. The large-cap stocks in the VN30 basket painted a similar picture, as 18 stocks added value, 5 declined, and 7 remained unchanged, resulting in a predominantly green sentiment.

“Unleashing the Power of Words: Vietstock Weekly 25-29/11/2024: Navigating Through Hidden Risks”

The VN-Index has staged a strong recovery since last week’s sharp decline. However, trading volume remains below the 20-week average, indicating that investors are still cautious. At present, the MACD indicator is signaling a sell, and it could potentially drop to the zero threshold. If it does breach this level, the risk of a short-term correction increases.