According to PHS, Bidiphar has been performing well since its business restructuring strategy in 2020, which involved expanding its customer base in the retail drugstore channel. The company has seen impressive compound growth rates in revenue and post-tax profits from 2019 to 2023, at 6% and 14% per year, respectively.

However, Bidiphar still relies heavily on imported raw materials, mainly from China and India, which may pose risks regarding price fluctuations and supply stability in the future.

The pharmaceutical industry in Vietnam is poised for significant growth, presenting numerous opportunities for domestic companies. Citing data from BMI (Fitch Solutions), Vietnam’s pharmaceutical market witnessed a 9% increase in revenue in 2023, amounting to approximately VND 142 trillion. This figure equates to 1.38% of the country’s GDP and accounts for 27.2% of healthcare expenditures.

BMI forecasts that by 2033, the total revenue of Vietnam’s pharmaceutical industry will reach approximately VND 297 trillion, with a projected compound annual growth rate of 7.7% over the next decade. This projected growth underscores the promising outlook for local pharmaceutical companies, offering expanded opportunities in production, distribution, and product innovation, while better catering to the evolving market demands.

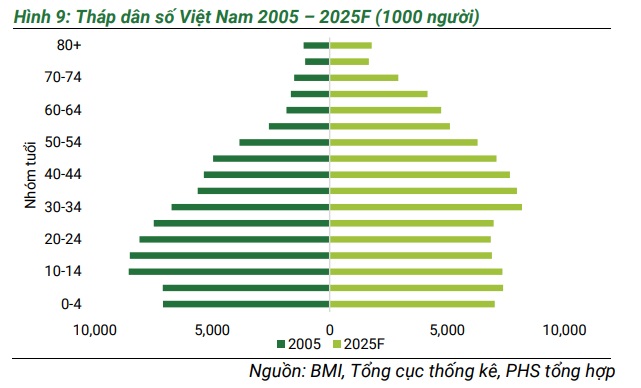

The optimistic growth prospects of the domestic pharmaceutical industry are largely attributed to favorable demographic factors and a substantial rise in healthcare spending. Specifically, an aging population, increasing per capita income, and heightened health awareness among Vietnamese citizens are key drivers of increased expenditures on medications and healthcare services.

The issue of an aging population in Vietnam was first raised in 2011 when the proportion of individuals aged 60 and above reached 10% of the total population, while those aged 65 and above accounted for 7.2%. According to the General Office of Population and Family Planning, this trend is projected to accelerate, with individuals aged 60 and above expected to make up over 20% of the population by 2038, and by 2049, the elderly population is estimated to constitute approximately 25% of the total population, making Vietnam one of the fastest-aging countries globally.

The rapid aging of the population heightens the demand for healthcare and pharmaceutical solutions, as older adults often require long-term treatments and multiple medications to manage chronic conditions, alleviate pain, and promote overall health. Additionally, while the burden of infectious diseases has lessened, chronic illnesses such as cardiovascular diseases, diabetes, and cancer are becoming increasingly prevalent.

In terms of GDP, data from the World Bank indicates that Vietnam’s per capita GDP in 2023 reached $4,346, marking an improvement from $3,586 in 2020. This upward trend signifies an enhancement in living standards. By 2030, Vietnam’s GDP is projected to increase to $7,500, with an anticipated growth rate of 7% annually.

This projected increase in GDP translates to enhanced affordability for healthcare services such as health insurance, regular check-ups, and essential medications. Per capita healthcare expenditures in Vietnam have already risen from $153 in 2020 to $222 in 2023. Moreover, the government will have additional resources to invest in healthcare infrastructure, including hospitals, medical centers, and community healthcare facilities, ultimately contributing to improved healthcare services.

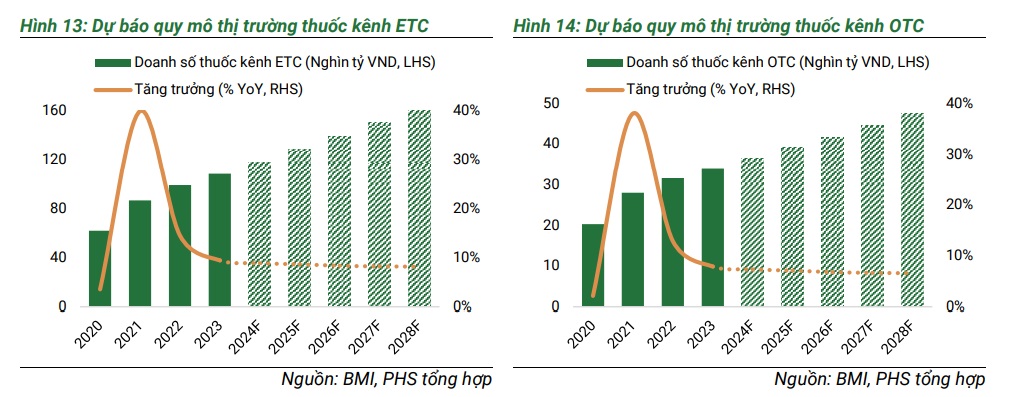

In the post-pandemic era, healthcare demands in Vietnam have surged significantly. According to Vietnam Social Security, healthcare visits covered by health insurance have rebounded and steadily increased from 125.6 million visits in 2021 to 175 million visits in 2023. Moreover, the participation rate in voluntary health insurance has shown a positive trend, surpassing 93% of the population in 2023. Consequently, the ETC (prescription drug) channel has experienced robust growth, driven by the expanding number of health insurance subscribers.

Data from BMI reveals that the ETC channel is poised to be the primary growth driver in Vietnam’s pharmaceutical market, with projected revenue of VND 162 trillion by 2028 and a ten-year compound annual growth rate of 8%. Prescription drugs are forecasted to capture a growing market share, increasing from 76% in 2023 to over 77% by 2028.

Bidiphar is well-positioned to capitalize on emerging opportunities, boasting a robust foundation and a diverse portfolio of nearly 400 pharmaceutical products across 19 therapeutic categories. Antibiotics, cancer treatments, and dialysis solutions are the company’s three primary therapeutic areas, collectively contributing approximately 65% of total revenue and 51% of gross profit in the first nine months of 2024.

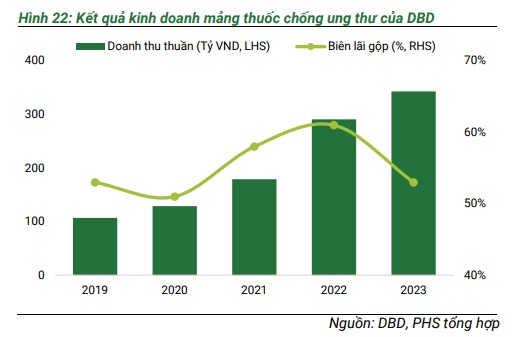

In Vietnam, the production of cancer treatments presents significant challenges for domestic pharmaceutical companies due to the extensive research and clinical trials required, coupled with substantial R&D costs. Developing cancer drugs necessitates substantial investment, complex manufacturing processes, and production facilities that adhere to stringent international standards. Consequently, approximately 88% of cancer treatment supplies in Vietnam are imported.

Bidiphar currently holds the highest market share among domestic companies in the cancer treatment segment, specifically in the context of hospital tendering. In 2023, the company captured a 62% market share in the Group 4 and 5 cancer drug categories produced in Vietnam. When considering the entire range of cancer drugs in the ETC tendering channel, Bidiphar holds an approximate 11% market share, attributed to its WHO-GMP-compliant products, which primarily compete in Groups 4 and 5.

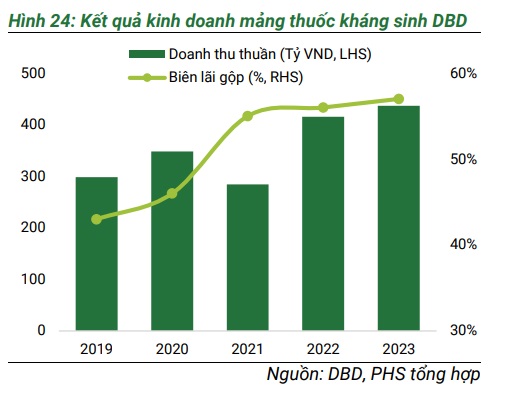

Regarding antibiotics, Bidiphar’s products are utilized in over 100 central-level medical facilities, including the Ho Chi Minh City Tropical Disease Hospital, the National Lung Hospital, and the Hanoi Medical University Hospital. Despite the highly competitive landscape in the hospital tendering segment for antibiotics, Bidiphar has demonstrated robust growth, attributed to the fact that 70% of its antibiotics are formulated as injectables tailored for the hospital channel. Consequently, revenue from Bidiphar’s antibiotic segment accounts for approximately 28% of its total pharmaceutical revenue, with a compound annual growth rate of 8% during the 2019-2023 period.

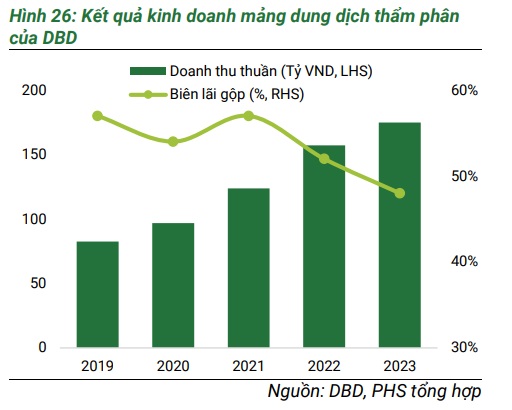

In the dialysis solution segment, competition remains relatively low in Vietnam, with only five companies involved in production and distribution through hospital channels. Bidiphar ranks among the top three players, holding a 24% market share in the ETC channel in 2023. Notably, Bidiphar’s products are priced 2 to 5 times lower than imported alternatives, giving the company a significant competitive advantage.

Notably, Bidiphar is committed to establishing a sustainable and long-term growth foundation for the ETC channel by investing in the construction of a manufacturing facility that meets EU-GMP standards.

Currently, the company operates two manufacturing plants that adhere to WHO-GMP standards: one at its headquarters on Nguyen Thai Hoc Street (established in 2006) and the other specializing in cancer drug production within the Nhon Hoi Economic Zone (operational since 2022). As part of its growth strategy for 2024-2028, Bidiphar plans to invest in two new manufacturing facilities that meet EU-GMP standards in the Nhon Hoi Economic Zone. These facilities will enhance the company’s production capacity and include a plant for small-volume sterile drug production and a plant for non-betalactam oral solid dosage (OSD) drug production.

The small-volume sterile drug production plant will be constructed on a plot of land spanning nearly 25,000 square meters, with an investment of VND 840 billion. The facility will primarily produce injectables, eye drops, and other sterile medications, adhering to EU-GMP standards, and is projected to have a production capacity of 120 million units per year. Bidiphar commenced construction on this project in Q3 2023, and it is expected to be operational by Q1 2027. The main building of the project has already been completed.

The non-betalactam oral solid dosage (OSD) drug production plant will have a total projected investment of VND 822 billion. It will specialize in producing non-betalactam oral solid dosage forms, including tablets, film-coated tablets, hard-shell capsules, sachets, and effervescent tablets. According to the plan, construction on this facility is expected to commence in 2025, with operations commencing in Q1 2027. The company is considering a private placement offering to strategic investors, with a proposed sale of 23.3 million shares at a minimum price of VND 50,000 per share, to raise capital for this project. This offering is anticipated to take place in 2024-2025, pending approval from the State Securities Commission.

Hai Au