Illustration of Vinhomes Royal Island

According to VNDIRECT’s recent report on Vincom Retail JSC (code: VRE), the company’s revenue from the transfer of shophouses in Q3 2024 decreased to VND 35.6 billion, down from VND 467 billion in Q2 2024 and VND 1,304 billion in Q3 2023, after handing over the remaining shophouses at the Vincom Shophouse Royal Park project (Dong Ha – Quang Tri).

Revenue from real estate transfers declined significantly as VRE has delivered almost all shophouse products at its launched projects. Nine-month revenue reached VND 779 billion, down 48.2% year-on-year.

As of the end of Q3/24, inventory value decreased by 60.7% compared to the beginning of the year, standing at VND 251 billion, of which VND 241 billion comprised shophouse products awaiting handover to customers.

VRE’s management shared that they plan to recognize shophouse sales revenue in Q4/2024, similar to the level in Q3. VNDIRECT expects the company to record approximately VND 40 billion in revenue.

In this context, VRE has made significant deposits to VIC/VHM for the long-term development of shopping malls.

As of the end of September 2024, VRE had made deposits of VND 14,220 billion for business activities with Vingroup, Vinhomes, and related parties, up 3.4% from Q2 and 144.6% year-on-year.

Of this, VND 11,180 billion was long-term deposits for the development of shopping malls at Vingroup/Vinhomes’ residential real estate projects under business cooperation contracts (BCC), while the remaining VND 3,040 billion was deposited with VIC and VHM for the commercial component at Vingroup/Vinhomes’ real estate projects.

Illustration of Vinhomes Golden Avenue

VRE has made deposits to purchase shophouses at Vinhomes Royal Island (Vu Yen Island, Hai Phong, NSA: 85,600 sq. m) and Vinhomes Golden Avenue (Quang Ninh, NSA: 24,200 sq. m) projects, with sales expected to launch in 2025 and revenue recognition by the end of 2025-2026. As of Q3/24, VRE held VND 3,040 billion in short-term deposits with VIC and VHM for these projects.

Additionally, VRE plans to open three new shopping malls this year, including two Vincom Mega Malls (Vincom Mega Mall Royal Island and Vincom Mega Mall Ocean City) and one Vincom Plaza (Vincom Plaza Vinh), adding 120,000 sq. m of GFA to its total leasable retail space.

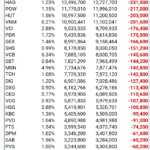

The Foreign Block: A 28-Session Sell-Off Streak and the Continued Unwinding of the Million-Dollar ETF

The week of November 11–18, 2024, marks yet another significant period of aggressive selling by the VanEck Vectors Vietnam ETF (VNM ETF). This is the fourth consecutive week of net selling by the fund, coinciding with a prolonged period of foreign investor selling spanning dozens of sessions.