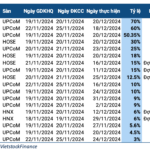

This week, 15 companies announced record closings to pay dividends. Of these, 11 companies paid dividends in cash, while four enterprises distributed dividends in stocks.

PNJ Guarantees a Loan of VND 500 Billion

Phu Nhuan Jewelry Joint Stock Company (PNJ stock code) approved the guarantee for two subsidiaries to borrow from banks. Specifically, PNJ guaranteed a loan of VND 400 billion for PNJ Jewelry Manufacturing and Trading One-Member Limited Liability Company and VND 100 billion for CAO Fashion One-Member Limited Liability Company to supplement working capital and issue L/C.

PNJ guarantees a loan of VND 500 billion for its two subsidiaries.

As of September 30, PNJ owned three subsidiaries, holding 100% of their charter capital. CAO Fashion One-Member Limited Liability Company was established in 2009, while PNJ Jewelry Manufacturing and Trading One-Member Limited Liability Company was founded in 2018.

TTC Hospitality Joint Stock Company (TTC Hospitality – VNG stock code) has privately issued 5,000 bonds with a par value of VND 100 million each to raise VND 500 billion in capital through a bond offering. The bonds will mature in three years, on November 25, 2027.

To secure the bond offering, TTC Hospitality mortgaged two hotels: the land use rights, attached assets, and all related rights of TTC Hotel Premium Can Tho and Hotel Michelia. Additionally, the bonds are guaranteed by the entire equity contribution in VNG.

The value of TTC Hotel Premium Can Tho, as assessed by the Century Valuation Company, is approximately VND 658 billion, while Hotel Michelia is worth around VND 341 billion. These two hotels were also part of the collateral for VNG’s previous bond offering in late 2022, valued at VND 576 billion and VND 254 billion, respectively.

The bond coupon rate is set at 10.98% for the first year, with subsequent years subject to a floating rate plus a margin of 5.78%. The bonds were arranged by Viet Capital Securities and unconditionally guaranteed by Thanh Thanh Cong Investment Company, which holds 30.36% of VNG’s charter capital.

TTC Hotel Premium Can Tho was mortgaged for the bond issuance.

The proceeds from the bond offering will be used by TTC Hospitality to repay the principal of the VNG bond offering to the public earlier this year, which amounted to VND 500 billion and is due in early January 2025.

Phu Tho Tourist Owes Overdue Taxes

Phu Tho Tourism Joint Stock Company (Phu Tho Tourist – DSP stock code) received 12 decisions from District 11 Tax Office in Ho Chi Minh City regarding the enforcement of tax collection by deducting funds from the company’s bank accounts. The total amount enforced exceeded VND 3.4 billion due to overdue taxes. The tax office sent these decisions to banks where Phu Tho Tourist holds accounts, such as Sacombank, Vietcombank, and VPBank, to request the deduction of funds.

Previously, on July 24, the Ho Chi Minh City Tax Department decided to enforce tax collection by suspending the company’s invoice use due to overdue taxes totaling more than VND 57 billion. However, the company was allowed to continue using invoices as they complied with the tax payment, as per the decision on October 17 of the Ho Chi Minh City Tax Department.

Phu Tho Tourist manages and operates four business units, including Dam Sen Cultural Park (Dry Dam Sen)

Phu Tho Tourist manages and operates four business units: Dam Sen Cultural Park (Dry Dam Sen), Ngoc Lan – Phu Tho Hotel Group, Dam Sen Tourism Service Center, and Vam Sat Mangrove Forest Ecotourism Area. The company also has a linkage in Wet Dam Sen and financial investments in two hotels: Saigon – Da Lat (Lam Dong) and Saigon – Dong Ha (Quang Tri).

Khang Dien House Trading and Investment Joint Stock Company (KDH stock code) will acquire 99.96% of the charter capital of Thuy Sinh Real Estate Joint Stock Company from its subsidiary, Vi La Joint Stock Company, for a total value of VND 599.8 billion. Upon completion of this transaction, Thuy Sinh will become a direct subsidiary of Khang Dien.

Thuy Sinh Real Estate is known as the investor of the Thuy Sinh – Phu Huu project (commercial name: The Classia Khang Dien, formerly known as Xanh City). The project covers an area of 4.3 hectares and is located on the frontage of Vo Chi Cong Street, in Huu Phu Ward, Thu Duc City. To fund this project, Khang Dien issued VND 400 billion in bonds in 2022, channeling the funds into this subsidiary.

Thuy Sinh Real Estate Joint Stock Company was established on May 30, 2013, with its head office located at 1B, 12th Floor, Saigon Centre, 67 Le Loi, Ben Nghe Ward, District 1, Ho Chi Minh City. In 2020, Khang Dien approved Vi La’s contribution of VND 360 billion to Thuy Sinh to increase its charter capital to VND 600 billion, which has remained unchanged since.

Khang Dien House Trading and Investment Joint Stock Company acquires Thuy Sinh Real Estate Joint Stock Company.

Currently, Mr. Pham Hong Phu is the Director and legal representative of Thuy Sinh. Mr. Phu also serves as the legal representative of several other subsidiaries of Khang Dien, including Sapphire Real Estate Investment and Business Company Limited, Nam Phu Real Estate Development Company Limited, Binh Trung Real Estate Investment and Business Company Limited, and Gia Phuoc Real Estate Company Limited.

FPT Corporation (FPT stock code) announced that December 3 would be the record date for the first 2024 dividend payment in cash, with a ratio of 10%. This means that for every share owned, shareholders will receive VND 1,000. With over 1.46 million shares in circulation, FPT will pay out more than VND 1,460 billion in dividends to its shareholders.

Sai Gon – Ha Noi Beer Joint Stock Company (BSH stock code) announced the record date for the first 2024 dividend payment in cash on December 2. With 18 million shares in circulation and a payout ratio of 10%, BSH will need to allocate VND 18 billion for this dividend payment. BSH is a subsidiary of Sabeco, with Sabeco holding nearly 53.6% of its capital. Consequently, Sabeco will receive nearly VND 10 billion from BSH.

The Debt-Ridden Business: TTC Hospitality Puts Up Hotels as Collateral for Bond Issuance

TTC Hospitality is proud to announce the issuance of 500 billion VND worth of bonds, secured by the company’s own hotel properties and equity investments in other enterprises.

The Ultimate Guide to Dividends: Unveiling the Top 3 Companies with Over 50% Payout Ratio for Nov 18-22

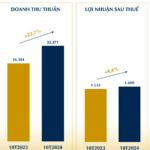

During the week of November 18-22, 2024, 18 companies will close the book on cash dividends, with 3 offering rates exceeding 50%. The highest rate is an impressive 70%, meaning shareholders owning 1 share will receive 7,000 VND.