The State Securities Commission (SSC) has recently issued Decision No. 490/QD-XPHC on administrative sanctions in the field of securities and the securities market regarding FLC Mining and Asset Management Joint Stock Company (FLC Gab, Stock Code: GAB, UPCoM).

Accordingly, FLC Gab was fined VND 85 million for failing to disclose information as required by law, as stipulated in Clause a, Point 4, Article 42 of the Government’s Decree No. 156/2020/ND-CP dated December 31, 2020, on administrative sanctions in the field of securities and the securities market.

Illustrative image

Specifically, FLC Gab failed to disclose on the SSC’s information disclosure system, the electronic information page of the Hanoi Stock Exchange (HNX), and the company’s website the following documents: Semi-annual financial statement for 2023 audited by the State Securities Commission, Annual Financial Statement for 2023, Annual Report for 2023, and Semi-annual Financial Statement for 2024.

FLC Mining and Asset Management Joint Stock Company, formerly known as FLC Tuynel Brick Joint Stock Company – Do Len Hau Loc, was established on May 20, 2016, with the Enterprise Registration Certificate No. 2802404931 issued by the Planning and Investment Department of Thanh Hoa province in the form of a joint-stock company.

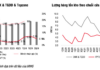

In terms of business results, in the third quarter of 2024, FLC Gab recorded revenue of over VND 1.88 billion, up 2,102.6% compared to the same period in 2023. The company attributed this significant increase in revenue to the impact of Storm No. 3, which led to a surge in demand for home repairs and warehouse improvements to recover from storm damage.

However, due to increased production costs, the company still reported a loss in after-tax profit of VND 1.4 billion, an increase of 76.7%. For the first nine months of 2024, FLC Gab’s revenue reached nearly VND 3.68 billion, a decrease of 65.56%. After deducting taxes and fees, the company reported a net profit of nearly VND 4.8 billion, while in the same period in 2023, the company reported a net loss of over VND 4.5 billion.

On the stock market, GAB shares have been under warning and trading restrictions since 2023 due to the company’s late submission of the semi-annual 2023 financial statement audited by the State Securities Commission, exceeding 45 days from the deadline for disclosure.