Left padding

Liquidity during the afternoon session unexpectedly dropped by 22% compared to the morning session, although the overall breadth remained positive, but the upward momentum weakened somewhat. This development partly reflects the caution of buyers as the market entered a resistance zone where stronger profit-taking may occur.

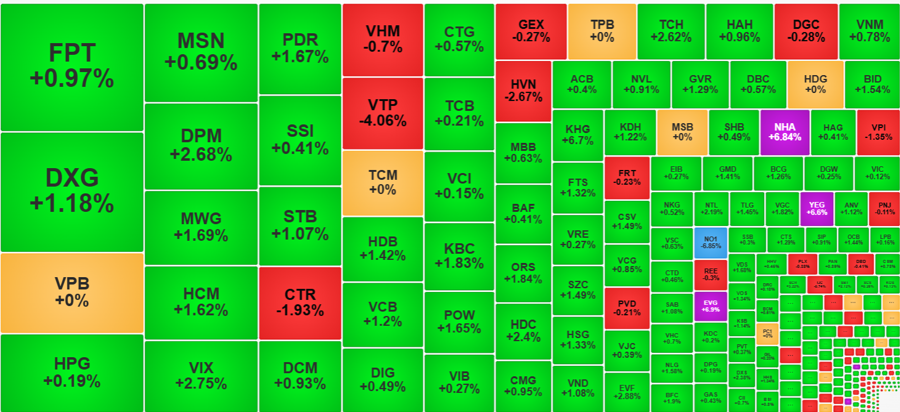

The VN-Index closed up 7.43 points (+0.6%), slightly weaker than the morning session (up 9.8 points/+0.79%). The breadth also contracted slightly with 290 gainers/101 losers (compared to 286 gainers/80 losers in the morning session).

This indicates that even though buying momentum weakened, selling pressure did not create much pressure either. Investors may not want to sell at lower prices, or they may not want to sell and hold on to their stocks… Whatever the reason, this reflects a relatively high level of expectation.

The weakness in stock prices was most evident among the blue-chip VN30 stocks. The liquidity of this basket decreased by about 15% compared to the morning session, and 22 stocks declined compared to the morning session’s close. However, the declines were mostly mild, with only a typical 1-2-step price drop. Notably, VHM plunged significantly, falling by 1.28% compared to the morning session and closing with a reversal, down 0.7% from the reference price. VPB was also a weak pillar, up 1.05% at noon, but closed flat. Some of the largest pillars, such as VCB, VIC, HPG, TCB, and GAS, also showed weakness. On the other hand, CTG, FPT, and BID were among the 10 largest stocks by market capitalization, with improved prices in the afternoon and were among the top 10 stocks by market capitalization. CTG closed up 0.57%, edging up 0.28% from the morning session. FPT gained 0.52%, ending the day up 0.97%. BID added 0.43%, closing up 1.54%.

Overall, a tug-of-war between buyers and sellers was still common, although most stock prices weakened, but not significantly. Such a range is also considered normal volatility. This helped to prevent low liquidity from becoming a negative factor and, instead, indicated a balanced situation with small selling pressure.

Mid-cap stocks gained strength in the afternoon session. Unlike the morning session, many blue-chips fell in price and were “kicked out” of the group of stocks with the best liquidity and the strongest gains. Specifically, the HoSE closed with 290 gainers, of which 106 stocks rose more than 1%. However, of these 106 stocks, only 13 had liquidity exceeding 100 billion VND, and the VN30 basket contributed only 5 stocks: MWG, STB, HDB, VCB, and POW. The mid-cap stocks with strong performance included DXG, up 1.18% with a liquidity of 527.7 billion VND; DPM, up 2.68% with a matching volume of 303.5 billion VND; HCM, up 1.62% with 259 billion VND; VIX, up 2.75% with 252.7 billion VND; and PDR, up 1.67% with 233.3 billion VND… The group with average liquidity also consisted of mid-cap stocks such as HDC, KHG, FTS, SZC, HSG, VND, and KDH…

The highlight of the afternoon session was the strong buying momentum from foreign investors. Specifically, they net bought 905.8 billion VND on the HoSE while selling 725.9 billion VND, resulting in a net buy value of 179.9 billion VND. In the morning session, they had a slight net buy of 52 billion VND. This was the third consecutive net buying session for foreign investors after months of net selling. The net buy value has been gradually increasing daily, with approximately 40 billion VND last weekend, 52 billion VND yesterday, and nearly 232 billion VND today.

The stocks that were net bought today were FPT (+137.4 billion VND), DPM (+127.6 billion VND), MSN (+112.2 billion VND), VNM (+27.4 billion VND), CTG (+24.3 billion VND), and STB (+22.7 billion VND). On the net selling side, PNJ (+109.6 billion VND), DGC (-78.2 billion VND), VCB (-47.6 billion VND), DXG (-31.7 billion VND), VTP (-26.9 billion VND), and VPB (-25.6 billion VND) were among the top net sold stocks.

The VN-Index closed at 1242.13 points today, retreating quite close to the 1240-point threshold after breaking through it in the morning. This area still holds psychological value as a resistance level. Many investors remain skeptical about the market’s ability to form a bottom and believe that the recent rally is merely a technical rebound.

The New Trendsetter: Breaking the Mold with an Unexpected Move

“With a nudge upwards, savings deposit interest rates are responding to the short-term liquidity challenges faced by the system during the peak credit growth season towards the year-end.”

Technical Analysis for the Session Closing November 27th: Deciphering the Diverging Forces Governing the Market

The VN-Index and HNX-Index both witnessed declines, alongside a significant dip in trading liquidity during the morning session. This indicates that investors are exercising caution in their transactions.

The Power of Persuasive Words: Crafting a Compelling Headline

“Sustaining the Uptrend: A Comprehensive Guide to Navigating the Volatile Market”

The VN-Index continued its upward trajectory, surging above the Middle Band of the Bollinger Bands. If, in the upcoming sessions, the index sustains its position above this threshold, coupled with trading volumes surpassing the 20-day average, the upward momentum will be reinforced. Moreover, the MACD indicator has flashed a buy signal, crossing above the signal line, boding well for the short-term outlook.