The morning’s slight wobble quickly ended as buying pressure forced prices up and sellers also supported the market. The market did not correct but continued to rise with very low liquidity. The VN-Index closed the session at 1250 points with strong net buying of nearly VND 334 billion by foreign investors. FPT excellently surpassed its historical peak thanks to foreign capital support.

The market closed the week and also ended November on a positive note. The VN-Index gained 8.35 points, or 0.67%, with 222 gainers and 147 losers. However, this positive result did not come easily. Even in the morning, the index was in the red with the number of declining stocks dominating.

Short-term profit-taking activities were still present, similar to previous sessions, but they could only create very short-term pressure during the session. This was partly because few people wanted to sell. This morning, the two exchanges matched about VND 5,744 trillion, and by the end of the session, the VN-Index was up 0.46%. In the afternoon, demand improved, and buyers pushed prices higher, and with the strength of some pillar stocks, the index closed at the highest level of the day.

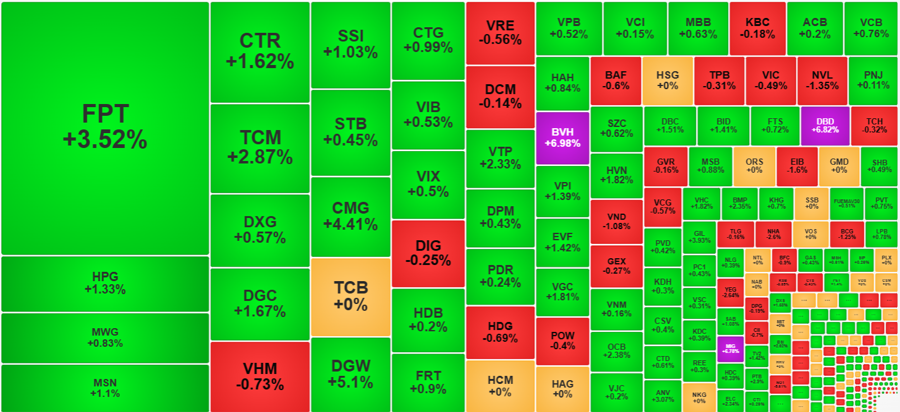

Leading the index today were the trio of FPT, BID, and HPG, all belonging to the market’s largest capitalization group. FPT made a strong impression with a sudden surge in the morning session, gaining 1.94%, and having the highest liquidity in the market. In the afternoon, the stock continued to strengthen and surpassed the historical peak at the beginning of October, closing above the reference price by 3.53%. The amount of money poured into FPT was also enormous, with VND 1,652.2 billion, accounting for 14.3% of the total matched value on the HoSE exchange. Foreign investors net bought VND 237.9 billion in FPT, and their buying volume accounted for about 35.6% of the stock’s liquidity. FPT alone contributed more than 1.7 points to the VN-Index. BID rose 1.41%, HPG rose 1.33%, and the two stocks added another 0.6 points.

The VN30 basket closed even stronger than the VN-Index, rising 0.75% with a breadth of 21 gainers and 6 losers. If it weren’t for the hindrance of VHM falling 0.73%, VIC falling 0.49%, and GVR falling 0.16%, the VN-Index would have had an even more powerful breakout. Nevertheless, the six blue-chip losers were all very light, except for VHM, GVR, and VIC, VRE fell 0.56%, POW fell 0.4%, and TPB fell 0.31%.

Quite surprisingly, the market is still rising amid very low liquidity. Today, the HoSE exchange, though up about 22% in trading value, reached VND 11,541 trillion, but with a significant contribution from FPT. Specifically, this stock’s trading volume doubled compared to yesterday. If we exclude FPT’s trading, the HoSE exchange’s liquidity today only increased by about 12%. Excluding FPT, the trading value on this exchange was less than VND 10,000 billion.

The fact that stocks rose with small liquidity continued to reflect that selling pressure was insignificant. Trading became more vibrant in the afternoon as buyers pushed prices up. HoSE and HNX’s matched liquidity in the afternoon increased by more than 14% compared to the morning and 26% over yesterday afternoon, making it the most vibrant afternoon session this week.

Among the 222 green stocks of the VN-Index today, 76 stocks rose more than 1%. Even excluding FPT, many stocks still had large liquidity, such as HPG rising 1.33% with a matching value of VND 369.2 billion; MSN rising 1.1% with VND 322.4 billion; CTR rising 1.62% with VND 319.3 billion; TCM rising 2.87% with VND 282.2 billion; DGC rising 1.67% with VND 229.4 billion; CMG rising 4.41% with VND 203.4 billion… Mid-cap stocks such as DGW, VTP, VPI, EVF, VGC, and OCB also rose well with liquidity of tens of billions of VND.

Although there were 147 red codes in the declining group, their liquidity accounted for only about 17% of the floor. Only a few stocks declined sharply with high liquidity. Notably, NVL matched VND 79.2 billion, down 1.35%; VND 75.8 billion, down 1.08%; EIB matched VND 53.6 billion, down 1.6%; and NHA matched VND 31.9 billion, down 2.6%. Overall, only about ten stocks fell more than 1% with liquidity from VND 10 billion and above.

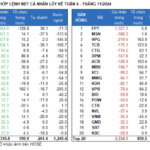

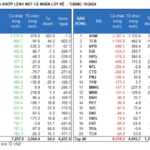

The highlight of foreign capital inflows continued to bring optimistic signals with net buying of nearly VND 334 billion on the HoSE exchange today. Including the HNX and UpCOM exchanges, the net buying value was about VND 364 billion. Thus, the HoSE exchange alone received nearly VND 967 billion in net capital this week, marking the first net buying week after ten consecutive weeks of net selling on this exchange. In addition to FPT, there were MSN + VND 88.8 billion, HPG + VND 72.6 billion, CTR + VND 64.3 billion, PNJ + VND 54 billion, MWG + VND 38.4 billion, CTG + VND 28.5 billion, DPM + VND 23.7 billion, and BID + VND 23 billion. On the selling side, VRE – VND 74.2 billion, VHM – VND 53.3 billion, HDB – VND 46.5 billion, and VCB – VND 27.1 billion.

The Vanishing Liquidity: Personal Cash Flows Take Profits, Net Selling 2,200 Billion VND Last Week

Individual investors net sold 1,979.5 billion VND this week, of which 2,162.5 billion VND was net sold in matched orders.

The Flow of Funds: Why Stockholders are Holding On – What Incentives are Driving the Money Holders?

The market climbed for another week, with indices outperforming the previous week’s numbers. However, liquidity took a significant dip, falling to a record low in the last one and a half years. Experts suggest that this upward trend is being supported by supply rather than cash flow, and even those with money are unsure whether to jump in at this point.

“Funded by Bill Gates’ Foundation, Omachi and Chin-su Manufacturer Soars: Triples in Value This Year, Enters Top 10 Biggest Companies in the Stock Market”

With impressive business results and an exciting IPO and uplisting journey, MCH’s stock has soared over the past year.