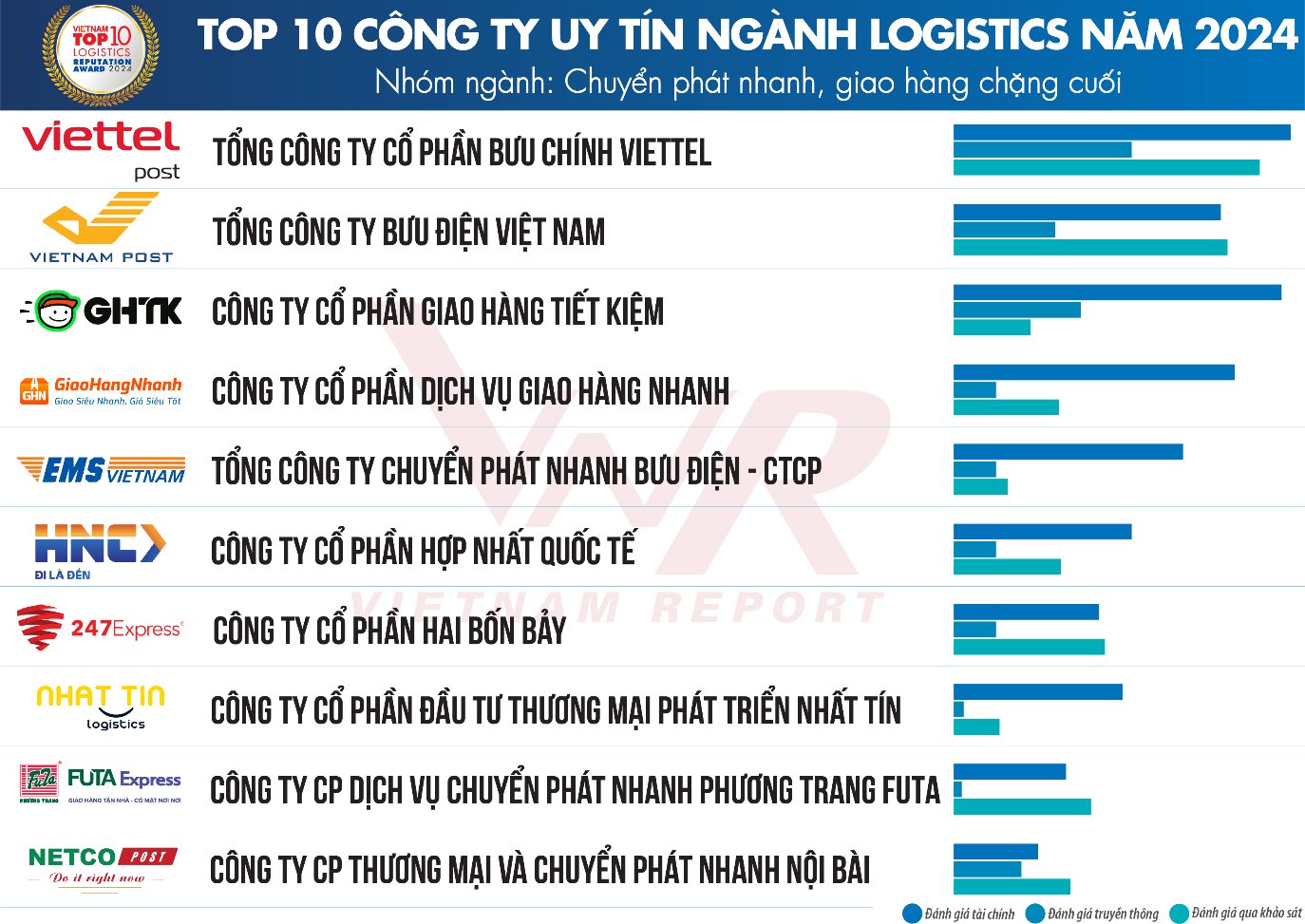

According to the report publisher, the selection of logistics enterprises was based on three criteria: Financial capacity reflected in the latest financial report; Media reputation evaluated through Media Coding – coding articles about the company in influential media channels; and a survey of the research objects and related parties, updated in November 2024.

In the Express Delivery and Last-mile Delivery sector, Viettel Post and Vietnam Post maintained their leading positions from the previous year. However, the top 5 this year witnessed the emergence of three new companies: Joint Stock Company of Delivery Savings, Fast Delivery, and Postal Express.

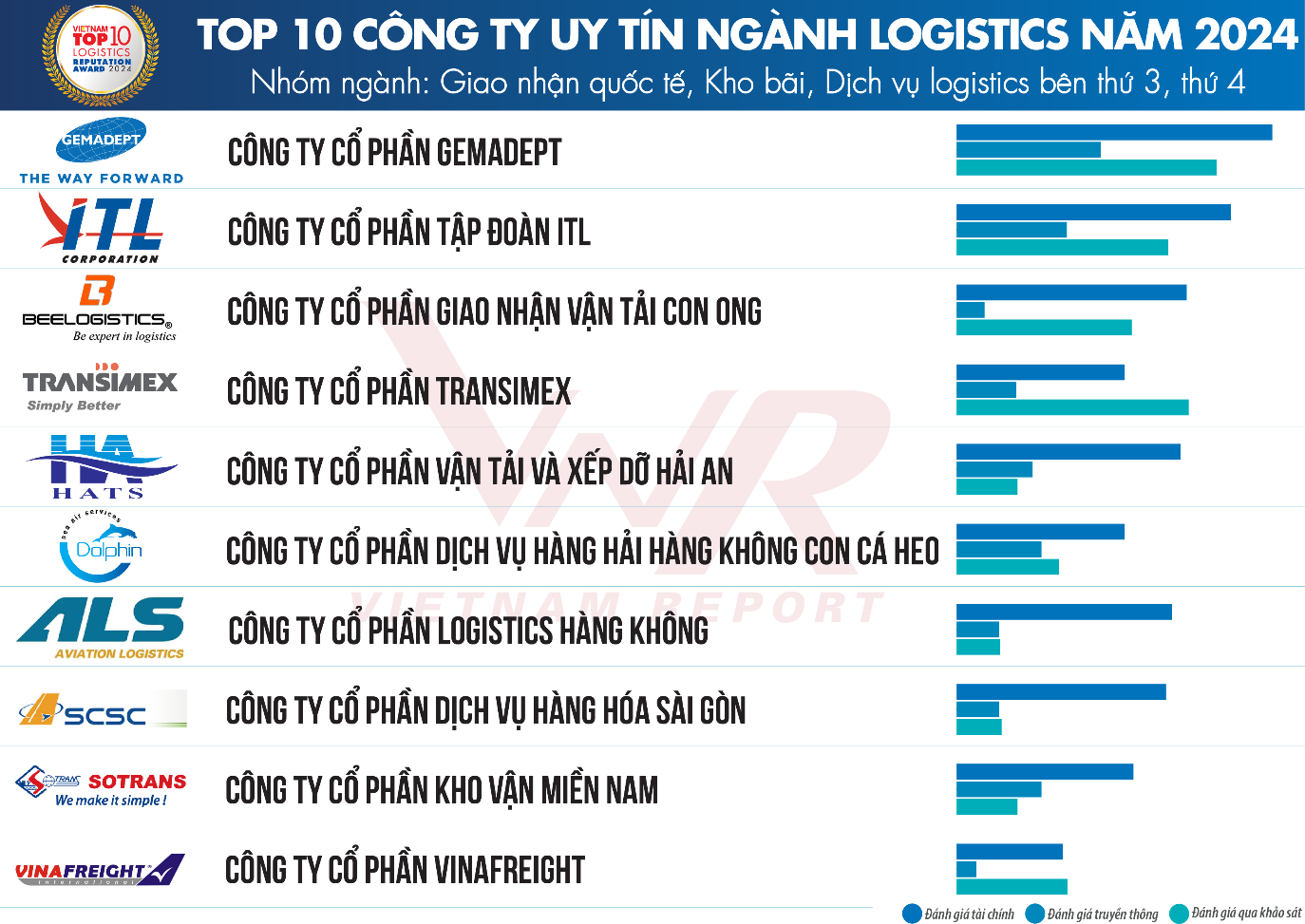

In the International Freight Forwarding, Warehousing, and Third-Party Logistics sector, Gemadept Joint Stock Company took the lead after two years of standing behind In Do Tran Freight Forwarding and Transport Joint Stock Company. The top 5 this year also included three new names: Hai An Transport and Stevedoring Joint Stock Company; Joint Stock Company of Bee Transport and Logistics; and Transimex Joint Stock Company.

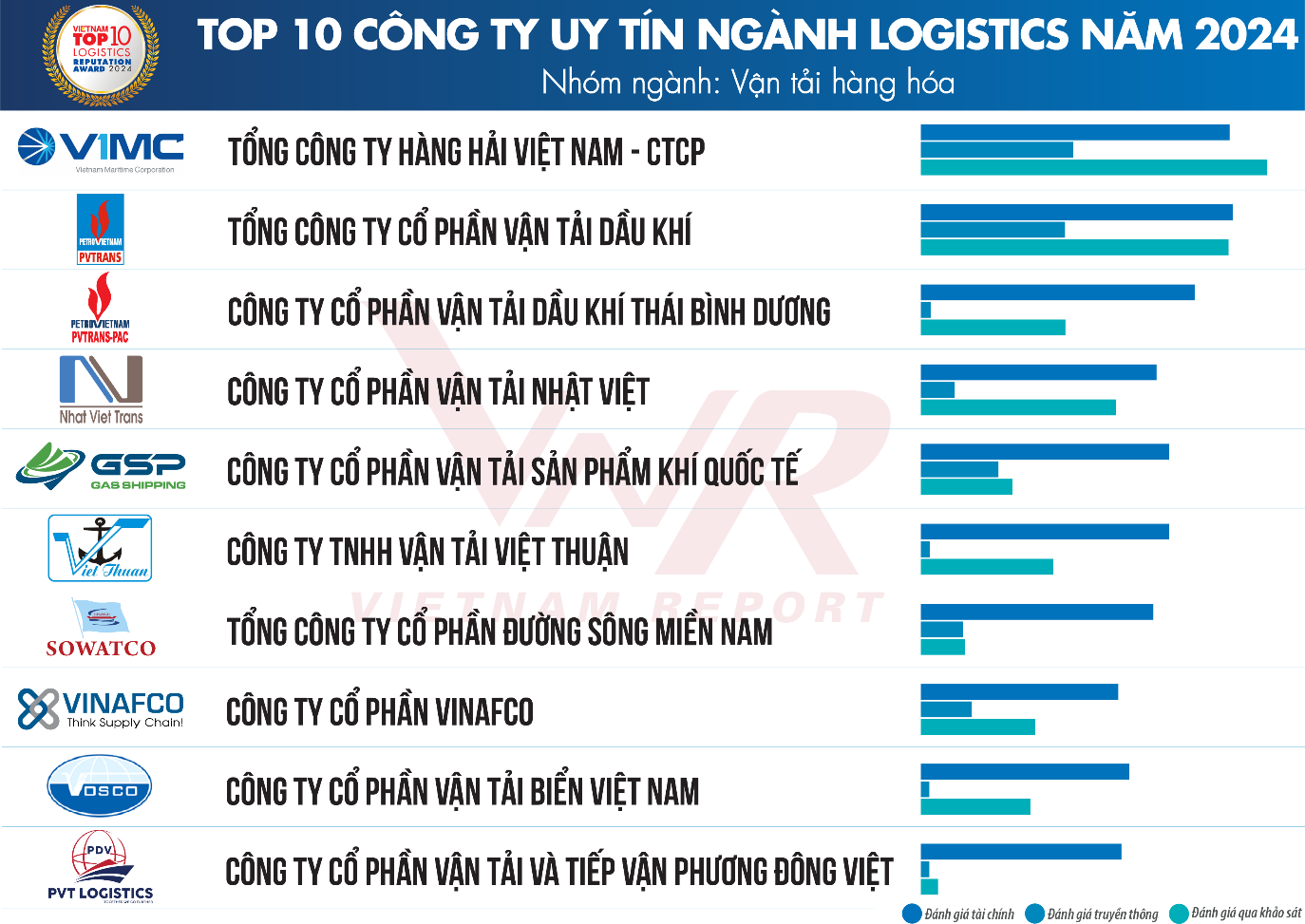

In the Freight Transport sector, the top 3 remained unchanged from the previous year, with the Vietnam Maritime Corporation leading the way.

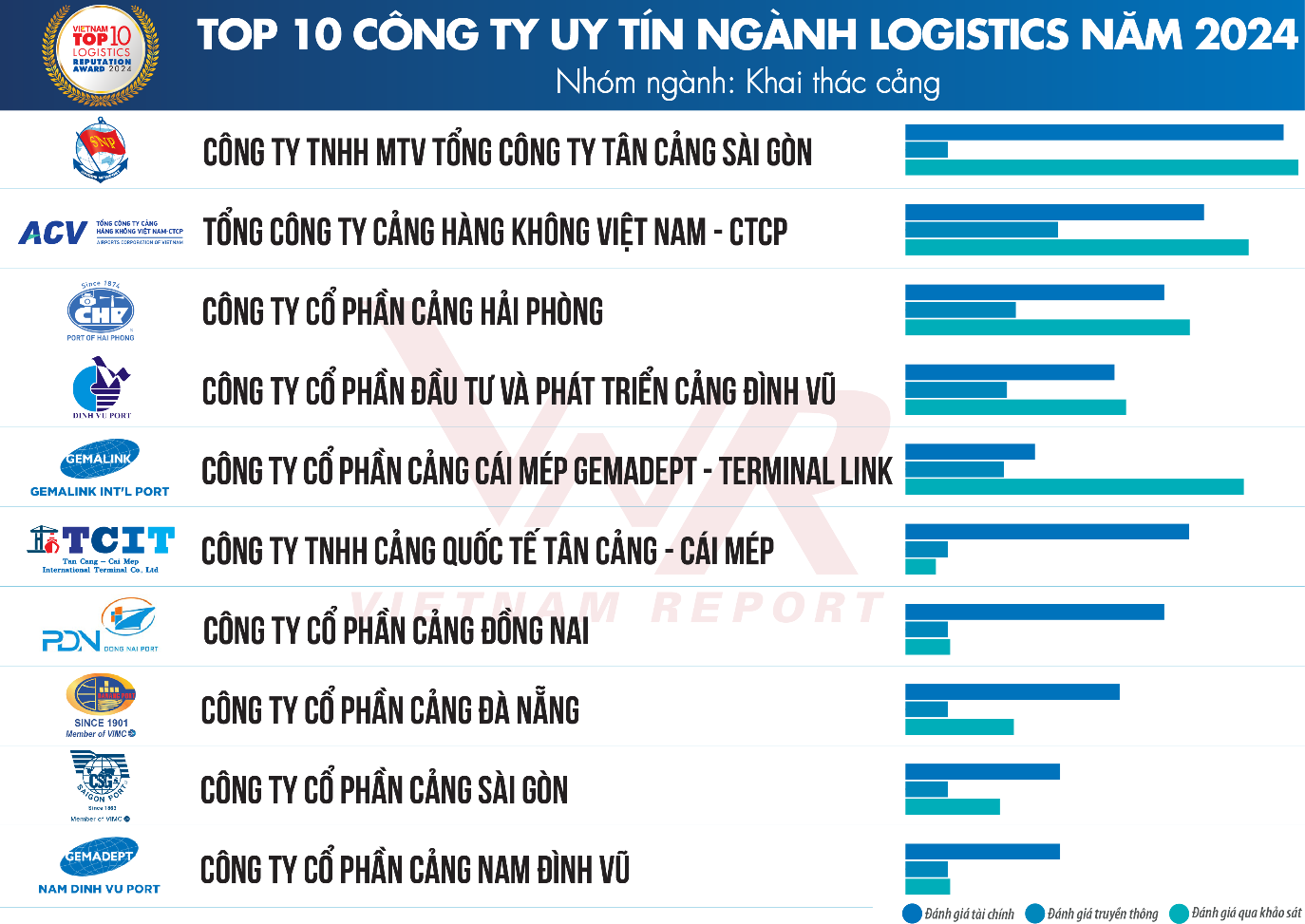

Finally, in the Port Operation sector, the top 3 positions were held by Saigon New Port, Vietnam Airports Corporation, and Hai Phong Port.

The Vietnam Report’s assessment states that in 2024, the Vietnamese logistics industry witnessed a strong recovery, thanks to export growth and supportive factors from the government, as well as improvements in the global supply chain. Vietnam’s exports in the first ten months of 2024 grew by 14.9%, reaching $335.6 billion, following a downturn in 2023.

Key industries such as electronics, textiles, and agriculture continued to lead the way, making significant contributions to total export turnover. Exports to the US, Vietnam’s largest market, nearly reached the $100 billion mark in the past ten months, with a trade surplus of over $86 billion, a substantial increase of 26.9% over the same period. This achievement is partly attributed to the shift in production from China to Vietnam amid the diversification of the global supply chain.

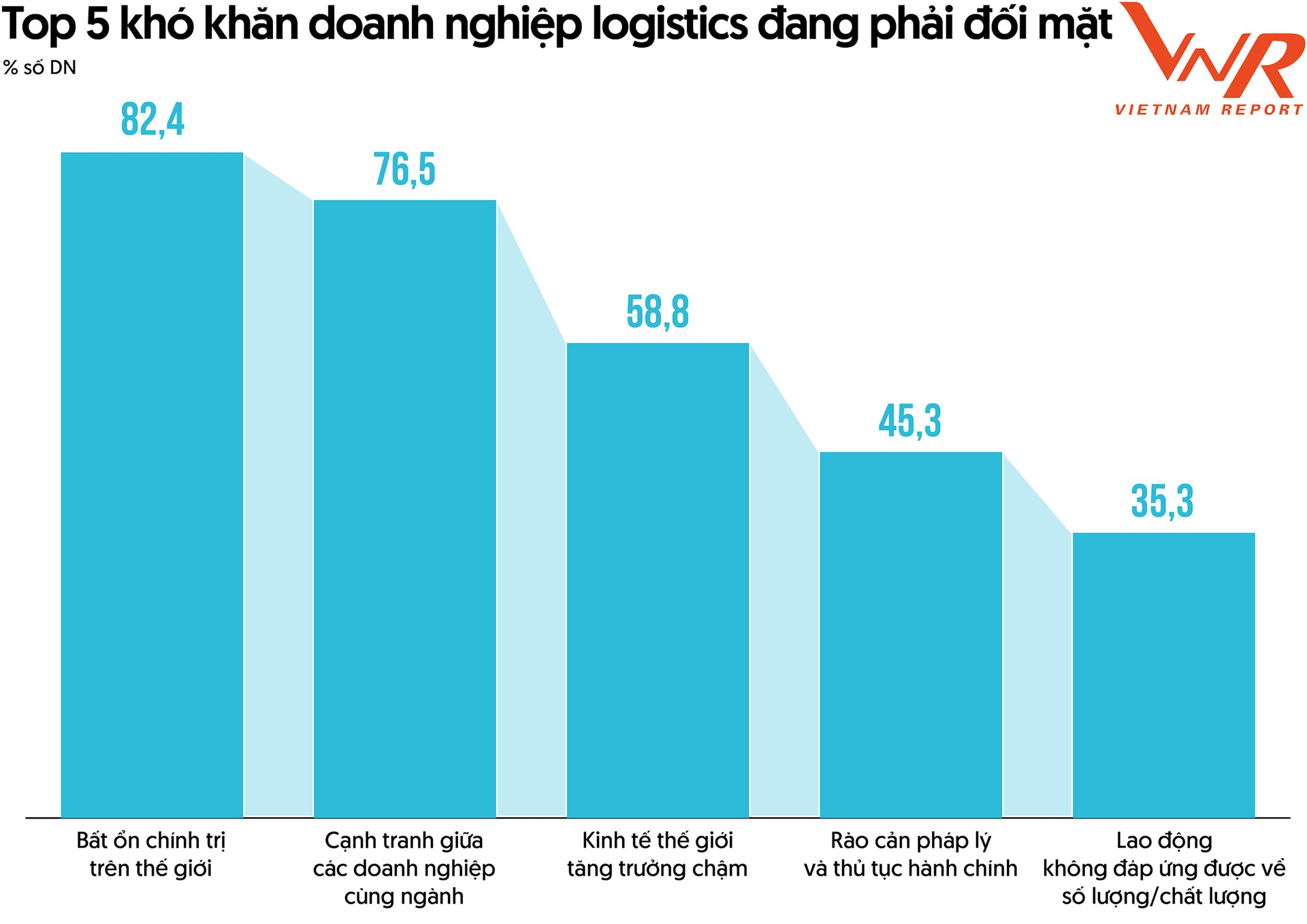

Challenges for Logistics Businesses

However, according to Vietnam Report’s report, domestic logistics enterprises are currently facing several challenges, including: Global economic and political instability (82.4%), Competition among enterprises in the same industry (76.5%), Slow global economic growth (58.8%), Legal barriers and administrative procedures (45.3%), and Labor shortage and skill mismatch (35.3%).

Specifically, global political instability was considered the most significant obstacle by 82.4% of logistics enterprises, disrupting the global supply chain. Geopolitical conflicts, such as the Russia-Ukraine war, US-China trade tensions, and economic protectionist policies from major economies, have negatively impacted international trade and cargo transportation. Additionally, economic sanctions, port closures in conflict zones, and volatile exchange rates have increased operating costs for logistics businesses.

Competition among logistics enterprises is the second-largest barrier, with 76.5% of companies acknowledging this as a significant challenge. Statistics show that Vietnam has over 30,000 registered logistics companies, of which domestic enterprises account for 89%, 10% are joint ventures, and 1% are wholly foreign-owned. However, most domestic enterprises are limited in terms of capital, human resources, and international operating experience, and there is a lack of linkage between the stages in the logistics supply chain.

Foreign companies still hold the lion’s share of the market, up to 70-80%. As a result, Vietnamese enterprises are mainly engaged in low-value segments such as domestic transportation and simple cargo handling. To overcome this challenge, domestic enterprises need to cooperate more closely, develop core competencies, and leverage their local advantages to enhance their competitiveness in the increasingly competitive market.

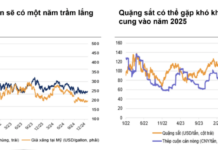

Slow global economic growth, as identified by 58.8% of enterprises, leads to reduced demand for cargo transportation. The flat global GDP growth translates to a contraction in trade volume, directly impacting the industry’s revenue. In its October 2024 report, the IMF lowered its global growth forecast – from 3.3% in 2023 to 3.2% in 2024 and 2025. With subdued global growth, Vietnam’s export turnover is unlikely to achieve significant annual increases.

Fourth, many logistics enterprises consider legal barriers and administrative procedures a significant challenge, which is a considerable issue in promoting industry development. Companies often spend a significant amount of time and resources on import-export procedures, affecting their operational efficiency. According to the World Bank’s report, the export clearance time in Vietnam is 55 hours, higher than the average of the ASEAN-4 countries (Thailand, Malaysia, Indonesia, and the Philippines).

Finally, the issue of labor shortage and skill mismatch, identified by 35.3% of respondents, hinders the ability to meet international standards. The Vietnamese logistics workforce lacks the required skills, while the development of e-commerce and modern supply chains demands highly skilled labor. By 2030, the demand for logistics human resources is expected to exceed 200,000 people, while the supply is projected to meet only about 10% of the market demand.

The Future of the Logistics Industry in 2025

Despite the challenges, the logistics business community remains optimistic about the prospects for 2025, continuing the recovery trend from 2024. In terms of the overall outlook for the logistics industry, 29.4% expressed a slightly more optimistic view, while 11.8% were much more optimistic.

Only 5.9% predicted a much more difficult year, indicating strong confidence in the industry’s robust and sustainable recovery. This reflects faith not only in the enterprises’ internal improvements but also in the supportive government policies and the growth of international trade.

Weaving a Brighter Future: Vietnam’s Textile Industry on Track to Achieve $44 Billion Export Target

The Vietnam Textile and Apparel Association (Vitas) asserts that the textile industry’s export target of 44 billion USD by 2024 is well within reach. The association bases this optimism on the fact that the end of the year typically sees a surge in production orders for the festive season, encompassing both Christmas and New Year celebrations.

SHB Ranks in the Top 10 Most Profitable Private Enterprises in 2024

Effective operations, sustainable growth, and positive contributions to the economy have earned SHB a place in the “Top 50 Most Profitable Enterprises in Vietnam.” This prestigious recognition highlights SHB’s remarkable performance and positions it among the top 10 most profitable private enterprises in the country.