VPBank’s Latest Savings Interest Rates

VPBank’s savings interest rates have been officially adjusted effective December 3rd. For individual customers, VPBank is offering 5 different tiers of deposit amounts with varying interest rate brackets: below VND 1 billion, VND 1 billion to below VND 3 billion, VND 3 billion to below VND 10 billion, VND 10 billion to below VND 50 billion, and above VND 50 billion.

Specifically, for customers with deposits below VND 3 billion, the interest rate for terms of 1-18 months has increased by 0.2 percentage points. The 1-month rate has been raised to 3.7%/year. The 2-5 month term now stands at 3.9%/year. The 6-11 month term has increased to 4.9%/year, while the 12-18 month term has gone up to 5.4%/year. The interest rate for the 24-36 month term remains at 5.5%/year.

For deposits ranging from VND 3 billion to VND 10 billion, the current interest rates fluctuate between 3.7% and 5.5%/year for terms of 1 to 18 months. The interest rate for the 24-month term has increased to 5.6%/year.

With deposits ranging from VND 10 billion to below VND 50 billion, the interest rates vary from 3.8%/year to 5.7%/year for terms of 1 to 24 months.

Meanwhile, for deposits of VND 50 billion and above, the bank offers an interest rate of 3.9%/year to 5.7%/year for terms ranging from 1 to 36 months.

VPBank’s latest savings interest rates.

Regarding online savings interest rates, VPBank has increased them by an average of 0.1-0.2 percentage points for different terms and tiers. Currently, for regular deposits, the interest rates range from 3.8%/year to 5.8%/year.

VPBank also offers an additional interest rate of 0.4-0.7%/year for Pre-Diamond and Diamond customers with deposits of VND 300 million and above through online channels.

Techcombank’s Latest Savings Interest Rates

Techcombank has also slightly increased its savings interest rates for short-term deposits starting December 2nd. As a result, the interest rate for 1-2 month terms for regular customers with deposits below VND 1 billion in the Phát Lộc savings program at the counter has increased by 0.1 percentage points to 3.25%/year. The interest rate for the 3-5 month term has been raised to 3.55%/year.

The bank has maintained the interest rate for 6-12 month terms, which currently stands at 4.45%/year for the 6-11 month term and 4.75%/year for the 12-36 month term.

Techcombank has made a similar adjustment by increasing the interest rate by 0.1 percentage points for terms of 1-5 months with deposit amounts ranging from VND 1 billion to VND 3 billion and above VND 3 billion for Inspire, Priority, and Private customer groups. The interest rates for other terms remain unchanged.

The online Phát Lộc savings interest rates have also been adjusted, with a 0.1 percentage point increase for terms of 1-5 months compared to the previous adjustment. Currently, for regular customers with deposits below VND 1 billion, the interest rates range from 3.35%/year to 4.85%/year for terms of 1-12 months.

Techcombank’s latest savings interest rates for customers with counter savings deposits.

Techcombank’s latest online savings interest rates for customers with Phát Lộc savings deposits.

MSB’s Latest Savings Interest Rates

MSB has also recently adjusted its savings interest rates effective December 3rd. For regular customers, the bank has increased the interest rate for deposits with terms of 1-12 months by 0.2%/year. Currently, the interest rates for counter deposits range from 3.6%/year to 5.5%/year for terms of 1 to 12 months, while online savings interest rates fluctuate between 4.1%/year and 5.8%/year.

MSB’s latest savings interest rates.

Notably, MSB has significantly increased the interest rate by 0.7%/year for certain terms for the following customer groups: preferred customers as defined by MSB from time to time; employees of MSB or TNG Corporation; individuals receiving salaries through accounts at MSB.

Specifically, the interest rate for the 6-month term has increased by 0.7%/year to 5.5%/year.

The interest rates for the 12-month, 15-month, and 24-month terms have been raised to 6.3%/year.

Source: MSB.

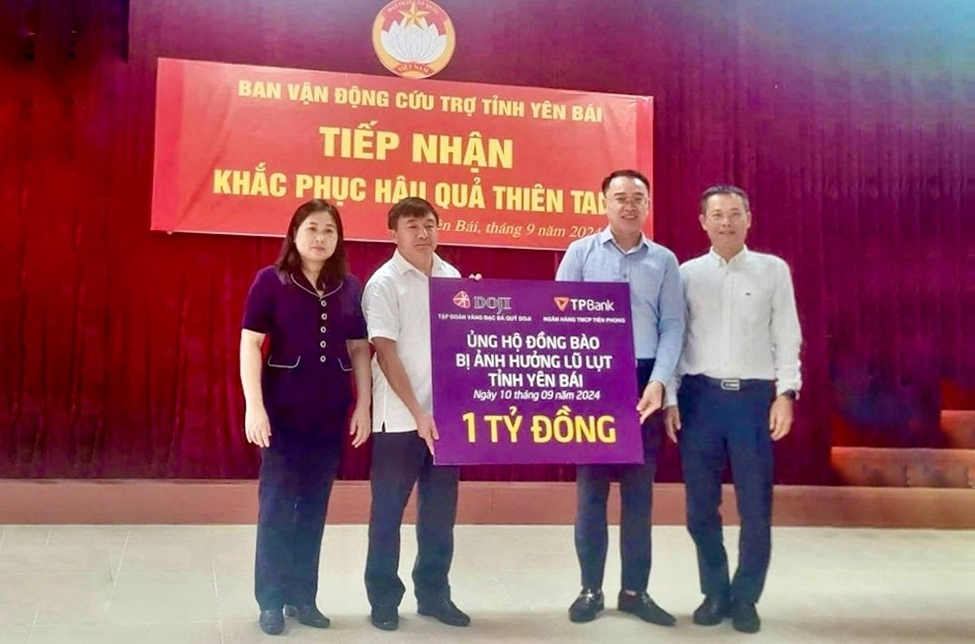

Withdrawing and Transferring Money Made Easy at the The Gioi Di Dong and Dien May Xanh Stores.

Customers can effortlessly top up their accounts or withdraw cash and transfer money to their loved ones swiftly, conveniently, and time-efficiently without the need to physically visit an ATM or a bank branch.

“Techcombank Weighs Sale of 15% Stake to New Strategic Investor if Foreign Owners Exit”

“Techcombank is on the lookout for a strategic investor with a particular set of skills. We are seeking a partner with advanced technological capabilities and established connections within key trade corridors, including Singapore, Japan, and South Korea. With their expertise, we aim to enhance our digital offerings and expand our reach, solidifying our position as a leading bank in Vietnam and beyond.”