Artificial Intelligence (AI) is shaping the future of most industries, and the financial markets are no exception. The rise of AI is putting pressure on stockbrokers as it can replace some of their work.

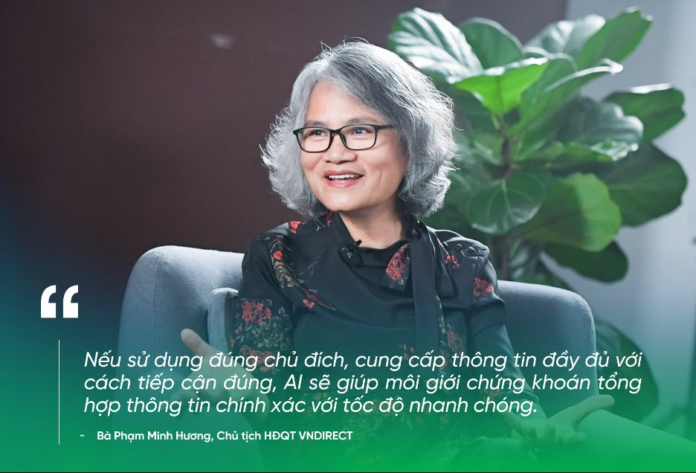

“Many brokers anxiously asked me if the development of AI would make a difference between an experienced broker and a new graduate since they could both use AI to write excellent analytical reports,” shared Ms. Pham Minh Huong, Chairman of VNDIRECT Securities, during the talk show The Investors co-organized by CafeF and VPBankS, which aired on December 3rd.

In reality, the pressure on traditional brokers is increasing as the AI race intensifies. Securities companies are continuously upgrading and innovating their technology, applying AI in stock consulting practices, and handling issues for customers. Many companies use AI to produce analytical reports and even stock valuations, thus aiding customers in making investment decisions. Instead of relying on traditional brokers, many investors are turning to new AI tools for stock picking and portfolio management advice.

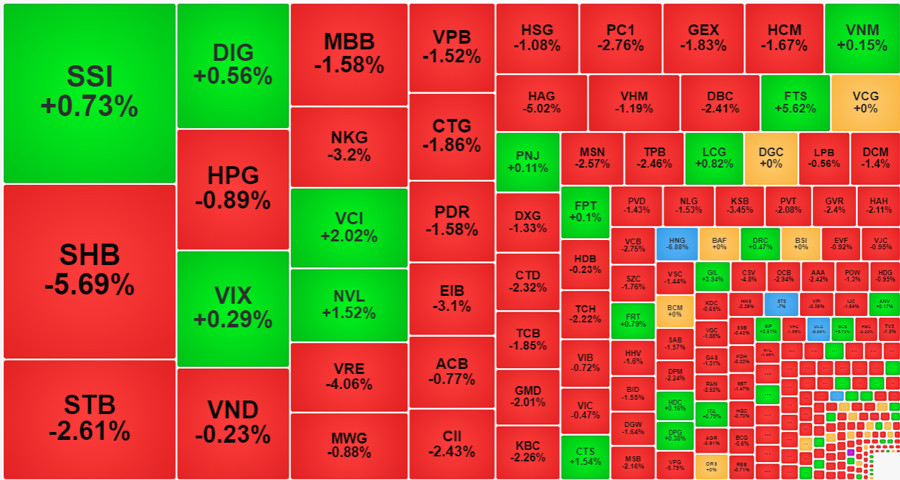

Brokers not only face challenges from AI but also a gloomy market and low liquidity. After two quarters of recovery, the brokerage activities of securities companies in the third quarter decreased significantly, with total revenue reaching just over VND 3,000 billion, a 28% decrease compared to the same period in 2023 and 23% lower than the previous quarter. This is the lowest revenue from brokerage activities for the group of securities companies in the past five quarters.

The significant drop in revenue directly affects stockbrokers, who largely depend on customer transaction fees. In addition to market difficulties, the trend of free trading, which is gaining traction in the stock market, poses another challenge to the brokerage profession.

What Do Stockbrokers Need in the AI Era?

Despite initial concerns about the AI wave, Ms. Pham Minh Huong, Chairman of VNDIRECT Securities, now believes that AI presents a significant opportunity for the brokerage profession and a tool available to all companies, eliminating the advantage of any specific entity.

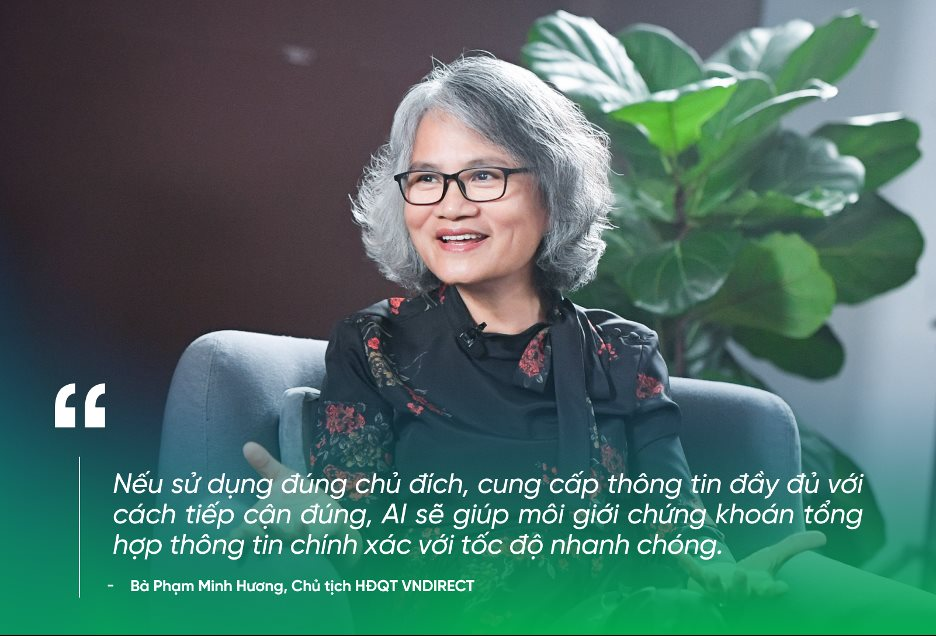

“In the past, we had to attend prestigious universities, learn from excellent teachers, or access very expensive materials to obtain valuable information. Now, with AI, everything is ‘open’ and accessible at a very low cost. If used correctly and with the right information and approach, AI will enable stockbrokers to synthesize information accurately and swiftly,” said Huong.

Ultimately, those who know how to utilize AI will have an advantage over those who don’t. Therefore, the future workforce in the securities industry needs to develop new skills that set them apart from AI, such as systems thinking, critical thinking, and emotional intelligence.

Notably, the leader argued that securities companies, including brokers, should focus on creating new values. When using AI, brokers must uphold ethics and standards to generate values that benefit customers, the community, and themselves. Brokers should not advise clients on which specific stocks to buy or sell. At VNDIRECT, it is prohibited for brokers to provide individual stock recommendations.

“Stockbrokers in the AI era need to accompany and guide investors to understand their needs, investment position, and risk appetite. Many investors rely too heavily on technology, lacking free will, and some even follow the crowd, easily becoming anxious and fearful of market fluctuations,” said Pham Minh Huong.

When using AI, investors must also take control of their investment journey, knowing what they want and maintaining what is important for a peaceful investment experience without losing sleep. It is crucial to have a plan for the worst-case scenario, so that with AI support, the investment journey can be a pleasant one.

In conclusion, while human brokers still play a role for many securities companies, even as the AI wave spreads, the brokerage profession will undergo a purification process. Only those brokers who are truly qualified, certified, professionally competent, and continuously improving will continue to accompany the investor community.

“The Investors” is an inspiring talk show series presented by CafeF and VPBank Securities (VPBankS), airing every Tuesday at 10:00 AM on CafeF’s Fanpage and every Tuesday and Friday at 12:00 PM on ON INFO TV – VTVcab9.

VPBank Securities Joint Stock Company (VPBankS) is the only securities company in the VPBank ecosystem with a leading charter capital in the market, amounting to VND 15,000 billion. VPBankS is also among the top 10 securities companies with the largest margin lending balance and has significant room for future growth. Furthermore, VPBankS has built a comprehensive ecosystem, integrating personalized products, platforms, and services tailored to individual risk appetites, fully meeting the investment needs of customers.

The Korean Stock and Currency Conundrum: A Night of Strategic Manoeuvres

The South Korean Finance Ministry has announced it stands ready to inject “unlimited” liquidity into the financial markets following President Yoon Suk Yeol’s decision to lift a decades-long military curfew, sending the won to its weakest level in years. In a new development, the office of the South Korean President announced that all of Yoon’s senior aides had offered to resign.

FPT Partners with Top 10 Global Enterprise Management Solution Provider, Yonyou

Recently, FPT Group signed an agreement with Yonyou Network Technology Co., Ltd. – a leading global provider of ERP solutions, ranked among the top 10 by IDC. Through this partnership, the two companies will combine their strengths to offer comprehensive digital transformation solutions to businesses across Southeast Asia.

“NCB Bank Wins Big at the Data for Life 2024 Competition with its Innovative Big Data and AI Solution”

On November 27, NCB Bank’s solution, “A Cloud-based Machine Learning Deployment Platform,” emerged as the runner-up at the Data for Life 2024 competition. This achievement was a testament to the solution’s profound foundational strength and extensive applicability across various societal sectors, outperforming nearly 380 domestic and international teams.