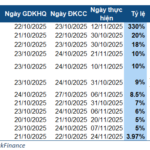

F88 Joint Stock Business Company announced the results of its bond offering with the code F88CH2425007 on December 3.

Specifically, from November 21-27, F88 successfully offered 1,000 bonds with the code F88CH2425007, with a par value of VND 100 million per bond, thereby raising VND 100 billion. This batch of bonds has an interest rate of 10.5%/year and a term of 12 months.

This is the seventh batch of bonds issued by F88 since the beginning of the year. Previously, the F88CH2425001, F88CH2425002, and F84CH2425003 batches were issued in April and May 2024, each valued at VND 50 billion, with a term of 12 months. The interest rate was 11-11.5%/year.

In August 2024, the company continued to issue two more bond codes, F88CH2425004 valued at VND 100 billion and F88CH2425005 valued at VND 50 billion. Both batches of bonds have a term of 12 months and an interest rate of 11%/year.

On October 1, F88 issued 700 bonds with the code F88CH2425006, with a par value of VND 100 million per bond and an issue value of VND 70 billion. This batch of bonds has a term of 12 months and an interest rate of 10.5%/year.

F88’s active bond issuance comes as two batches of bonds, F88CH2324002 and F88CH2324003, with a total value of VND 250 billion, are due for repayment on November 21, 2024, and December 23, 2024, respectively.

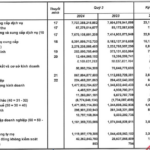

In terms of business results, this financial company reported a post-tax profit of over VND 89 billion in the first half of 2024, a strong recovery from a loss of over VND 368 billion in the same period last year.

As of the end of the second quarter of 2024, equity decreased slightly by 4% to VND 1,519.6 billion. The debt-to-equity ratio increased from 1.44 times to 1.96 times, equivalent to total liabilities of approximately VND 2,980 billion, of which bond debt accounted for about VND 600 billion.

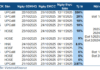

“Overcoming ‘Breathalyzer’ Challenges, Sabeco, the Beer Industry Giant, Reports Profitable Q3 Growth with 70% of Assets in Cash”

For the first nine months of the year, Sabeco recorded net revenue of VND 22,940 billion and a remarkable after-tax profit of VND 3,504 billion, reflecting a 5% and nearly 7% increase, respectively, compared to the same period last year.