While the VN-Index struggled at the 1,250-point mark, shares of VCA of VICASA Steel Joint Stock Company – VNSTEEL continued to surge to 10,400 VND per share. This marked the third consecutive session of gains for the stock, pushing its price to a 15-month high.

Along with the share price increase, trading activity in VCA also picked up with over 13,000 shares changing hands. Prior to this, VCA often experienced low liquidity or only a few hundred shares being traded.

The rally in VCA shares followed news that its parent company, Vietnam Steel Corporation – Joint Stock Company (VNSteel – TVN ticker symbol) planned to divest its stake at a high price.

VNSteel is the largest state-owned enterprise in the steel industry with a charter capital of nearly VND 6,800 billion. The State Capital Investment Corporation (SCIC) holds over 93% of its shares. In addition to VNSteel, Thép Đà Nẵng Joint Stock Company is another major shareholder in Thép Vicasa, holding 7.14% of its capital.

Recently, VNSteel announced its resolution to divest its entire holding of 9.87 million shares, equivalent to a 65% stake in VCA. The divestment is expected to start in November and be completed by the end of the year or the first quarter of 2025.

There are two options for the divestment of Thép Vicasa’s capital. The first is to transfer shares through matching transactions on the HoSE. The second option is to transfer shares through off-floor transactions of HoSE (public offering of shares by shareholders of public companies through public auctions) including normal public auctions and public auctions by lot.

VNSteel stated that after studying the company’s performance and evaluating the pros and cons of the above methods, the transfer of capital through a public auction by lot has more advantages compared to the other methods.

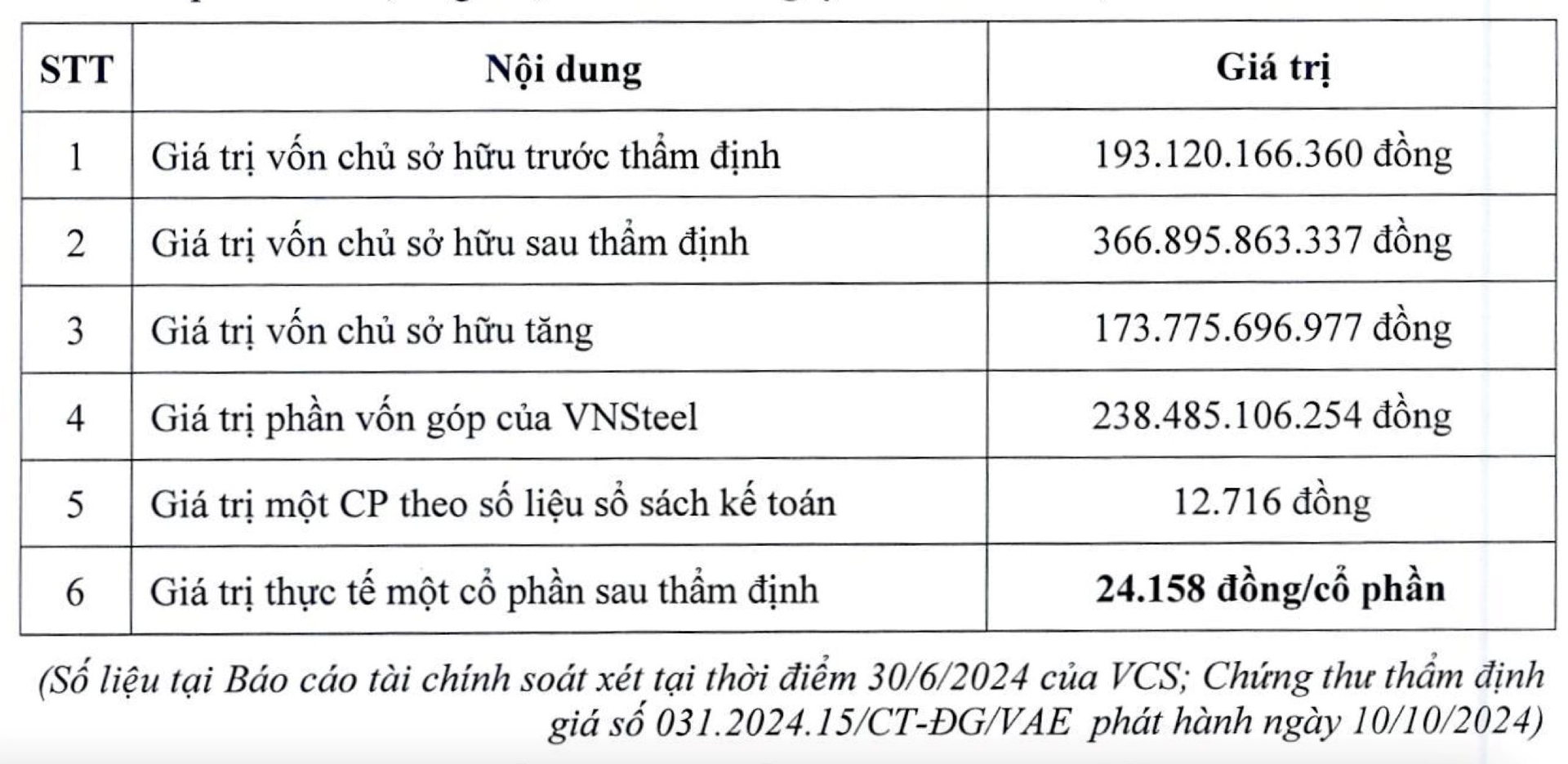

Therefore, the General Director agreed to choose the method of transferring shares through off-floor transactions of HoSE, which is a public offering of shares through a public auction by lot. The starting price for the lot is VND 238 billion, equivalent to a value of VND 24,158 per share as appraised by Vietnam Audit and Valuation LLC.

In terms of financial results, in the first nine months of the year, Thép Vicasa recorded net revenue of VND 1,013 billion, down 19% compared to the same period last year. After deducting expenses, the company posted a loss of VND 1.5 billion, while in the same period last year, it made a profit of VND 3.5 billion. For the third quarter of 2024, VCA incurred a loss of over VND 3.3 billion.

For the first nine months of 2024, Thép Vicasa recorded net revenue of VND 1,013 billion, a 19% decrease year-over-year. After expenses, the company reported a net loss of VND 1.5 billion, compared to a profit of VND 3.5 billion in the same period last year. In Q3 2024, VCA’s net loss exceeded VND 3.3 billion.

The Foreign Sell-Off: A Tale of Stock Market Turbulence

The market opened the last month of 2024 with a lackluster trading session, despite the VN-Index posting impressive gains at the open. However, foreign investors turning back to net selling is an unsettling signal for the market.

The VCB Pushes VN-Index Below 1,250 Points, Insurance Stocks Surge: A Market Surprise

The recovery efforts this afternoon failed to bear fruit, as the dominant force of the ‘super-pillar’ VCB overwhelmed the lackluster performance of other blue-chips. The VN-Index closed with a loss of 1.38 points, with VCB’s 1.27% decline accounting for over 1.6 points. However, bottom-fishing funds were active, driving significant gains in numerous stocks, particularly in the insurance sector.