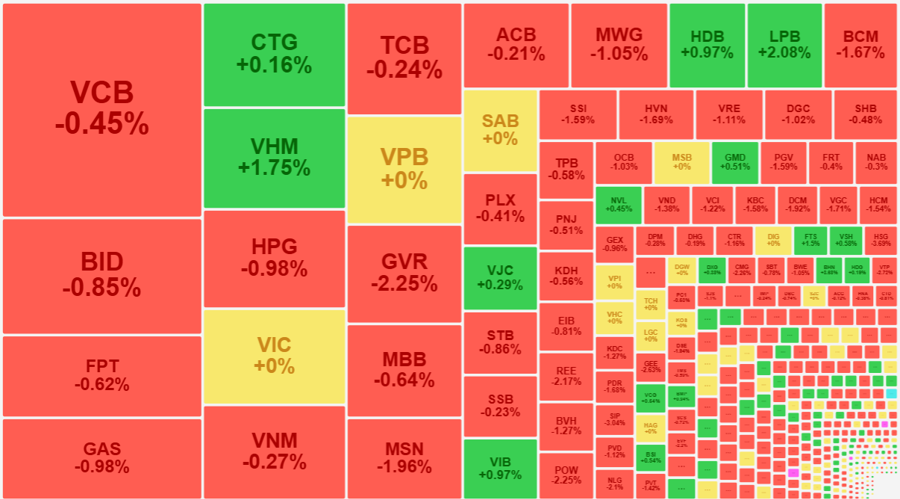

Technical Signals for the VN-Index

In the trading session on the morning of December 2, 2024, the VN-Index gained points, but trading volume did not show a clear improvement. This indicates that investors’ doubts remain.

Additionally, the VN-Index is heading towards testing the group of 100-day and 200-day SMA lines, while the MACD indicator maintains its previous buy signal. In a positive scenario, if the index successfully surpasses this resistance level, the mid- and long-term optimistic outlook will return in the upcoming sessions.

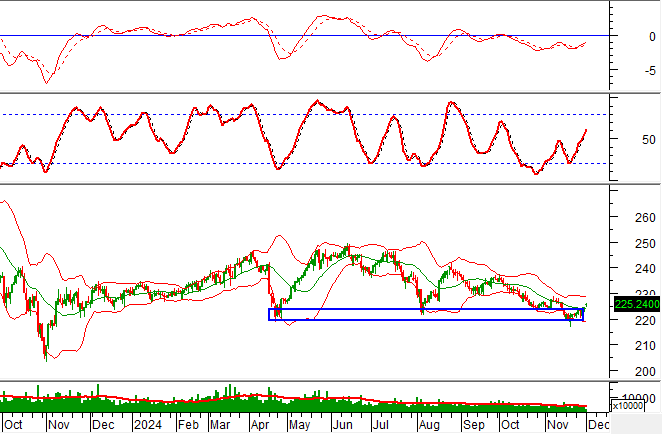

Technical Signals for the HNX-Index

On December 2, 2024, the HNX-Index rose, but liquidity slightly decreased in the morning session, indicating investors’ hesitation.

Currently, the HNX-Index is retesting the old bottom of April 2024 (equivalent to the 220-225-point region) while the MACD indicator gives a buy signal again. This suggests that the short-term outlook may improve in the coming sessions.

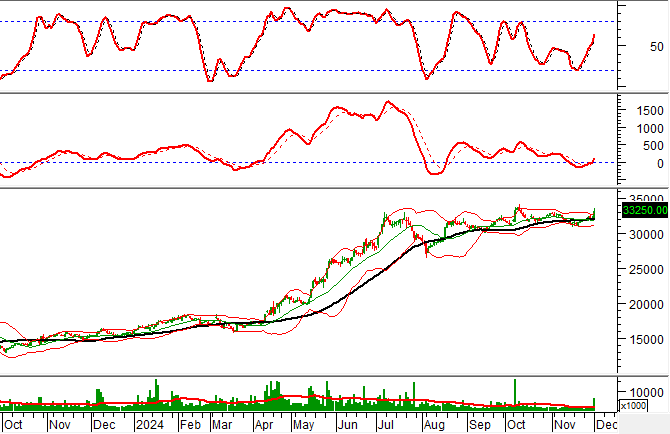

LPB – Loc Phat Bank

On the morning of December 2, 2024, LPB’s price increased sharply, and a candle pattern similar to White Marubozu appeared, with liquidity exceeding the 20-session average. This indicates active trading by investors.

Currently, the stock price rebounded after successfully testing the Middle line of the Bollinger Bands, while the Stochastic Oscillator indicator continues to rise after giving a previous buy signal, further strengthening the short-term upward trend of the stock.

Moreover, the stock price rebounded after successfully testing the 50-day SMA line, indicating the presence of a mid-term optimistic outlook.

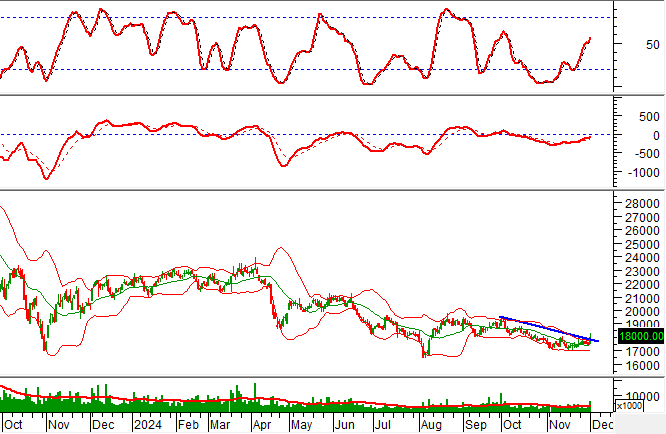

VCG – Vietnam Export-Import and Construction Corporation

In the morning session of December 2, 2024, VCG’s price rose, and trading volume significantly increased, surpassing the 20-session average, reflecting investors’ optimism.

Additionally, the stock price broke out of the short-term downward trendline, and the MACD indicator is continuously expanding the gap with the Signal line after giving a previous buy signal, indicating the possibility of a short-term recovery in the upcoming sessions.

Technical Analysis Department, Vietstock Consulting

Technical Analysis for the Session Closing November 28th: A Mix of Positive and Negative Signals

The recent volatile trading sessions of the VN-Index and HNX-Index, characterized by a tug-of-war between buyers and sellers and erratic liquidity, reflect the fragile sentiment among investors.

The Power of Persuasive Writing: Crafting Compelling Headlines

“The Week Ahead: Uptrend Momentum Sustained”

The VN-Index extended its gains from the previous week, forming a bullish White Marubozu candlestick pattern. This indicates strong buying pressure as the index closed near its high. Additionally, the VN-Index has crossed above the 200-week SMA, reflecting a positive long-term outlook and an increasingly optimistic investor sentiment. However, the MACD indicator is currently showing a sell signal, and a drop below the zero line could trigger a short-term correction. If this occurs, the likelihood of a downward adjustment increases.

Technical Analysis for the Session on November 29: Investor Sentiment Continues to Improve

The VN-Index and HNX-Index both climbed, with a notable surge in trading liquidity during the morning session, indicating a positive shift in investor sentiment.