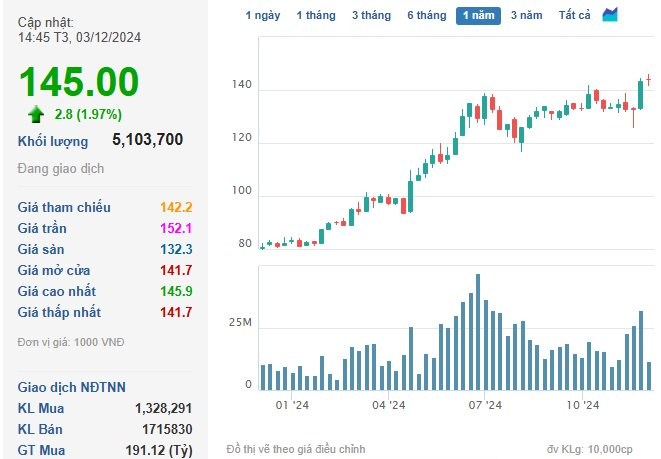

FPT Corporation’s FPT stock closed at VND 145,000 per share on December 3rd, marking a 1.97% increase from the previous session. The trading volume of matched orders exceeded 5.1 million units. This new peak surpasses the historical record for this technology stock, and FPT’s market capitalization has soared, currently surpassing VND 213,305 billion.

FPT shares soar to new heights, reaching an all-time high. (Source: Cafef)

FPT shares welcomed the new year 2024 at a price range of VND 83,000 per share. Consequently, the current market price has witnessed an impressive surge of nearly 75%, equivalent to an increase of roughly VND 62,000 per share.

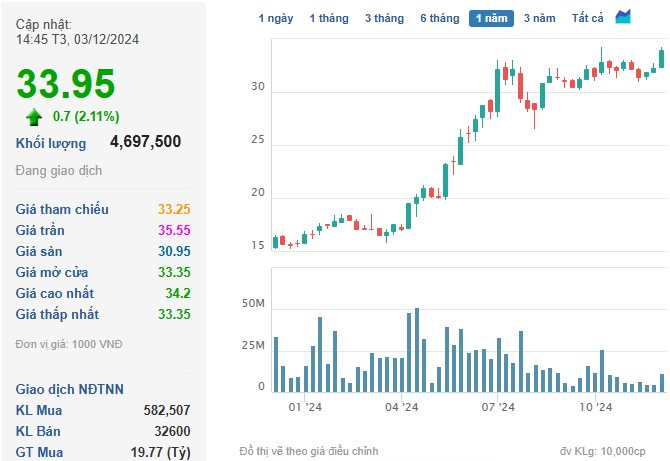

Likewise, LPB shares of LPBank continued their upward trajectory, reaching a new all-time high.

At the close of the December 3rd session, LPB shares were priced at VND 33,950 each, reflecting a 2.11% rise from the previous day. The trading volume of matched orders neared 4.7 million units.

LPB shares soar, climbing nearly 125% since the beginning of the year. (Source: Cafef)

This new peak marks the highest point in the history of this banking stock’s listing. Consequently, LPBank’s market capitalization has also witnessed a substantial boost, now surpassing VND 86,831 billion.

LPB shares commenced the new year 2024 at a price range of VND 16,000 per share. Thus, since the beginning of the year, the market price of LPB shares has skyrocketed by nearly 125%, equivalent to an increase of approximately VND 20,000 per share.

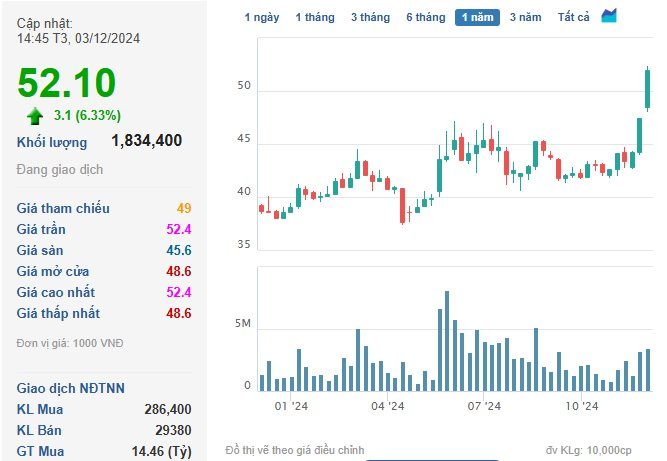

Turning our attention to the VN30 basket, BVH shares of the Bao Viet Group emerged as the top gainer, surging by 6.33% to VND 52,100.

This marks the third consecutive session of significant gains for BVH shares, accompanied by a notable surge in trading volume, averaging approximately 1.8 million units per session.

Presently, BVH shares are trading at their highest level in over two years. As a result, Bao Viet’s market capitalization has swelled, now surpassing VND 38,675 billion.

BVH shares continue their upward trajectory. (Source: Cafef)

BVH shares soared in the aftermath of news that the Bao Viet Group has appointed a new Acting Chair of the Board of Directors and a new Acting General Director, effective November 27, 2024, marking a significant shift in the company’s upper echelons after a period of upheaval.

Additionally, two blue-chip stocks within the VN30 basket that exhibited notable gains and provided support to the VN-Index during today’s trading session were HDB shares of HDBank and POW shares of PV Gas, both of which climbed by more than 2%.

Specifically, at the close of the December 3rd session, HDB shares were priced at VND 26,050 each, reflecting a 2.56% increase from the previous day. The trading volume of matched orders surpassed 11.3 million units.

POW shares concluded the session at VND 12,650 per share, representing a 2.02% increase, with a trading volume of matched orders exceeding 13.6 million units.

Both of these stocks are currently trading at their highest levels in the past month.

VN-Index Dips Below the 1,250-Point Threshold

While market liquidity witnessed a notable improvement, selling pressure dominated the buying interest of investors. The benchmark VN-Index halted its losing streak but failed to hold on to the 1,250-point level.

At the close of the December 3rd session, the VN-Index shed 1.38 points to settle at 1,249.83. Similarly, the HNX-Index dipped by 0.04 points to 225.29, while the UPCoM-Index remained unchanged at 92.44 points.

Market liquidity improved, with the total trading value on the three exchanges nearing VND 17,200 billion. The HoSE exchange alone accounted for over VND 15,500 billion of this figure.

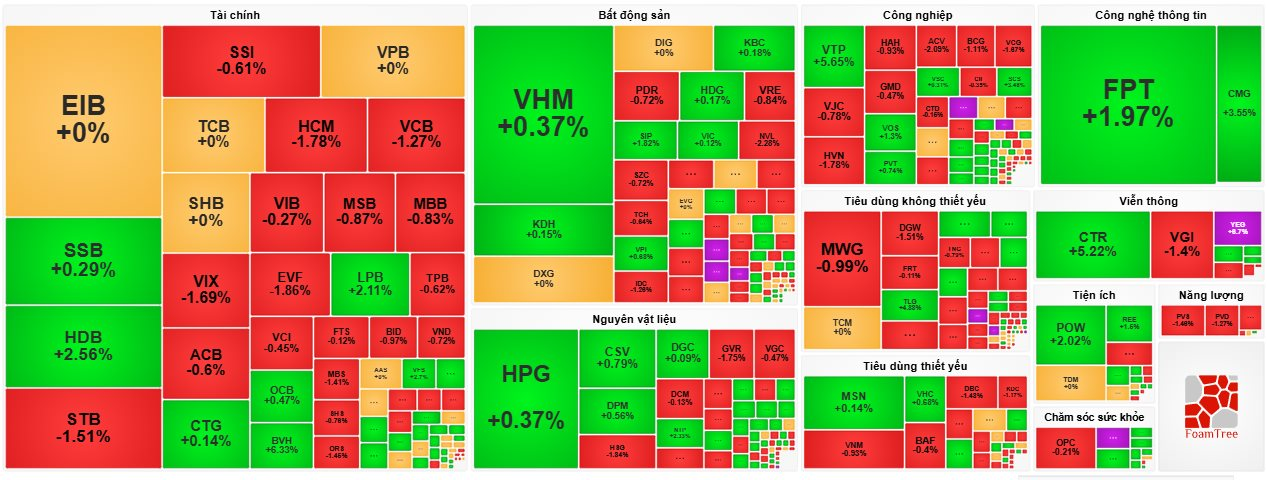

The stock market was predominantly painted red during today’s trading session.

Red dominated the market as the VN-Index slipped below the 1,250-point mark.

The “king” stocks were enveloped in red, with notable decliners including VCB (-1.27%), STB (-1.51%), and SGB (-2.48%). Other stocks that fell by less than 1% were VIB, MSB, MBB, ACB, BID, TPB, and KLB.

Contrarily, LPB and HDB shares soared by more than 2%, followed by PGB (+1.91%), NAB (+1.9%), BVB (+0.89%), OCB (+0.47%), SSB (+0.29%), and CTG (+0.14%).

In the real estate sector, green prevailed, with SNZ (+2.65%), SIP (+1.82%), DXS (+2.14%), TAL (+2.78%), and SJS (+1.81%) leading the gains. This was accompanied by a slew of blue-chip stocks in the sector that managed to stay in the green, recording gains of less than 1%, including VHM, VIC, KDH, VPI, KBC, SSH, and HDG.

Conversely, NVL shares, which dropped by 2.28% to VND 10,700, emerged as the biggest blue-chip loser in the real estate sector. QCG and IDC followed suit, declining by 3.61% and 1.26%, respectively. This was trailed by a cohort of stocks that fell by less than 1%, including BCM, VRE, NLG, SZC, PDR, and TCH.

Defying the market trend, the insurance group attracted robust investment inflows, led by the industry giant BVH, which surged by 6.33%. This was trailed by PRE (+5.06%), MIG (+3.76%), BMI (+3.12%), PTI (+1.6%), VNR (+0.85%), and BIC (+0.14%).

The technology sector also soared, propelled by two heavyweights: FPT (+1.97%) and CMG (+3.55%).

Additionally, the pharmaceutical group witnessed a strong performance, with IMP surging by the maximum allowable limit of 6.92%, alongside notable gains for DBD (+2.43%), DHT (+8.84%), DVN (+2.34%), DCL (+0.19%), DHG (+1.97%), and PMC (+7.34%).

Furthermore, several blue-chip stocks across various sectors recorded robust gains, including NTP (+2.33%), VTP (+5.65%), SCS (+3.48%), CTR (+5.22%), YEG (+6.7%), POW (+2.02%), REE (+1.6%), and NT2 (+1.29%).

Conversely, blue-chip stocks from other sectors exerted significant downward pressure on the market, with prominent decliners including GVR (-1.75%), HSG (-1.84%), HVN (-1.78%), ACV (-2.09%), DGW (-1.51%), DBC (-1.43%), VGI (-1.4%), PVS (-1.48%), PVD (-1.27%), MWG (-0.99%), VNM (-0.93%), KDC (-1.17%), and BSR (-0.51%).

The Stock Market Liquidity Dries Up, FPT Shares Prop Up the VN-Index

The stock market is experiencing a drought in liquidity, with total trading values across all three exchanges reaching just under VND 12,900 billion. In a surprising turn of events, the FPT stock of the tech giant FPT witnessed a significant surge, single-handedly propping up the main VN-Index.