VN-Index made gains in the morning session, briefly reaching 1,250 points, an increase of over 9 points. However, waning demand caused the index to retreat, closing just above the reference level. At the end of the November 28 trading session, the VN-Index rose 0.14 points (0.01%), finishing at 1,242.11 points. The trading value on the three exchanges was lower than the 20-session average, reaching nearly VND 12,300 billion.

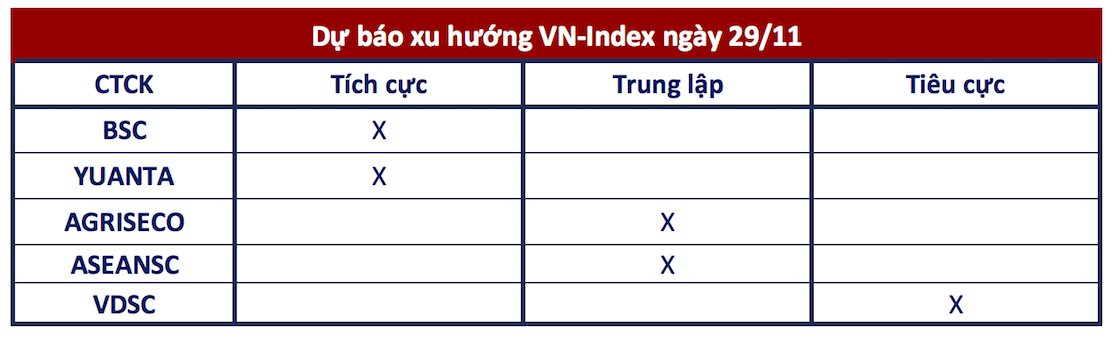

Varying predictions for the next trading session:

Continued recovery:

BSC Securities maintains the view that the VN-Index could continue its recovery in the short term, forming a V-shape and potentially reaching 1,265 points.

Yuanta Securities anticipates the market to extend its gains in the next session, with the VN-Index fluctuating around 1,245 points. They also note that the market remains in a short-term accumulation phase, suggesting narrow fluctuations and low liquidity in upcoming sessions, with possible differentiation in cash flow between stock groups.

A positive sign is the increasing cash flow into small-cap stocks. Additionally, short-term psychological indicators continue to rise, indicating enhanced opportunities for new purchases.

Fluctuations around 1,240 points:

Agriseco Securities notes that technically, the VN-Index opened with a gap up but closed with a bearish candle. This is the second consecutive session with weak demand and increasing selling pressure, yet the index has not dropped below the 20-day moving average. They believe the market needs a few more fluctuations to test the 1,240-point level and attract more cash flow in the coming sessions.

Agriseco recommends that investors hold their previously purchased positions and consider increasing their proportions during market dips, prioritizing leading stocks in the VN30 with discounted prices.

Continued sideways trend:

According to ASEANSC Securities, the market is fluctuating around the 1,240-1,244 point range, indicating a balance between buyers and sellers in a sideways trend. The convergence of the 20-day and 50-day exponential moving averages (EMAs) suggests a continued narrow and quiet trading range, with large-cap stocks stagnating due to decreasing demand and selling pressure. They predict that the sideways trend may persist as the market accumulates liquidity and gradually reduces selling pressure.

Retreat to below 1,238 points:

VDSC Securities forecasts a market retreat to the 20-day moving average (MA) region of around 1,238 points or slightly lower to test supply and demand. If supply increases and dominates during this exploratory phase, there is a risk of continued downward pressure.

They advise investors to slow down and observe supply and demand dynamics, while also effectively managing their portfolios. Consideration can be given to short-term profit-taking or portfolio restructuring to minimize risks.

Tomorrow’s Stock Market Outlook, November 29: Will Profit-Taking Pressure Subside?

In the November 28 stock session, profit-taking selling pressure on stocks eased. Investors hope that this signal will persist into the next session.

The Joy of Being an FPT Shareholder

For the third time this year, FPT shareholders are set to receive an interim cash dividend. This marks the 36th time that FPT stock has reached new heights since the beginning of 2024, showcasing its consistent performance and strong growth trajectory.