Services

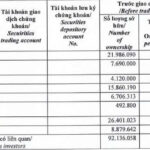

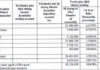

As such, Eximbank’s chartered capital has been increased by VND 1,218,544,590,000 (previous chartered capital of VND 17,469,561,480,000) through a dividend payout in the form of stock issuance from undistributed profit accumulation up to 2023 after allocating funds to reserves, according to the plan for capital increase approved by the Annual General Meeting of Shareholders in 2024.

Customers transacting at Eximbank Saigon. (Photo: Eximbank)

|

The approval of the State Bank of Vietnam for this capital increase is not only significant for Eximbank’s sustainable development and enhanced competitiveness but also affirms the bank’s reputation in the current Vietnamese financial market.

The additional capital will be utilized to expand Eximbank’s business operations, ensuring safety and efficiency while maximizing benefits for its shareholders. It will also facilitate the expansion of credit provision, investment in modern technology, and the development of innovative financial products to better serve the diverse needs of individual and business customers, especially small and medium-sized enterprises (SMEs).

On Trade Finance

Recently, the Asian Development Bank (ADB) decided to increase the trade finance limit for Eximbank from USD 75 million to USD 115 million.

This increase is a testament to Eximbank’s transparent business operations, effective risk management, and strong support for businesses, particularly SMEs. The new limit from ADB not only expands Eximbank’s financial resources but also strengthens its position in the trade finance sector.

By maximizing the utilization of ADB’s financial resources, Eximbank is committed to providing optimal financial solutions and supporting Vietnamese businesses, especially SMEs. The bank will accompany the economy on its journey of integration and sustainable development in the coming years, specifically in import-export financing (ensuring cash flow for international transactions), letters of credit (L/C) (guaranteeing safe and efficient payments), and green trade finance (supporting sustainable and environmentally friendly projects).

Business Performance

In the first nine months of 2024, Eximbank achieved remarkable business results, surpassing expectations. The bank’s total assets increased by 11% from the beginning of the year, representing a 16.9% growth compared to the same period last year. Total capital mobilization increased by 9.1% from the beginning of the year and 12.2% compared to the previous year. Meanwhile, loan balances grew by 15.1% from the start of 2024 and 18.9% year-over-year. Notably, the pre-tax profit for the first nine months of 2024 increased by 39% compared to the same period in 2023, reflecting the efficiency of the bank’s management and business operations. The Capital Adequacy Ratio (CAR) has been consistently maintained at 12-14%, well above the 8% requirement set by the State Bank of Vietnam, underscoring Eximbank’s stability and strong financial position.

With the successful capital increase and new milestones in international cooperation, Eximbank is committed to continuous innovation, enhancing the quality of its products and services, and accelerating digital transformation to meet the diverse needs of its customers. The bank will also continue to be a trusted partner, supporting the growth and development of businesses and the Vietnamese economy.

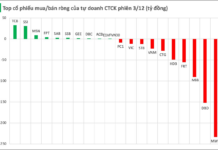

“Foreign Fund Group Offloads Over 1.2 Million PVS Shares”

On November 21, 2024, Dragon Capital demonstrated its strategic acumen in the stock market by purchasing 170,000 PVS shares while offloading 1.4 million, thereby reducing its ownership stake to below 7%.

Unleash the Festive Cheer and Elevate Your Business with Techcombank: Win a Share of the VND 5 Billion Prize Pool!

“As the year draws to a close, Techcombank is thrilled to announce its new program, ‘Festive Season, Business Boost’, designed to accelerate small and medium-sized enterprises’ success. With a total value of up to 5 billion VND, the program offers an array of enticing benefits. To boost businesses’ luck during this festive season, Techcombank will be awarding monthly grand prizes, including a European tour and three VinFast automobiles. The program, running until January 31, 2025, is sure to bring a boost to businesses as they close out the year.”

Eximbank’s Pre-Extraordinary General Meeting in Hanoi: A Successful Capital Increase to VND 18.7 Trillion

This information was released ahead of the bank’s upcoming Extraordinary General Meeting (EGM) in Hanoi, scheduled for November 28th.