This week, 20 businesses announced their intention to close the books to pay dividends. Of these, 14 companies will pay cash dividends, three will issue stock dividends, one will offer bonus shares, and two will provide a combination of dividend options.

A Series of Buys

Mr. Le Van Tan, Chairman of the Board of Directors of Lam Son Sugar Joint Stock Company (stock code: LSS), registered to purchase 500,000 shares to increase his ownership stake. The transaction will take place from November 22 to December 21 through order matching and agreement. Upon completion, Mr. Tan’s holdings in LSS will increase to nearly 4.34 million shares (equivalent to 5.41% of charter capital). It is estimated that Mr. Tan will spend approximately VND 6 billion to acquire these shares.

Chairman of Lam Son Sugar Joint Stock Company registers to buy 500,000 shares.

Prior to Mr. Tan, Mr. Le Trung Thanh, Vice Chairman of the Board of Directors of LSS, purchased 2.65 million shares out of the 3 million LSS shares registered from October 2 to October 31. The reason for not buying all the registered shares was that the market price did not meet expectations. Following this transaction, Mr. Thanh has increased his ownership to 5.67% of the charter capital.

Mr. Le Hai Doan, Chairman of the Board of Directors of HIPT Joint Stock Company (stock code: HIG), registered to purchase one million HIG shares for investment purposes. The transaction will take place from November 21 to December 20. If the transaction is completed, Mr. Doan’s ownership in the company will increase to 47% of the charter capital. It is estimated that Mr. Doan will need to spend approximately VND 10 billion to buy the registered shares.

Mr. Nguyen Thanh Phong, Member of the Board of Directors of Thu Dau Mot Water Joint Stock Company (stock code: TDM), registered to purchase one million shares to restructure his investment portfolio. The transaction will take place from November 19 to December 17 through order matching or agreement. Currently, Mr. Phong does not hold any TDM shares. It is estimated that Mr. Phong will spend about VND 50 billion to purchase these shares.

Recently, TDM also announced the purchase of 6.82 million CTW shares of Can Tho Water Supply and Drainage Joint Stock Company to expand its operating area. If successful, the ownership ratio of TDM and its related parties in CTW will increase to 13.72 million shares, holding 49% of the total circulating shares of CTW. The offer price set by TDM is VND 30,400 per share, with an expected total value of over VND 207 billion. The registration period for selling is from November 12 to December 23.

ASKA Pharmaceutical, the largest shareholder of Ha Tay Pharmaceutical Joint Stock Company (stock code: DHT), registered to buy 500,000 shares to increase its ownership. The transaction will take place from November 20 to November 26 through agreement and order matching.

If the transaction is completed, ASKA Pharmaceutical will increase its ownership in Ha Tay Pharmaceutical to over 29.3 million shares (equivalent to 35.6% of charter capital). It is estimated that ASKA Pharmaceutical will spend more than VND 36 billion to purchase the registered shares.

ASKA Pharmaceutical, the largest shareholder of Ha Tay Pharmaceutical Joint Stock Company, registers to buy 500,000 shares.

ASKA Pharmaceutical became a shareholder of Ha Tay Pharmaceutical in 2020, after successfully acquiring 6.6 million shares to own 24.9% of DHT. After multiple share purchases, this Japanese pharmaceutical company now holds 35% of DHT.

TNA Shares Remain Suspended

Hanoi Stock Exchange (HNX) announced the listing of TNA shares of Thien Nam Import-Export Commercial Joint Stock Company on the Upcom market. Accordingly, nearly 49.6 million TNA shares will be traded on Upcom from November 29, with a reference price of VND 3,700 per share.

However, TNA shares remain suspended from trading as the company was subject to mandatory delisting due to serious violations of information disclosure obligations under Clause 1, Article 120 of the Government’s Decree 155/2020/ND-CP dated December 31, 2020, detailing the implementation of a number of articles of the Securities Law. Additionally, the shares fall under the case of suspension from trading as stipulated in Point d, Clause 1, Article 36 of Decision No. 34/QD-HDTV dated November 16, 2022, of the Members’ Council of Vietnam Stock Exchange.

Within 15 working days from the date of suspension (from November 29), Thien Nam must submit a written explanation to HNX, clarifying the reasons for the suspension and proposing solutions to address the issue.

Previously, HoSE decided to cancel the listing of nearly 49.6 million TNA shares from November 19. The last trading date was September 13, as TNA shares had been suspended from trading since September 16.

Military Commercial Joint Stock Bank (stock code: MBB) has approved the private offering of shares to professional securities investors. This offering involves more than 25.7 million shares, equivalent to 7.4% of charter capital, to supplement resources for business activities. The offering price is VND 23,040 per share.

May Song Hong Joint Stock Company will spend approximately VND 262 billion in this interim dividend payment.

These shares will be offered to four professional securities investors and will be restricted from transfer within one year from the end of the offering. MBS expects to raise nearly VND 600 billion from this offering. The proceeds will be allocated to proprietary trading (VND 100 billion) and margin lending (nearly VND 493 billion).

On December 2, May Song Hong Joint Stock Company (stock code: MSH) will finalize the list of shareholders for the 2024 interim cash dividend payment at a rate of 35%, meaning that shareholders owning one share will receive VND 3,500. With more than 75 million circulating shares, MSH is expected to spend approximately VND 262 billion in this interim dividend payment.

Vietnam Thuong Tin Commercial Joint Stock Bank (Vietbank, stock code: VBB) announced that November 29 is the record date for the implementation of the right to receive stock dividends at a rate of 25%. Accordingly, Vietbank will issue nearly 143 million new shares to pay dividends to shareholders.

The source of the issuance is from undistributed profit after tax up to December 31, 2023. After the issuance, the bank’s charter capital will increase by nearly VND 1,428 billion, to VND 7,139 billion. The expected completion time is by the end of 2024.

The Ultimate Guide to Unlocking Dividend Rewards: Maximizing Your Returns with a 19% Cash Dividend Payout and a Leading Securities Firm at Your Service.

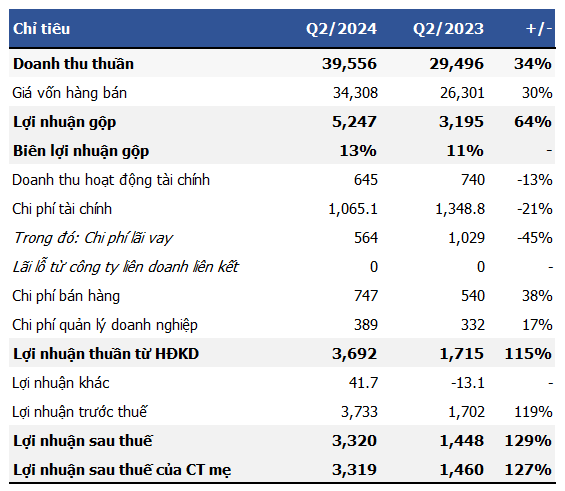

This week, a total of 17 companies are offering cash dividends, with rates ranging from a high of 19% to a low of 0.6%.