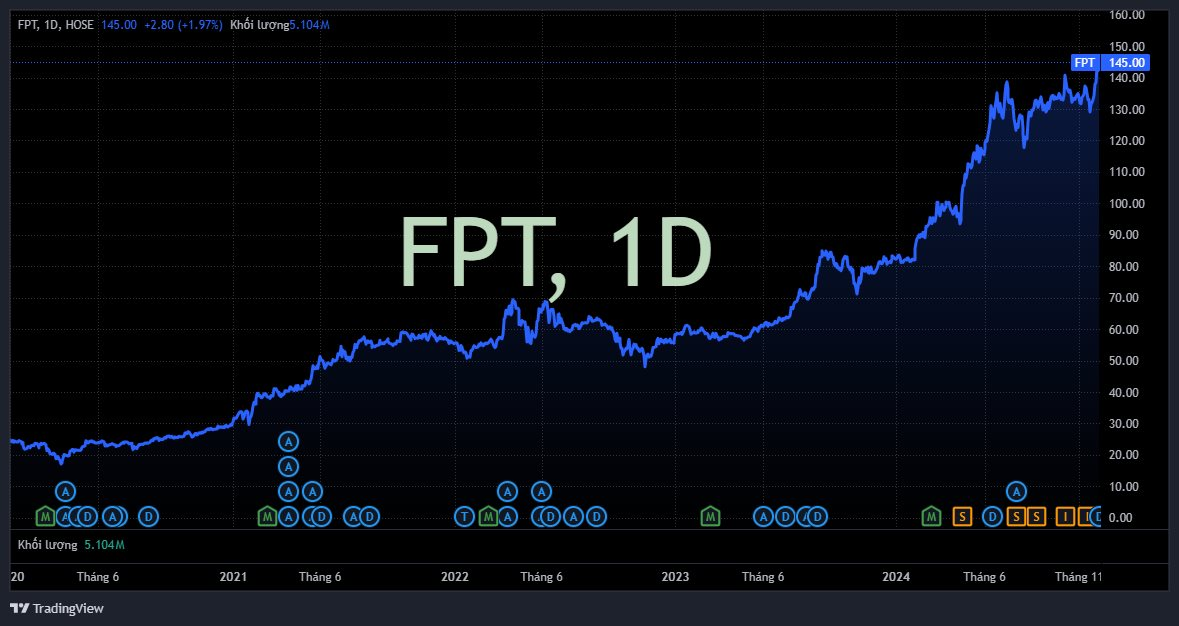

Vietnamese stocks may have struggled, but FPT shares shone bright once more. On December 3rd, the technology stock closed up nearly 2% at 145,000 VND per share. This marked a historic high for FPT, the largest technology corporation in Vietnam, as it surpassed its previous peak during its 18-year listing on the stock exchange.

So far this year, FPT has reached new highs a remarkable 37 times, a record unmatched in the history of Vietnamese stocks. Since the beginning of the year, FPT has surged by approximately 76%, outperforming the VN-Index.

As a result, the market capitalization of FPT reached a record high of 213 trillion VND (~8.4 billion USD). This remarkable achievement propelled FPT to become the largest private enterprise on the stock exchange, second only to state-controlled giants such as Vietcombank, BIDV, ACV, and Viettel Global.

This success brought great joy to FPT’s shareholders, especially its founding members: Chairman of the Board of Directors, Truong Gia Binh, and his long-time associates, Bui Quang Ngoc and Do Cao Bao. The trio holds a significant portion of their wealth in FPT shares, and their collective net worth has soared to nearly 20.3 trillion VND, an increase of 8.7 trillion VND since the beginning of 2024.

Chairman Truong Gia Binh, who owns over 102 million FPT shares (6.99% of the capital), has seen his wealth increase by nearly 6.4 trillion VND since the beginning of the year, reaching approximately 14.8 trillion VND.

FPT’s shareholders also benefit from consistent annual dividend payments. On December 3rd, FPT finalized the list of shareholders eligible for the first 2024 dividend payment of 10% in cash. With nearly 1.5 billion circulating shares, FPT is expected to distribute approximately 1,500 billion VND. The payment is scheduled for December 13, 2024, just ten days after the record date.

This marks the second dividend payment to shareholders in 2024. Previously, in mid-June, the company distributed the remaining 10% dividend for 2023 in cash. Additionally, FPT rewarded its shareholders with a 15% stock dividend (for every 20 shares held, investors received 3 new shares).

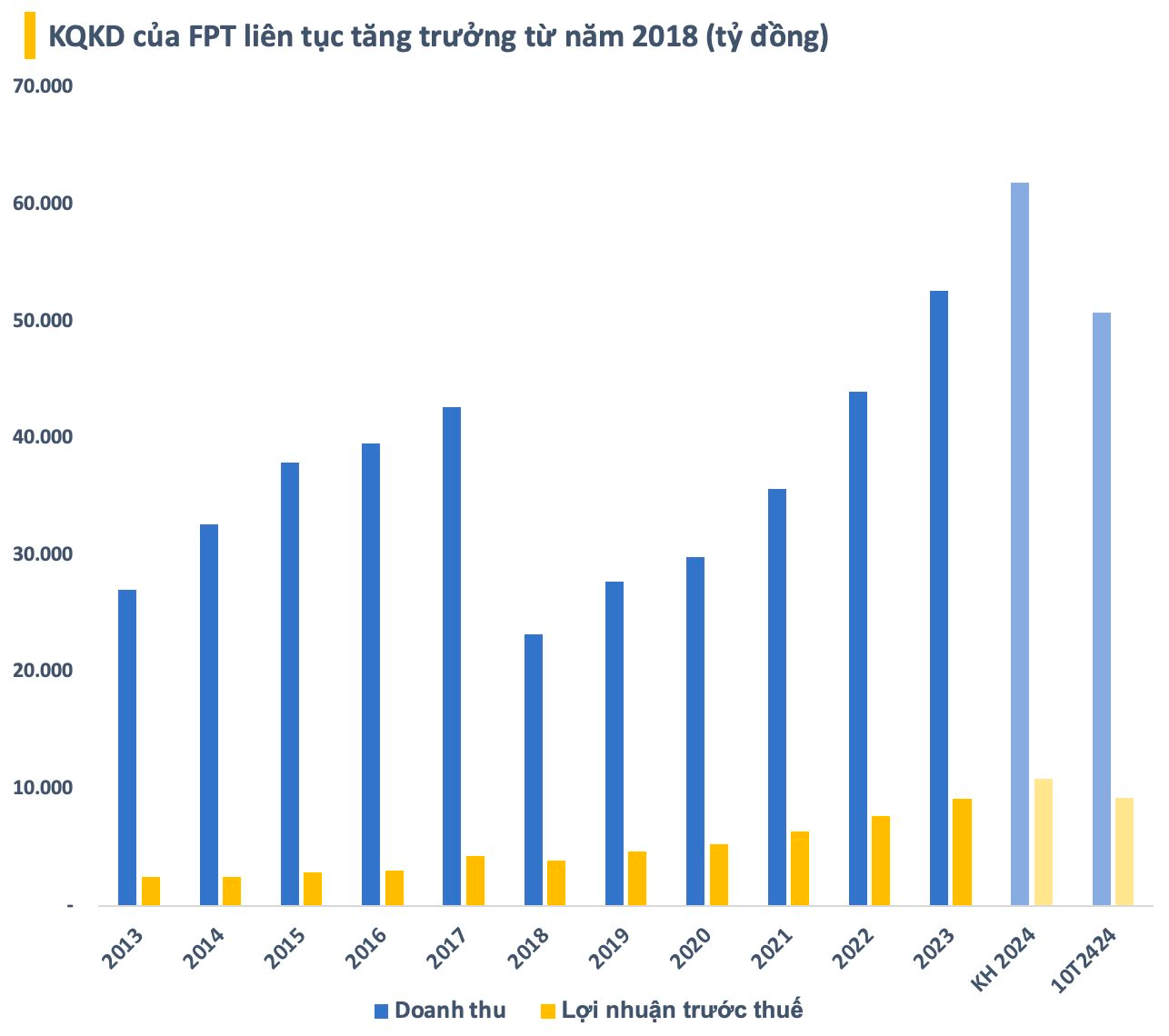

The remarkable performance of FPT is underpinned by its astonishing business results. For the first ten months of the year, FPT recorded a revenue of 50,796 billion VND and a pre-tax profit of 9,226 billion VND, representing increases of 19.6% and 20%, respectively, compared to the same period in 2023. After-tax profit attributable to the parent company’s shareholders and EPS reached 6,566 billion VND and 4,494 VND/share, respectively, reflecting a 21% increase compared to the previous year.

For 2024, FPT has set ambitious business targets, aiming for a record-high revenue of 61,850 billion VND (~2.5 billion USD) and a pre-tax profit of 10,875 billion VND. These goals represent an approximate 18% increase compared to the company’s performance in 2023. With the results achieved in the first ten months, FPT has already accomplished 82% of its revenue target and 85% of its profit goal.

The King of Stocks is Snubbed in November

The lackluster trading environment has dampened the price performance of bank stocks in the past month.

“Unleashing Dragon Capital’s Secrets: The 740,000 Đức Giang Chemical Shares Sale”

Dragon Capital, a prominent foreign investment fund, has recently offloaded 740,000 DGC shares through four of its member funds. This strategic move has resulted in a decrease in their ownership stake, now falling below the 8% threshold in Duc Giang Chemicals, a notable player in the chemical industry.

Foreigners Net Sell VND12,000 Billion in November

Foreign investors offloaded a massive 12,004.3 billion VND in the past month of November, with an impressive 9,453.8 billion VND sold purely through order-matching transactions.