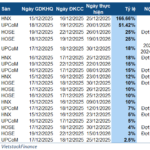

The bond interest rate for the first year is set at 10.98% p.a., with subsequent years having a floating rate plus a 5.78% margin. This new issuance is still arranged by Techcom Securities (TCBS) and will be unconditionally and irrevocably guaranteed by Investment Thanh Thanh Cong (TTCI) – a unit that holds 30.36% of VNG‘s capital.

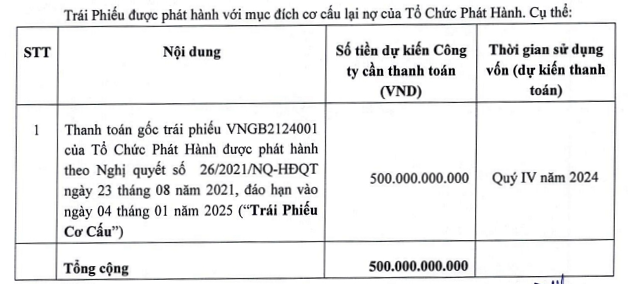

Proceeds from the bond sale will be used to repay the principal amount of the VNG bond issued to the public earlier in 2022, with an equal value of VND 500 billion, and is expected to mature in early January 2025.

VNG issues new bonds to refinance its old debt from 2022. Source: VNG

|

For this latest loan, the company is mortgaging two hotels it operates for tourism accommodation; these include land use rights, assets attached to the land, and all related property rights to the TTC Hotel Premium – Can Tho and Michelia hotels. Additionally, the bonds are secured by the entire equity contribution in VNG.

The TTC Hotel Premium – Can Tho, valued by Century Valuation Joint Stock Company, is estimated to be worth approximately VND 658 billion, while the Michelia hotel is valued at VND 341 billion. These two hotels were also part of the collateral for VNG‘s previous bond issue, valued at VND 576 billion and VND 254 billion, respectively, at the end of 2022.

VNG received an initial vnBBB+ rating from Saigon Ratings in May, which is not too high (four levels below the highest vnAAA according to the rating agency’s current standards), due to the expectation that the company will have a significant need for investment capital in the coming time, potentially leading to an increase in the debt-to-equity ratio.

Saigon Ratings anticipates that VNG‘s successful execution of quality M&A deals in 2024 will contribute to a significant increase in revenue and cash flow in the short and medium term, forming a basis for future credit rating upgrades. However, this also poses a financial risk, along with the possibility of being significantly affected by abnormal negative events, as evidenced by the impact of COVID-19 in the past.

Michelia Hotel in Nha Trang. Source: VNG

|

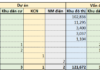

“Steel Giant” Plunges into Losses: A Decade of Woes with $2.4 Billion Deficit, Eroding Shareholder Value, and $3.3 Billion Debt Owed to Top Creditor, Vietinbank.

Pomina’s equity has been eroded to just over VND 500 billion, pushing its debt-to-equity ratio to a staggering 17.4 times.

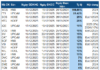

Profits Plummet as Hoang Quan Mekong’s Debt Reaches 15 Times Equity

Hoang Quan Mekong reported a net profit of over 231 million VND in the first half of 2024, a staggering 92% decrease compared to the previous reporting period. The company’s total liabilities exceeded 5 trillion VND.