On December 2, the State Securities Commission (SSC) issued Decision 1343/QD-XPHC on administrative sanctions in the field of securities and the stock market against IDI Multinational Investment and Development JSC (IDI: HoSE).

According to the SSC, IDI was fined over VND137 million for violating regulations on transactions with shareholders, business managers, and related persons. Specifically, according to the audited financial statements for 2022 and 2023, IDI provided loans to its parent company, Sao Mai Group JSC (ASM: HoSE).

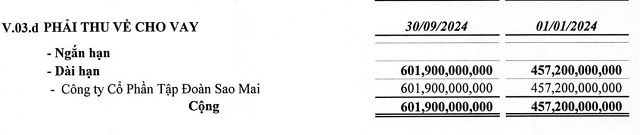

The 2023 audited financial statement shows that ASM borrowed long-term from IDI more than VND 457 billion (2023) and VND 334 billion (2022) in loan agreements lasting over 12 months with interest rates depending on the time of borrowing. This amount did not decrease but continued to increase in 2024, reaching over VND 602 billion at the end of Q3/2024.

IDI’s loan value to its parent company. Source: IDI’s Q3/2024 Financial Statement

IDI is one of the leading seafood processing and exporting enterprises in Vietnam. IDI’s shares were officially listed on the stock exchange in 2011. Currently, IDI is in the business of processing and trading tra fish products, fishmeal, fish oil, and animal feed…

In terms of business results, IDI’s Q3/2024 consolidated financial statement recorded net revenue of VND 1,881 billion, up 7.5% over the same period. After deducting cost of goods sold, gross profit was VND 155 billion, up 40% year-on-year.

During the period, financial expenses and selling expenses increased by 75%, while management expenses decreased. As a result, IDI’s after-tax profit was VND 17.8 billion, down 24% over the same period last year.

For the first nine months of the year, IDI’s revenue was VND 5,449 billion, up 2%, while after-tax profit was over VND 54 billion, down 20% year-on-year.

In 2024, IDI targets revenue of VND 8,499 billion and after-tax profit of VND 276 billion. After three quarters, the company has completed 64.4% of its revenue target and 19.5% of its profit target.

As of September 30, 2024, the company’s total assets were VND 8,368 billion, an increase of more than VND 90 billion compared to the beginning of the year.

Short-term receivables accounted for VND 2,655 billion, an increase of more than VND 500 billion from the beginning of the year, mainly due to a significant increase in short-term receivables from customers. Inventories slightly decreased to VND 1,414 billion.

Cash and cash equivalents and investments held to maturity were nearly VND 1,476 billion. IDI recorded more than VND 400 billion in construction in progress at Binh Long Urban Area.

The company’s total financial debt was VND 4,345 billion, of which short-term debt was VND 4,107 billion, and the remainder was long-term debt. The company did not provide a detailed breakdown of its creditors in this report.

The VCB Pushes VN-Index Below 1,250 Points, Insurance Stocks Surge: A Market Surprise

The recovery efforts this afternoon failed to bear fruit, as the dominant force of the ‘super-pillar’ VCB overwhelmed the lackluster performance of other blue-chips. The VN-Index closed with a loss of 1.38 points, with VCB’s 1.27% decline accounting for over 1.6 points. However, bottom-fishing funds were active, driving significant gains in numerous stocks, particularly in the insurance sector.

The Technical Analysis of the Afternoon Session: Investors Remain Hesitant

The VN-Index and HNX-Index rose in tandem, but with no significant improvement in liquidity, indicating investors’ cautious sentiment.

Suburban Land Auctions: Where Dreams Die and Prices Soar

After land auctions with thousands of participants, where prices were driven up to 5-14 times their starting value, recent land auctions have been plagued by further instability. Bidders offered prices of up to 30 billion VND per square meter in one round, only to offer zero in the next, or participants abruptly left the auction midway.

“Unleashing Dragon Capital’s Secrets: The 740,000 Đức Giang Chemical Shares Sale”

Dragon Capital, a prominent foreign investment fund, has recently offloaded 740,000 DGC shares through four of its member funds. This strategic move has resulted in a decrease in their ownership stake, now falling below the 8% threshold in Duc Giang Chemicals, a notable player in the chemical industry.

The Greenback Slides as Dollar Index Hits a Two-Week Low

The central exchange rate fell by 44 dong during the November 28-29 sessions. The selling price of USD at commercial banks decreased accordingly and remained pegged to the ceiling set by the State Bank. Meanwhile, the black-market exchange rate remained stagnant.