TT6 is set to issue over 5.1 million shares at a ratio of 100:25, with each shareholder receiving one right for every share owned, and 25 new shares being purchased for every 100 rights. The post-issue chartered capital is expected to increase by 25% to nearly VND 260 billion.

The offering price of VND 10,000 per share is approximately 20% higher than the closing price of TT6 shares on December 2, 2024. The company intends to allocate more than VND 20 billion to repay debts to the Vietnam Foreign Trade Joint Stock Bank – Can Tho Branch, and the remaining VND 31 billion will be used to pay for goods and raw materials from suppliers. These expenses are expected to be incurred from the second quarter of the following year.

This written ballot also includes a series of issues related to other matters, such as the re-promulgation of the Charter, changes in the management and operational organization model, and the cancellation of the Internal Control Regulations. It also involves the revocation of the plan to offer additional shares to existing shareholders, which was approved at the Annual General Meeting of Shareholders in June. The original plan was to use the entire VND 51.3 billion to purchase passion fruit and mango from suppliers.

Shareholders can send their ballots to the Company’s office in Phung Hiep District, Hau Giang Province, before the deadline of 12:00 on December 12, 2024.

Mr. Pham Tien Hoai. Source: TT6

|

Notably, more than 20 million new TT6 shares have been traded on UPCoM since August this year, with 50.3% of the capital owned by Mr. Pham Tien Hoai, a founding shareholder.

TT6 was formerly known as TNHH MTV Tien Thinh Agricultural Processing Company, established exactly ten years ago, on December 3, 2014, with a chartered capital of VND 10 billion. The company set up its first factory in Hau Giang Province to produce fruit juice. Their first export was in 2016, with natural juice made from tangerines. In 2019, the company installed four flexible dryers to produce dried fruit products.

In the first few years of constructing factories and purchasing machinery, in addition to bank loans, TT6 mainly operated with capital from Mr. Pham Tien Hoai, and its chartered capital gradually increased. By 2021, when it transitioned to a joint-stock company model, the company welcomed two other major shareholders: Agri Group Investment and Agriservices Agricultural Services. Each unit contributed VND 9.9 billion to own 5.8% of the capital but quickly divested entirely afterward.

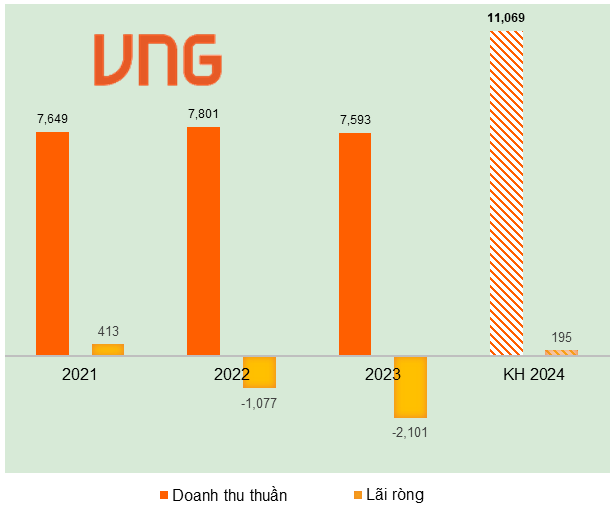

TT6‘s business performance has generally been profitable but is showing signs of decline. In the first nine months of 2024, revenue decreased by 10% compared to the same period last year, reaching approximately VND 191 billion, while gross profit increased to VND 27 billion. The company still made a net profit of VND 4.7 billion, unchanged from the previous year. In 2023, TT6 recorded a net profit of VND 8 billion, a significant decrease from VND 14 billion in 2022 and 2021, due to challenges in the export market.

The Power Player: VNDirect’s Chairwoman Pham Minh Huong to Feature on The Investors Talk Show on December 3rd

The Investors is an insightful talk show series that offers a unique perspective on the world of investing. Each episode features seasoned business leaders, fund managers, securities experts, and influential investors who share their wisdom and insights on the Vietnamese stock market and the latest investment trends. With their extensive experience and knowledge, these experts provide valuable insights that go beyond the surface, giving viewers a deeper understanding of the market and empowering them to make informed investment decisions.

Quarterly Review: Which Sector Will the 18,000 Billion NAV ETF Duopoly Heavily Invest In?

According to the latest report from BSC Research, the portfolios of two large ETFs are set for notable changes in the upcoming Q4 2024 reconstitution. Viettel Post’s VTP is predicted to feature in both ETF portfolios, while Nam A Bank’s NAB is likely to be added to the VNM ETF.