Ho Chi Minh City Technical Infrastructure Investment Joint Stock Company (Code: CII, HoSE) announces that December 16th is the upcoming record date to close the list of shareholders attending the upcoming Extraordinary General Meeting of Shareholders. The timing and venue of the meeting will be announced later.

CII has only disclosed that the content of the upcoming meeting is to approve the plan to issue convertible bonds to the public in 2025.

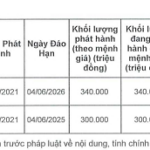

Previously, on February 27, 2024, the CII’s General Meeting of Shareholders approved the plan to issue convertible bonds to the public in 2024, with the total value of bonds issued based on the number of outstanding shares of 318,778,113.

On November 4, 2024, CII issued additional CII shares to convert CII42013 convertible bonds at the bondholder’s request in the 8th batch. As a result, CII increased the number of shares issued from 318,778,113 to 319,752,413, corresponding to an increase in charter capital from 3,187.8 billion VND to over 3,197.5 billion VND.

Therefore, on November 20, 2024, the CII Board of Directors issued Resolution No. 103/NQ-HĐQT (NK 2022-2027) approving the withdrawal of the public offering of convertible bonds filed with the State Securities Commission.

Illustrative image

To continue implementing the plan to issue convertible bonds to the public, on November 26, 2024, the CII Board of Directors issued Resolution No. 105/NQ-HĐQT (NK 2022- 2027) approving the convening of an extraordinary general meeting of shareholders.

As of September 30, 2024, CII’s total debt increased by 17% compared to the beginning of the year, equivalent to an additional 3,210 billion VND, to 22,096 billion VND. Of this, short-term debt was 4,270 billion VND, and long-term debt and convertible bonds were 17,826 billion VND.

In terms of business activities, in the third quarter of 2024, CII recorded revenue of 706.5 billion VND, down 3.5% over the same period, and after-tax profit of 95.47 billion VND, slightly down 0.8% over the same period.

Accumulated in the first nine months of 2024, CII recorded revenue of 2,284 billion VND, slightly down 1.7% over the same period, and after-tax profit of 534 billion VND, up 152% over the same period last year.

The Top 10 Tax-Paying Enterprises in Dong Nai Unveiled

As of the end of November, Dong Nai’s 2024 budget, including domestic and import-export revenue, had been successfully achieved, with significant contributions from the top 10 enterprises.

“HDBank’s Extraordinary General Meeting: Empowering Human Capital for Strategic Initiatives”

On November 20, 2024, HDBank, a leading joint-stock commercial bank in Vietnam, announced its plans to convene an extraordinary General Meeting of Shareholders. The primary purpose of this assembly is to seek approval for strategic human resource plans that align with the bank’s sustainable development goals for the upcoming period.