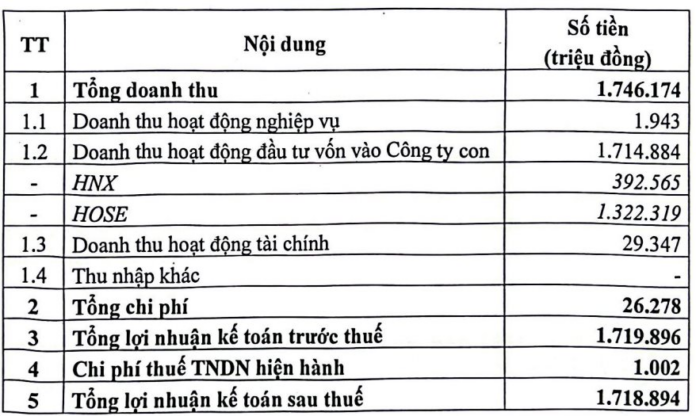

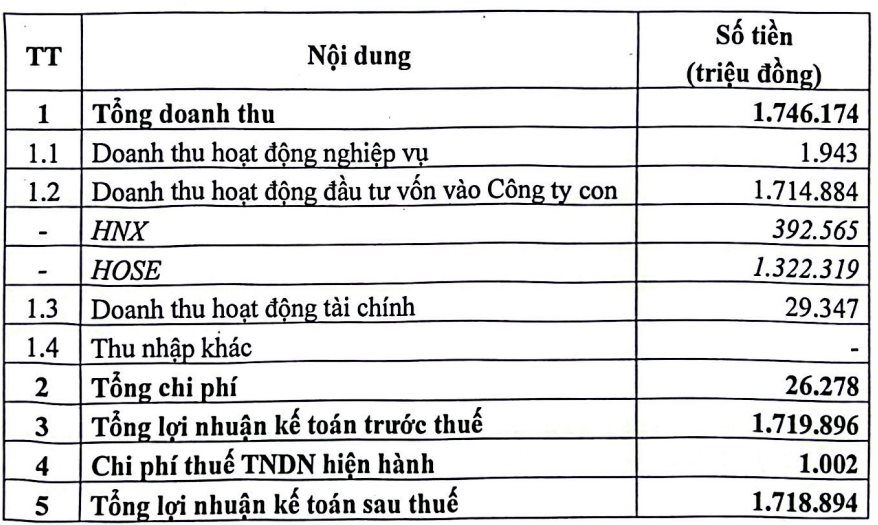

According to the Vietnam Stock Exchange (VNX)’s announcement, the total revenue for the first nine months of 2024 exceeded VND 1,746 billion, up 27% compared to the same period last year. Notably, the revenue from investment activities in subsidiary companies reached nearly VND 1,715 billion.

The two subsidiary exchanges, Ho Chi Minh Stock Exchange (HOSE) and Hanoi Stock Exchange (HNX), contributed VND 1,322 billion (up 32%) and VND 393 billion (up 23%) in revenue, respectively. Additionally, VNX recognized VND 29 billion in financial activities.

Total expenses for the nine-month period amounted to over VND 26 billion, a 15% increase year-on-year. As a result, VNX’s after-tax profit stood at VND 1,719 billion, marking a 28% increase.

For the full year 2024, VNX set a target of nearly VND 2,800 billion in total revenue and over VND 1,420 billion in after-tax profit. With these latest results, VNX has already achieved 62% of its revenue target and surpassed the profit goal by 21% within just nine months.

VNX’s performance occurred amidst fluctuations in Vietnam’s stock market. While the VN-Index maintained a growth rate of over 10% since the beginning of the year, it faced challenges in surpassing the 1,300-point threshold. Liquidity has also been subdued in recent months.

In early November, VNX held a ceremony to announce the decision of the Minister of Finance to appoint Mr. Nguyen Duy Thinh, Chairman of HNX, as a Member of the Members’ Council and General Director of VNX, replacing Mr. Pham Van Hoan.

The Digital Revolution: Unlocking the Potential of Depositary Receipts

On November 21, 2024, the securities exchanges of ASEAN (Indonesia Stock Exchange, Bursa Malaysia, the Philippine Stock Exchange, Singapore Exchange, the Stock Exchange of Thailand, and Vietnam Stock Exchange) signed a Memorandum of Understanding (MoU) to collaborate on depositary receipt (DR) products, enhancing investment opportunities for investors in the region.

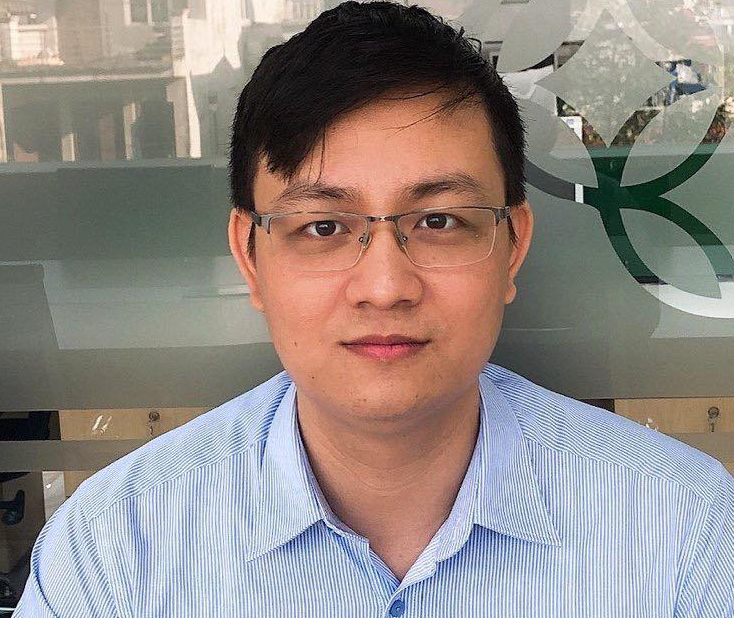

The Radiant East Holding Stock (RDP) Falls into Trading Halt

Rạng Đông Holding (RDP) has once again found itself in hot water with regulators due to non-compliance with information disclosure regulations. As a result, the Ho Chi Minh Stock Exchange (HoSE) has taken decisive action by moving to suspend trading of RDP shares, shifting them from restricted trading to a trading halt.

The Sun Jupiter Financial Stock Alert: A Cautionary Tale

“Shares of SJF, owned by Sao Thai Duong, have been placed on alert status due to the company’s delay in submitting its 2024 semi-annual financial report. The report was due over 15 days ago, and this delay has raised concerns among investors and regulators alike. With a history of providing transparent and timely financial disclosures, this recent development is an unusual occurrence for the company. The market is now eagerly awaiting the release of the audited financial statements to understand the company’s current financial health and future prospects.”

The Penultimate Proposal: Unveiling the Ministry of Finance’s New Suggestions for Service Pricing in the Securities Sector

The Ministry of Finance is seeking feedback on the draft circular guiding service prices in the securities sector applied at the Vietnam Stock Exchange and its subsidiaries, and the Vietnam Securities Depository and Clearing Corporation.