There was no adjustment to the cash flow, which stood firm, awaiting a discount to buy. After fluctuating in the previous session, the index was unexpectedly pushed up sharply in today’s session, rising by 8.35 points to the 1,250-point region, bewildering the market.

The main driving force came from foreign capital inflows, as this group resumed strong net buying, with a value of 333.9 billion VND. Cumulatively, over the past five sessions, they have net bought nearly 1,000 billion VND after net selling 91,000 billion VND since the beginning of the year. The breadth also improved, with 222 gainers and 147 losers. Real estate was the only group that faced greater selling pressure than buying demand, with Vin stocks falling in unison: VHM decreased by 0.73%, VIC by 0.49%, and VRE by 0.56%. Meanwhile, industrial real estate stocks were stronger, rising across the board.

On the contrary, most other sectors advanced, with strong gains in telecommunications, up 4.49%; information technology, up 3.55%; insurance, up 5.11%; food and beverage, up 1.44%; banks, up 0.62%; and securities, up 0.5%. Accompanying this were the top stocks that contributed to the market’s gains: FPT contributed the most with 1.74 points, followed by VCB and BID, which added nearly 2 points. Other contributors included BVH, HPG, CTG, MSN, and HVN.

As the market continued to rise, skeptical investors did not rush in, resulting in today’s liquidity not being exceptionally high. The total matching value on the three exchanges was nearly 15,000 billion VND, of which foreign investors net bought 359.7 billion VND. Specifically, in terms of matching transactions, they net bought 226.9 billion VND.

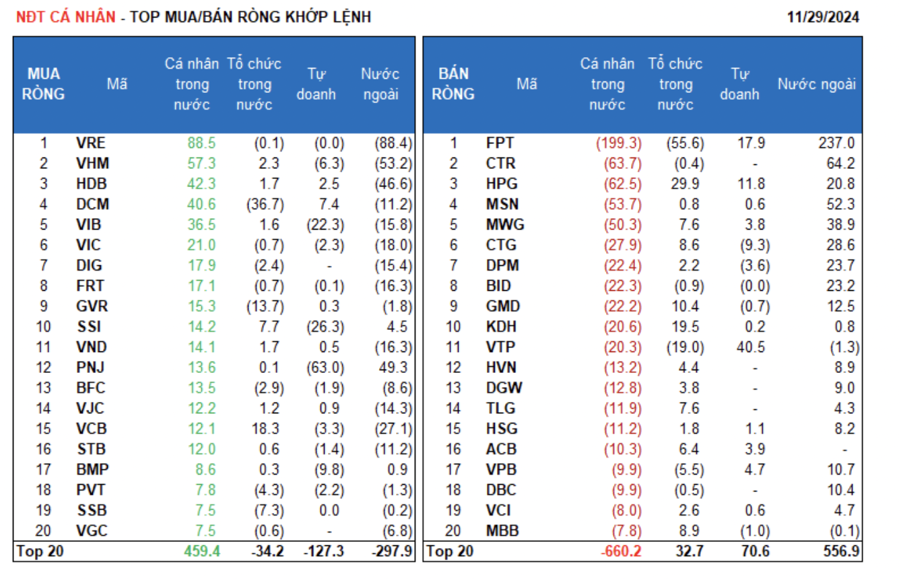

Foreign investors’ main net buying on the matching side was focused on information technology, food and beverage, and consumer staples sectors. The top net bought stocks on the matching side by foreign investors included FPT, CTR, MSN, PNJ, MWG, CTG, DPM, BID, HPG, and GMD.

On the net selling side, foreign investors focused on the real estate sector on the matching side. The top net sold stocks on the matching side by foreign investors included VRE, VHM, HDB, VCB, TCB, FRT, VND, VIB, and DIG.

Individual investors net sold 129.4 billion VND, of which 220.6 billion VND was net sold on the matching side.

Specifically, in terms of matching transactions, individual investors net bought 9 out of 18 sectors, mainly focusing on the real estate sector. The top net bought stocks by individual investors included VRE, VHM, HDB, DCM, VIB, VIC, DIG, FRT, GVR, and SSI.

On the net selling side, individual investors net sold 9 out of 18 sectors, mainly focusing on information technology, food and beverage, and consumer staples sectors. The top net sold stocks by individual investors included FPT, CTR, HPG, MSN, MWG, CTG, BID, GMD, and KDH.

Proprietary trading net sold 83.5 billion VND, of which 81.2 billion VND was net sold on the matching side.

Specifically, in terms of matching transactions, proprietary trading net bought 10 out of 18 sectors. The top net bought sectors were industrial goods & services and food and beverage. The top net bought stocks on the matching side by proprietary trading today included VTP, FPT, HPG, TCB, DCM, SBT, VPB, VNM, ACB, and MWG. The top net sold sector was financial services. The top net sold stocks included PNJ, FUEMAV30, SSI, VIB, BMP, CTG, VHM, BVH, CMG, and TPB.

Domestic institutional investors net sold 117.0 billion VND, of which 74.9 billion VND was net bought on the matching side.

Specifically, in terms of matching transactions, domestic institutions net sold 5 out of 18 sectors, with the largest net selling value in the chemicals sector. The top net sold stocks by domestic institutions included FPT, DCM, VTP, GVR, SSB, HAH, VPB, IMP, TCH, and HDG. The top net bought sector was financial services. The top net bought stocks included FUEMAV30, HPG, KDH, VCB, GMD, TCB, MBB, CTG, FUEVFVND, and SSI.

Today’s negotiated transactions reached 2,041.0 billion VND, up 18.1% from the previous session, contributing 13.7% of the total trading value.

Notably, there were negotiated transactions involving the transfer of 841,000 FPT shares (equivalent to 120.3 billion VND) and more than 2.1 million MSN shares (equivalent to 155.4 billion VND) between foreign institutions.

In addition, individual investors continued to trade in the banking sector (SHB, STB, SSB, LPB, VPB, EIB) and large-cap stocks (FPT, MSN, HPG, MWG).

The allocation of cash flow by sector showed an increase in construction, chemicals, retail, software, and textiles, while there was a decrease in real estate, banking, securities, steel, electrical equipment, oil and gas, and plastics, rubber, and fibers.

Specifically, in terms of matching transactions, the allocation of cash flow by sector showed an increase in mid-cap stocks (VNMID) and a decrease in large-cap stocks (VN30) and small-cap stocks (VNSML).

The Power Player: VNDirect’s Chairwoman Pham Minh Huong to Feature on The Investors Talk Show on December 3rd

The Investors is an insightful talk show series that offers a unique perspective on the world of investing. Each episode features seasoned business leaders, fund managers, securities experts, and influential investors who share their wisdom and insights on the Vietnamese stock market and the latest investment trends. With their extensive experience and knowledge, these experts provide valuable insights that go beyond the surface, giving viewers a deeper understanding of the market and empowering them to make informed investment decisions.

The Foreign Block Turns Net Sellers After 6 Consecutive Buying Sessions, Dumping Real Estate Across the Board

Liquidity on the three exchanges reached 13.4 trillion VND, with foreign investors selling a net of 310.2 billion VND after six consecutive sessions of net buying of over 424.5 billion VND.

The Unbelievable “Shock”: MBS Offers a Whopping 100% Margin Interest Gift to Traders in December

Belief in Vietnam’s ability to achieve or surpass its 7% growth target by the end of 2024 is fueling a stock market surge. In this context, MBS is rolling out its “Margin Shock” program for the first time, offering a market-leading 100% interest repayment to empower investors and boost the overall market.