The economy is on a solid path to end the year on a positive note.

Vietnam’s real GDP growth outperformed expectations in Q3 2024, surging to 7.4% year-on-year, surpassing the market average forecast of 6.1% and UOB’s prediction of 5.7%. This is the highest growth rate since Q3 2022, when economic activities rebounded strongly from the pandemic trough. The latest result has contributed to widening the 7.09% (revised) growth in Q2 2024, leading to a cumulative increase of 6.82% year-on-year in the first nine months of 2024.

The surprising outcome of Q3 2024 reflects the resilience of the economy, despite the devastation caused by Typhoon Yagi. Although the key sectors were affected by the storm, agricultural, forestry, and fishery output in Q3 2024 still managed to increase by 2.6% year-on-year (slower than the 3.6% in Q2 2024). Manufacturing output continued to accelerate to 11.4% year-on-year, up from 10.4% in Q2. The services sector grew by 7.5% year-on-year, following a 7.1% increase in Q2. Overall, in Q3 2024, the services sector was the main driver contributing 3.24 percentage points to GDP growth, followed by industry and construction with 3.37 percentage points, with these two sectors accounting for 89% of the overall 7.4% rise.

The latest published data indicates that Vietnam’s growth trajectory remains on track. As of October, Vietnam’s exports rose by 14.9% year-on-year, maintaining double-digit growth so far. For the full year of 2024, UOB forecasts Vietnam’s exports to increase by 18%, making it the strongest year since 2021. Imports grew by 16.8% year-on-year during the January-October period, resulting in a trade surplus of $22.3 billion in the first ten months, the second-largest surplus recorded after $28 billion in 2023. In relation to this, the growth momentum of foreign direct investment (FDI) continues to expand, with registered FDI capital reaching $27.3 billion in the first ten months of 2024, up 2% from the same period in 2023. Actual FDI inflows up to October stood at $19.6 billion and are on track to make 2024 the third consecutive year of record FDI inflows.

Domestically, the growth trajectory of retail sales in 2024 has largely remained stable so far, with a 7.1% increase in October and an average growth of 8.5% year-on-year from the beginning of the year. This compares to a 10.4% rise in 2023. This stability is partly supported by a 41% increase in tourist arrivals, totaling 14.1 million visitors from the beginning of the year to October. This surge is attributed to an increase in visitors from key tourism sources, including South Korea, China, Taiwan, the US, and Japan. However, compared to the pre-COVID boom in 2019, tourist arrival data continues to show a decline, and it may take another year or two to return to pre-pandemic levels.

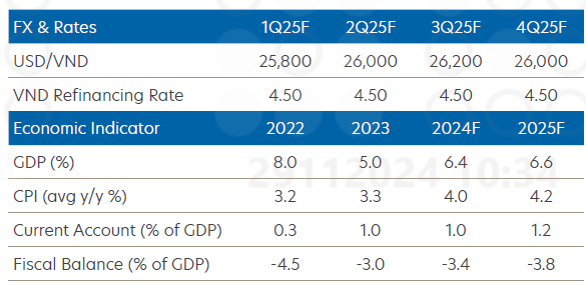

Considering these factors, UOB maintains its forecast for Vietnam’s full-year growth at 6.4%, with Q4 2024 growth expected to reach 5.2% year-on-year. For 2025, UOB predicts a growth rate of 6.6%.

The Vietnamese National Assembly has set a GDP growth target of 6.5-7.0% for 2024 and 6.5-7.0% for 2025, while “endeavoring” to achieve 7.0-7.5%. However, with the US preparing for Trump 2.0, potential global trade tensions and risks could emerge soon.

A key risk to note is the potential trade restrictions on Vietnam, as the US trade deficit with Vietnam has more than doubled from $39.5 billion in 2018 to nearly $105 billion in 2023. Overall, the US trade deficit with ASEAN has nearly doubled to $200 billion in 2023 from below $100 billion in 2018, with global trade dynamics and supply chains adjusting to the restrictions imposed during Trump 1.0.

The State Bank of Vietnam will maintain stability for now.

With the economy still growing strongly in 2024 and extending into 2025, the State Bank of Vietnam (SBV) is under no immediate pressure to loosen its policies. The inflation rate has remained below the 4.5% target since June 2023, thus alleviating much of the pressure on the SBV.

However, with the anticipated rise in global trade tensions under Trump 2.0 and the growing concern about the strength of the US dollar, the SBV is expected to pay attention to the downward pressure on the VND. Therefore, UOB anticipates that the refinancing rate will remain at its current level of 4.5%.

VND continues to depreciate to a new low.

The VND has experienced a volatile period in the past few months. After recording the largest quarterly gain (3.5%) since 1993 in Q3 2024, the VND reversed all these gains in October-November. Despite its strong fundamentals, the VND remains constrained by external factors such as the recovering US dollar as the market prices in a scenario of fewer Fed rate cuts during Trump 2.0.

The Vietnamese Dong’s Devaluation: A Tricky Tightrope for Vietnam’s Central Bank

The HSC predicts a slight increase in the policy rate to 4.75% and 5% by the end of 2025 and 2026, respectively. This forecast is based on a thorough analysis of economic indicators and market trends. With inflationary pressures mounting and a need to curb rising prices, a gradual increase in interest rates is expected to stabilize the economy and encourage sustainable growth.

Unveiling Eximbank’s New Credit Package: The 30,000 Billion VND Advantage

As FDI flows into Vietnam surge, Eximbank introduces a preferential credit package of VND 3,000 billion (“FDI Premium”) with interest rates starting at 3.4% and a fee package (“FDI Priority”) with zero fees for over-the-counter payment transfers tailored for FDI clients. These offerings are designed to provide comprehensive support for businesses’ capital needs and reduce their international transaction costs.

Why You Shouldn’t Buy Gold Right Now

This morning (October 25th), gold ring prices remain at a staggering high of 89 million VND per tael, on par with the SJC gold bullion price. Several experts advise against investing in gold at this time due to the high price point and the volatile nature of the market, which could see prices fluctuate dramatically.