KienlongBank is committed to promoting the bank’s sustainable development, meeting international and Vietnamese environmental, social, and governance standards.

Leading the Comprehensive Implementation of Basel III & ESG

Basel III, the international standard for bank capital adequacy, and ESG (Environmental, Social, and Governance) standards, a framework for measuring sustainability and corporate responsibility, are two key strategies for modern banks. These standards have become the benchmark for sustainable development, helping banks integrate internationally. Recognizing its role in contributing to a sustainable economy, KienlongBank has set a clear direction to build a bank that not only grows in scale and governance strength but also aims to build a robust and environmentally friendly ecosystem that meets social responsibility requirements.

At KienlongBank, after the successful implementation of Basel II, the bank has also embarked on the comprehensive implementation of Basel III across all three pillars to enhance capital and liquidity quality, resilience to adverse events, and post-event recovery. Simultaneously, the bank is strengthening the implementation of ESG standards to meet environmental, social, and governance norms in Vietnam and internationally.

With the determination of the Board of Directors and the high efforts of the Project Team, along with the dedicated consulting support from two reputable strategic partners (KPMG & EY), KienlongBank marks a significant milestone in its relentless journey. The bank has completed the Basel III liquidity and capital standards, considered a proactive step in complying with regulations suited to the nature of commercial banking activities.

The bank has also published its ESG sustainability report, aligned with international standards, covering four key themes, 14 critical topics, and 55 applied GRI standards, along with a four-pillar-based approach. Additionally, the bank has issued its ESG declaration, encompassing sustainable growth, customer focus, professional development, and governance determination.

As KienlongBank approaches its 30th anniversary (1995-2025), successfully implementing and pioneering the synchronized deployment of these two key projects is not just about adhering to the bank’s long-term strategic orientation but also signifies the Board of Directors’ strong commitment to focusing resources on enhancing governance capabilities, elevating customer experience, developing sustainable financial products, and increasing value for society. The bank’s mission is to “share green values and pioneer in green programs and activities for the benefit of community development.”

KienlongBank officially announces its 2024 sustainability report

Mobilizing Resources for the Journey to New Horizons

Amidst the ever-changing times, KienlongBank has formulated a transformation strategy to prepare for its journey to new horizons, adapting to the diverse preferences of customers in the digital age, and keeping pace with the market to gain a competitive edge and capture market share.

The three key leaders, all named “Minh,” have joined forces to drive the Digital Transformation revolution at KienlongBank.

With this resolute spirit, KienlongBank has continuously emphasized, improved, and invested resources in its organizational structure and governance foundation, making it one of the three core pillars (Technology Transformation, Governance Model Transformation, and People Transformation) in the new phase. Risk management capabilities are of particular focus and can be considered a critical mission for KienlongBank, as the bank builds comprehensive risk assessment methods and international standard defense scenarios with the accompaniment of leading consulting units.

KienlongBank’s agility in keeping up with the market and its proactive, synchronized approach in the new development strategy have contributed to its success. In addition to efficient and safe financial indicators, KienlongBank’s sustainability goal is further advanced through a transparent and cohesive working environment and meaningful social initiatives, with the common interest of the community as the core value.

KienlongBank: Leading the Way with Concurrent Basel III & ESG Initiatives

“With the synchronized implementation of both the Basel III and ESG projects, KienlongBank is demonstrating its strong commitment to enhancing its risk management capabilities and resilience against unforeseen fluctuations. The bank is also actively promoting its development towards sustainability, adhering to international and Vietnamese standards in environmental, social, and governance practices.”

Masan High-Tech Materials: Honored as a “Sustainable Enterprise” for Seven Consecutive Years

On November 29, Masan High-Tech Materials, a leading provider of advanced materials, was once again recognized for its sustainability efforts, securing a place in the prestigious Top 100 Sustainable Businesses in Vietnam (CSI 100). This acknowledgment underscores the company’s unwavering commitment to environmental stewardship, social responsibility, and strong governance practices.

The AI Factory’s Handshake: Will it Bring an “Evolutionary Leap” in Revenue for FPT?

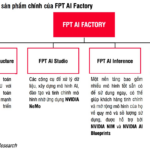

SSI’s AI infrastructure is a comprehensive, end-to-end solution for developing AI capabilities, outperforming its competitors in Japan. FPT AI Factory offers a robust and dynamic platform, providing organizations with the tools and resources needed to harness the power of artificial intelligence. With its cutting-edge technology and innovative features, FPT AI Factory empowers businesses to stay ahead of the curve in the ever-evolving world of AI.