The VN-Index closed at the end of November at 1,250 points, a 1.11% decrease, but it rose by 1.82% in the last trading week of the month.

Entering December, Agriseco Research assesses that the economic growth rate in Q4 will be higher than in previous quarters thanks to fiscal, monetary, and consumption stimulus policies that have been promoted to support the economy. Along with this, the State Bank of Vietnam has decided to adjust and increase credit limits for some banks to support the economy in the last month of the year.

In the context of easing exchange rate pressure and foreign investors showing signs of stopping net selling, Agriseco believes that this is a suitable phase to reinvest after the market hit a short-term bottom in November, and the current P/E of the VN-Index is at an attractive level of 13.0x, which is lower than the 5-year average.

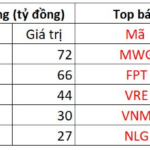

Accordingly, the analysis team chooses leading enterprises with reasonable valuations and expects positive Q4/2024 and full-year 2024 business results to build an investment portfolio for December 2024.

In the technology group, Agriseco believes that FPT Corporation (code: FPT) has a positive outlook thanks to FPT’s monthly profits continuing to increase, with October 2024 recording the highest level in the last 5 years, mainly driven by the technology segment. FPT has signed the highest-value digital transformation contract to date, worth $225 million with a US customer in October 2024.

FPT’s long-term prospects lie in semiconductors and AI as the company has officially launched an AI factory with Nvidia to provide AI and Cloud services in Vietnam and Japan. Agriseco Research expects a bright outlook for FPT with a boost from the foreign technology services segment.

Furthermore, FPT has a strong financial potential, maintains a consistent dividend policy, and is about to pay a 10% cash dividend for 2024 in December. Agriseco Research assesses that FPT remains an attractive investment opportunity with a development orientation in AI – semiconductors – automotive software.

In parallel, Gemadept Joint Stock Company (code: GMD) is expected to continue to grow positively. Total import and export turnover in the first ten months of 2024 grew by 16% over the same period and continues to be expected to improve strongly in the last months of the year as the main export markets show positive signals, and inventory levels have decreased to a low level.

The volume of containers through Gemadept’s ports in the first nine months also recorded positive growth, of which Gemalink port reached 1.3 million TEUs, up 90% over the same period in 2023.

Recently, GMD issued shares to existing shareholders to raise an additional VND 3,000 billion. This money will be used to implement the Nam Dinh Vu port project phase 3 from the end of 2024, which will increase the capacity to 1.65 million TEUs/year (+65% compared to before). The Gemalink deep-water port project phase 2, implemented from 2025, will increase the capacity to 2.4 million TEUs/year (+60% compared to phase 1).

Another enterprise that Agriseco forecasts as prospective is Hoa Phat Group (code: HPG), mainly driven by domestic construction steel. The analysis team expects that the Land Law, Housing Law, and Real Estate Business Law will permeate the economy and boost supply, while the government’s promotion of the construction of key transport infrastructure at the end of the year will increase the domestic consumption of construction steel.

Hoa Phat is also expected to benefit from the decrease in raw material input prices. Gross profit margin in Q3/2024 reached 14%, an improvement compared to the first half of the year, thanks to the significant decrease in coke and iron ore prices due to weak consumption in China. Meanwhile, domestic steel prices fell only 3% thanks to positive domestic steel demand. Along with flexible inventory management, HPG’s profit margin is expected to continue improving in the coming quarters.

With the prospect of the Dung Quat 2 project, which is expected to contribute revenue from 2025 with a capacity of 1.4 million tons of HRC/year, Agriseco Research evaluates that the current price is suitable for long-term holding of HPG shares.

In the real estate group, Nha Khang Dien (code: KDH) is expected to have brighter business results in Q4 thanks to the handover of real estate projects.

KDH’s financial situation is quite safe, with net cash holdings still maintaining VND 3,315 billion, and the debt-to-equity ratio is around 0.4x after the capital increase. Analysts expect that two projects in cooperation with Keppel, Emeria and Clarita, which are about to be put into business at the end of 2024 – 2025, will boost profit growth, helping to maintain the company’s business cash flow.

On the other hand, Nha Khang Dien owns a land fund of over 600ha in the eastern region of Ho Chi Minh City. As of September 30, inventory reached VND 22,450 billion, up 19% from the beginning of the year, in projects such as KDC Tan Tao, Emeria, Clarita, Solina, Green Village, Phong Phu 2, and Binh Trung Industrial Cluster. These are projects with potential for price increases, expected to promote KDH’s long-term growth potential.

REE Corporation (code: REE) is forecasted to have a positive growth outlook thanks to the hydropower segment. According to the Ministry of Industry and Trade, the electricity demand in 2025 is expected to be high, with the basic scenario of electricity growth reaching 11-12%. REE’s hydropower segment will be mobilized more due to the high probability of La Nina occurring at the end of 2024 and early 2025.

In addition, the Tra Khuc 2 and Duyen Hai wind power plants, with a total capacity of 78MW, acquired by REE in 2024, are expected to contribute revenue from 2026.

Moreover, the M&E segment is assured with a large backlog. As of Q3/2024, the total value of new contracts accumulated by REE reached VND 3,092 billion, up 16% compared to the full-year revenue in 2023, thanks to winning contracts from Long Thanh Airport projects. With the expectation that the real estate market will become more vibrant from the end of 2024 and the government promoting the implementation of key construction projects, the M&E segment is expected to improve in the coming time.

Finally, in the banking group, Agriseco said that Vietcombank (code: VCB) has the safest asset quality in the system. As of September 30, 2024, VCB’s non-performing loan ratio (NPL) was 1.22% – the lowest in the banking industry, and the loan loss reserve (LLR) remained stable at over 200%.

In the afternoon of November 30, the National Assembly approved the policy of additionally capitalizing the State capital (VND 20,695 billion) to increase capital for VCB to VND 83,591 billion through the form of paying dividends in shares from the after-tax profit retained in the period of 2018-2021 of VND 27,700 billion, equivalent to a rate of about 49.6%.

In addition, VCB’s plan to supplement capital from post-tax profit remaining after deducting the funds according to the regulations in 2022 and 2023 (estimated at VND 45,900 billion) is expected to be approved soon, thereby creating a positive effect on the stock price in the short term.

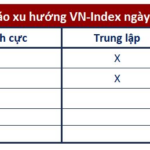

The Ultimate Guide to Stock Market Trends: Will the VN-Index Tumble or Rebound?

The majority of securities companies predict that the market may continue to be volatile in the next trading session. Investors are advised to trade cautiously and with a keen eye on market trends.

The Foreign Sell-Off: A Tale of Stock Market Turbulence

The market opened the last month of 2024 with a lackluster trading session, despite the VN-Index posting impressive gains at the open. However, foreign investors turning back to net selling is an unsettling signal for the market.