2024 marks a pivotal year for enhancing corporate governance in Vietnam. As demands for good corporate governance increase, investing in effective governance linked to ESG is no longer a choice but a crucial need for businesses, especially listed and public companies.

Today, investors, particularly international investment funds, are focusing their sustainable investments on businesses that implement corporate governance practices linked to measuring environmental and social impact. Corporate governance is deemed a very important channel to attract market and business investments.

“However, the overall level of corporate governance in Vietnam, especially when linked to ESG, is currently at the lowest level among ASEAN countries and below the average assessment,” noted a prominent speaker at the 7th annual forum of the Institute of Directors in Vietnam (VIOD), themed “Investing in Corporate Governance: Strategies to Attract Responsible Investors in the Context of International Market Integration.”

Only well-governed companies can attract investment and command a premium.

Mr. Pham Van Thinh, CEO of Deloitte Vietnam, provided evidence that over the past 20 years, investors worldwide have increasingly discussed governance. “Previously, businesses and investors only focused on financial aspects and profits, but now they are more concerned with responsible investing. The world is also witnessing a significant rise in responsible investor groups,” said Mr. Thinh.

According to a study cited by Mr. Thinh, the responsible business market has reached hundreds of trillions of US dollars. As investors’ greatest fear is losing money, improving corporate governance has become a priority.

Mr. Trinh Hoai Giang, CEO of HSC Securities, concurred from a securities company perspective. He observed that investors today are more concerned with non-financial aspects, including legal issues and, more importantly, corporate governance.

“I believe that only well-governed companies can achieve successful deals at premium prices,” said Mr. Giang. For instance, in the financial sector, a joint-stock commercial bank recently closed a deal at a price 20 times its EBITDA.

Therefore, according to the HSC representative, businesses should focus on five key issues: risk management, transparency, conflict of interest management, and, most importantly, adopting best practices. “Business owners must have a holistic perspective that considers not only profits and shareholder interests but also environmental and social impacts,” emphasized Mr. Giang.

Using an analogy, he likened a well-governed business to a talented and well-behaved student who excels in both academic performance and moral conduct.

PAN Group CEO on the Risk of Famine by 2050 and the Importance of Governance

Image: Speakers sharing insights on corporate governance.

As one of the leading agricultural groups in Vietnam, PAN Group’s CEO, Nguyen Thi Tra My, began her presentation with a prediction that famine could occur by 2050. “Food security is of utmost importance, especially as Vietnam is considered the kitchen of the world. As a leading enterprise in the agricultural sector, we are aware of our mission,” she said.

Ms. My also pointed out that the world is changing rapidly, with geopolitical risks, rapid technological advancements, and AI making everything unpredictable. In addition to these risks, the agricultural and food industry faces the added challenge of climate change.

“We don’t have lofty dreams like Elon Musk, designing spacecraft to take humans to the Moon. PAN Group has 11,000 employees and over 10 member companies, most of which are listed. Our challenge is governance. The concept of corporate governance is how a company is directed and controlled,” emphasized the PAN Group CEO.

According to her, the most significant difference lies in the diversity of fields, experience, age groups (U40-80), and gender. Notably, in the parent company’s board structure, female members account for 44%. In contrast, a report by HOSE indicates that less than 10% of listed companies currently have at least one-third female board members. Therefore, ensuring good corporate governance in a diverse context requires innovation and risk management, a “combo” that the PAN Group leadership constantly emphasizes.

Ms. My shared that PAN Group annually presents The PAN Group Innovation Awards, and in 2024, the Group implemented over 560 applied initiatives, with 10 initiatives receiving recognition and awards. Additionally, amidst a volatile world, PAN Group actively develops new products, especially in agriculture. The Group has successfully researched and developed rice varieties resistant to salinity, flooding, heat, and sturdy enough to withstand storms.

Overall, corporate governance is a critical factor today. According to McKinsey and the World Bank, companies with good governance quality will be valued 10-20% higher and have 10-15% lower capital costs when raising capital. This proves that good corporate governance is not just a necessity but a matter of survival.

KienlongBank: Leading the Way with Concurrent Basel III & ESG Initiatives

“With the synchronized implementation of both the Basel III and ESG projects, KienlongBank is demonstrating its strong commitment to enhancing its risk management capabilities and resilience against unforeseen fluctuations. The bank is also actively promoting its development towards sustainability, adhering to international and Vietnamese standards in environmental, social, and governance practices.”

A New Direction for Eximbank: Approving the Resignation of 3 Key Members and Relocating the Head Office to Hanoi

On November 28, 2024, the Vietnam Export Import Commercial Joint Stock Bank (Eximbank, HOSE: EIB) held an extraordinary general meeting to approve the relocation of its head office from Ho Chi Minh City to Hanoi. This move comes amidst a heated discussion sparked by a proposal from a group of shareholders ahead of the upcoming annual general meeting.

The Secret Commission: How Banks Push Loans to Sell Insurance

Financial experts have revealed that, in the first half of this year, there has been feedback regarding customers being required to purchase insurance packages to access loan disbursements. The root cause of this issue lies in the high commissions offered by insurance companies for investment-linked insurance products, with some companies paying over 100% in commissions to their partners, leading to this unscrupulous behavior by banks.

Positive Signals from the Vietnamese Banking Sector in Q3 2024

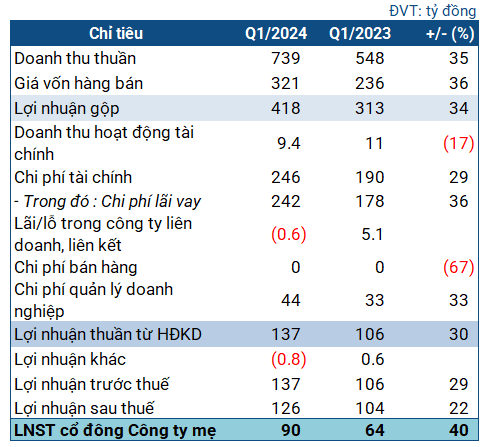

In a tumultuous economic climate, the Vietnamese banking sector in Q3 2024 demonstrated resilience and growth, with positive signals across the board. The latest financial reports indicate significant improvements in the financial performance of commercial banks, especially with the impending expiration of Circular 06. The CAMELS evaluation model paints a comprehensive picture of the current health and stability of the country’s banking system.

“The Chili King” Phuc Sinh Shares Insider Stories on Attracting Million-Dollar Investments from Europe after a Decade of ESG Practices

Mr. Phan Minh Thong, Chairman of Phuc Sinh Company, reveals the behind-the-scenes story of attracting million-dollar investment from a Dutch fund.