In a recent development, KBSV Securities (KBSV) provided an insightful analysis of TCB’s stock performance. The report highlights the bank’s strategic partnership as a diamond sponsor and co-organizer for the “Anh trai vượt ngàn chông gai” concert. This move is expected to enhance Techcombank’s brand positioning in the market.

As part of this initiative, Techcombank offered concert tickets to existing and new customers who opened accounts and utilized the “Sinh lời tự động” feature. The response was remarkable, with 4,500 tickets claimed and over 120,000 customers activating the “Sinh lời tự động” feature on the Techcombank Mobile app.

This campaign effectively boosted the bank’s low-cost, non-term deposits, with interest rates ranging from 0.2-0.5%. Additionally, it helped expand the bank’s potential customer base for future growth. However, KBSV’s analysts also noted that the sponsorship would likely result in increased operating expenses for the bank during the period.

The analysis also offered a positive outlook on Techcombank’s credit growth for the 2025-2027 period. KBSV anticipates the bank to maintain a credit growth rate of 21% for 2024 and 16-18% for the following years. This projection is supported by the expected recovery of the real estate market, which will drive mortgage lending. Techcombank’s focus on home loan disbursements has been the primary driver of credit growth in the individual customer segment.

In addition to real estate lending, the bank is also diversifying its loan portfolio into other sectors such as FMCG, retail, and logistics. “We observe improved disbursements in these sectors due to a more stable economy and the current peak lending season,” KBSV stated in its report, expressing optimism about TCB’s credit growth for 2024 and beyond.

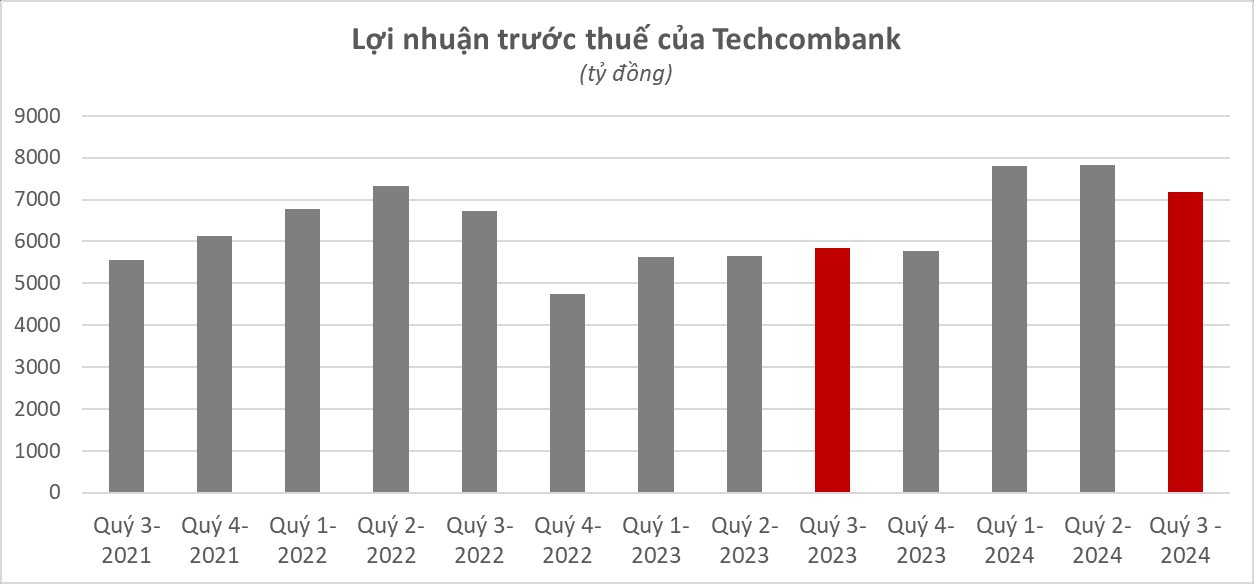

According to the bank’s Q3 2024 financial report, Techcombank recorded a pre-tax profit of VND 22,800 billion in the first nine months of 2024, reflecting a 33% increase compared to the same period in 2023.

As of September 2024, Techcombank’s total assets reached VND 927,100 billion, representing a 9.1% increase from the beginning of the year and an 18.7% surge compared to the same period last year. The bank’s individual credit growth stood at 17.4% year-to-date, reaching VND 622,100 billion. On a consolidated basis, credit growth in the individual customer segment was the main driver in Q3, with customer deposits increasing by 8.9% year-to-date and 21% year-over-year to VND 495,000 billion.

Notably, Techcombank achieved a record-high CASA balance of VND 200,300 billion, resulting in a CASA ratio of 40.5%. This indicates a strong preference for low-cost deposits, which is beneficial for the bank’s overall financial performance.

The Soaring Success of Bidiphar Stock (DBD): Trading Prices Soar Over 30% Higher Than the Start of the Year

DBD stock of Binh Dinh Pharmaceutical – Medical Equipment Joint Stock Company hit its second consecutive ceiling, setting a new all-time high since its listing. Moreover, the share price of this pharmaceutical stock has surged over 30% since the beginning of the year, marking a significant milestone for the company.

“The Ripple Effect”: What Experts Say About the Trend of Rising Savings Account Interest Rates

“The likelihood of a “race” to increase deposit interest rates in the final weeks of 2024 is predicted to be low.

“Techcombank Weighs Sale of 15% Stake to New Strategic Investor if Foreign Owners Exit”

“Techcombank is on the lookout for a strategic investor with a particular set of skills. We are seeking a partner with advanced technological capabilities and established connections within key trade corridors, including Singapore, Japan, and South Korea. With their expertise, we aim to enhance our digital offerings and expand our reach, solidifying our position as a leading bank in Vietnam and beyond.”

The Prime Minister Directs the State Bank of Vietnam to Enhance Credit Management Solutions for 2024

Prime Minister requests SBV to focus on more drastically and effectively performing the tasks and solutions on directing interest rates, exchange rates, credit growth, open market operations, money supply, and reducing the lending interest rate floor to provide the economy with capital at a reasonable cost.