Left padding

On November 29, 2024, the State Securities Commission (SSC) issued Decision No. 1337/QD-XPHC on administrative sanctions in the securities and stock market field against Cong Thanh Cement Joint Stock Company.

Accordingly, Cong Thanh Cement was fined VND 92.5 million for failing to disclose information that must be disclosed in accordance with Point a, Clause 4, Article 42 of the Government’s Decree No. 156/2020/ND-CP dated December 31, 2020, on sanctions for administrative violations in the securities and stock market field.

Illustrative image

Specifically, Cong Thanh Cement failed to disclose on the SSC’s information disclosure system documents including the financial reports for Q4/2022, Q1/2023, Q3/2023, and Q4/2023; Explanation for the reason of changes in post-tax profit from 10% compared to the same period last year for the 2022 audited financial report; Notice of signing the 2023 audit contract; The company failed to disclose on the Hanoi Stock Exchange (HNX) information disclosure system documents: Report on the situation of using the proceeds from bond issuance audited in 2022, 2023, and the first half of 2023; Status of bond principal and interest payment in 2022, 2023, and the first half of 2023; Report on the implementation of the commitments of the issuing enterprise to bondholders in 2022 and the first half of 2023.

In addition, the company disclosed information on the SSC’s public information disclosure system with incomplete content according to regulations, including the 2022 and 2023 audited financial reports; 2022 and 2023 Annual Reports; 2023 Semi-annual reviewed financial report; Resolution No. 01-2023/NQ-HQT dated January 5, 2023 of the Board of Directors on borrowing money from the Deputy General Director; Explanation for the auditor’s denial of opinion in the 2023 financial report; Explanation for the reason of changes in post-tax profit from 10% compared to the same period last year for the 2022 Semi-annual reviewed financial report, 2023 Semi-annual reviewed financial report, and 2023 financial report.

At the same time, Cong Thanh Cement was fined VND 65 million for disclosing information with incomplete content as prescribed in Point b, Clause 3, Article 42 of Decree No. 156/2020/ND-CP.

Specifically, in the 2023 Corporate Governance Report, the company did not present Resolution No. 01-2023/NQ-HQT dated January 5, 2023 of the Board of Directors on borrowing money from the Deputy General Director. In addition, information about transactions between the company and related parties, including the repayment of VND 10.1 billion to Ms. Nguyen Thi Da Thao – Deputy General Director of the company, was not presented. This transaction was recognized in the 2022 audited financial report; the company borrowed VND 17.4 billion from Ms. Thao, which was recognized in the 2023 audited financial report.

Cong Thanh Cement was fined VND 350 million for failing to register securities transactions. Accordingly, the company completed the registration of public companies on November 13, 2009, but has not registered for trading shares on the securities trading system up to now.

The total amount of administrative fines that Cong Thanh Cement has to pay is VND 507.5 million.

In addition to the administrative sanction, Cong Thanh Cement must also apply remedial measures, which is to submit the registration dossier for securities trading and listing to the Vietnam Stock Exchange and its subsidiaries within a maximum period of 60 days, as prescribed in Point a, Clause 7, Article 18 of Decree No. 156/2020/ND-CP, for the act of failing to register securities transactions.

Cong Thanh Cement Joint Stock Company was established on January 23, 2006, with its head office located in Tam Son village, Tan Truong commune, Nghi Son town, Thanh Hoa province. The company’s main business activity is the production of clinker, cement, lime, and gypsum.

According to the 2023 audited financial report, as of November 31, 2023, Cong Thanh Cement had a charter capital of VND 900 billion, and its legal representative was Ms. Nguyen Thi Hoang Thi – CEO.

The Power Player: VNDirect’s Chairwoman Pham Minh Huong to Feature on The Investors Talk Show on December 3rd

The Investors is an insightful talk show series that offers a unique perspective on the world of investing. Each episode features seasoned business leaders, fund managers, securities experts, and influential investors who share their wisdom and insights on the Vietnamese stock market and the latest investment trends. With their extensive experience and knowledge, these experts provide valuable insights that go beyond the surface, giving viewers a deeper understanding of the market and empowering them to make informed investment decisions.

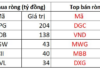

Quarterly Review: Which Sector Will the 18,000 Billion NAV ETF Duopoly Heavily Invest In?

According to the latest report from BSC Research, the portfolios of two large ETFs are set for notable changes in the upcoming Q4 2024 reconstitution. Viettel Post’s VTP is predicted to feature in both ETF portfolios, while Nam A Bank’s NAB is likely to be added to the VNM ETF.