Divergence Among Banks

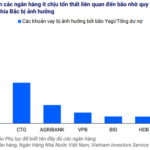

According to Dr. Dinh Trong Thinh, an economic expert, the rise in non-performing loans reflects the reality of the impact of the Covid-19 pandemic. The pandemic has severely affected all aspects of life, society, businesses, and individuals, leading to financial difficulties and reduced income, making debt repayment even more challenging. Furthermore, the effects of Typhoon Yagi have disrupted the operations of businesses in 26 provinces and cities. The latest update from the SBV shows that the entire system has recorded approximately VND 192,000 billion in credit debt affected by Typhoon Yagi, an increase of VND 27,000 billion compared to the estimated figure at the end of September 2024. These debts are being restructured by banks, which also implies an increase in potential non-performing loans in the future.

On the other hand, Circular No. 06/2024/TT-NHNN amending and supplementing Circular No. 02/2023/TT-NHNN on restructuring and maintaining the debt group classification to support customers facing difficulties in the banking sector will expire in a little over a month. This will lead to an increase in on-balance-sheet non-performing loans for credit institutions. According to the SBV, as of August 31, 2024, the total value of principal and interest restructured and maintained in the debt group by credit institutions was nearly VND 250,000 billion.

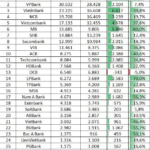

Dr. Chau Dinh Linh of the University of Banking in Ho Chi Minh City believes that as banks expand their credit growth, there will inevitably be a trade-off with an increase in the non-performing loan ratio. However, the rise in non-performing loans and their status across banks will vary. This depends on several factors, including their risk management systems, asset quality compliance standards, capital adequacy, and Basel regulations they are implementing. As a result, while the non-performing loan ratio may increase, it remains safe for some large banks with strong risk management capabilities. In contrast, the ratio is already quite high for small and medium-sized banks, and these banks must implement short-term handling solutions and improve their long-term governance capabilities.

The increase in non-performing loans has led banks to increase their loan loss provisions. According to Dr. Nguyen Huu Huan of the University of Economics in Ho Chi Minh City, the amount of provisions will depend on the “health” of each bank. Therefore, there are differences in the non-performing loan coverage ratio among banks. Efficiently operating banks with good financial results will make higher provisions and consider them “savings” to ensure stable long-term operations. In contrast, banks with lower profits may not be able to make sufficient provisions, resulting in a modest coverage ratio. With a thin buffer, these banks will face more challenges when dealing with potential risky loans that turn into non-performing loans.

Banks need to make adequate provisions, strengthen their buffers, and enhance their financial capacity to proactively handle non-performing loans

Enforcement of Collateral Is Not a “Magic Wand”

Regarding non-performing loan handling, many bank leaders have expressed that one of the significant pressures is the expiration of National Assembly Resolution 42 on piloting bad debt handling. Some provisions, especially those related to support from public security and local authorities in enforcing creditors’ rights to seize collateral, have not been inherited in the 2024 Law on Credit Institutions. In reality, non-cooperation, procrastination, and opposition to debt repayment and collateral surrender are on the rise. Therefore, the involvement of ministries, sectors, and competent authorities is necessary to support credit institutions in handling non-performing loans and seizing collateral for non-performing loans. The prosecution and adjudication processes at court levels and enforcement procedures should be streamlined and expedited.

While acknowledging the challenges posed by the expiration of Resolution 42 in handling non-performing loans, Dr. Chau Dinh Linh believes that enforcing collateral is not a “magic wand” for reducing the non-performing loan ratio. In reality, during the implementation of Resolution 42, the banking sector still faced resistance from borrowers through various measures that the resolution could not anticipate. Therefore, according to this expert, the critical aspect is the “input” of the loan, and banks should strengthen their assessment and selection of good customers. “The essence of assessing a good customer lies in their business plan rather than solely relying on collateral. If they have a good business plan and financial capacity, customers will be able to ensure debt repayment,” added Dr. Chau Dinh Linh. Additionally, banks should also make adequate provisions, strengthen their buffers, and enhance their financial capacity to proactively handle non-performing loans.

In response to an inquiry at the 8th session of the 15th National Assembly, Governor of the State Bank of Vietnam, Nguyen Thi Hong, stated that to control non-performing loans, the SBV requires credit institutions to carefully assess and evaluate the repayment capacity of borrowers when granting loans to prevent new non-performing loans. For existing non-performing loans, credit institutions should actively handle them by urging borrowers to repay, collecting debts, and auctioning off the assets of non-performing loans. The SBV has also established a legal framework for debt trading companies to participate in handling non-performing loans.

While concerns about non-performing loans persist, there are also optimistic signs for the future. Rong Viet Securities Company (VDSC) expects an improvement in the non-performing loan situation in the last quarter due to a recovering economy, a reviving real estate market, and more cautious credit policies.

Asset Risk of Banks Remained Stable in the First Nine Months of 2024

According to VIS Rating, the asset risk for banks in September 2024 remained stable, with limited impact from Typhoon Yagi. However, liquidity risk heightened as banks increasingly relied on short-term market funds and interbank interest rates surged.

The Ultimate Guide to Bank Risk Buffers: Strengthening Your Financial Safety Net

The banking sector report, released by VIS Rating on November 20, 2024, revealed a concerning trend. According to the report, nearly 20% of the assessed banks demonstrated weak capital safety profiles. This issue was particularly prominent among small and medium-sized banks, which also faced heightened liquidity risks due to their reliance on short-term market funds and the rise in interbank interest rates.

An Essential Circular on the Classification and Retention of Loan Groups in the Banking Sector is Nearing its Expiry

The Circular 02 issued by the State Bank of Vietnam (SBV), which provides guidelines on debt restructuring and allows for the retention of the original debt classification, will expire on December 31, 2024.