The stock market has long been considered one of the most attractive investment avenues. However, a sad reality is that up to 95% of regular stock market investors incur losses. While there is no official statistic, many experts, and even leaders of securities companies, have spoken out about this issue.

What is the reason behind this?

In reality, more than 90% of securities accounts in Vietnam belong to individual investors. This group also accounts for 80-90% of market transactions. However, most individual investors are amateurs. Many of them simply want to find an investment channel that yields higher returns than savings accounts. At a workshop held by the State Securities Commission (SSC) and Dragon Capital Vietnam Fund Management Company (Dragon Capital), six limitations of individual investors in securities trading were identified: lack of time for research, lack of knowledge, lack of experience, lack of strategy, lack of information, and psychology.

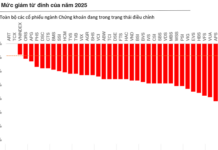

Among these, psychological factors have a significant impact on investment performance. The desire to get rich quick leads individual investors to buy and sell stocks hastily, often falling prey to FOMO (fear of missing out). In an environment dominated by individuals, investors are easily influenced by rumors, peer pressure, and herd mentality. This results in a common scenario of buying at the peak and selling at the bottom.

Additionally, most non-professional individual investors do not have sufficient time to research before making buying or selling decisions. Lacking financial knowledge and understanding of the businesses they invest in, their industries, and their operations, makes investing challenging. Even when lucky enough to buy profitable stocks, investors often fail to calculate the right time to take profits. On the other hand, many desperately hold on to losing positions because they don’t know when to cut their losses.

For non-professional investors, trading decisions are often based on sentiment and the information they can access. However, the stock market is characterized by information asymmetry between individual and institutional investors, and between small and large investors. While regulatory authorities continuously improve the legal framework to create a more transparent and healthy investment environment, individual investors should also take responsibility for protecting themselves.

Where can investors ‘put their trust‘?

Financial investment is not a simple task; it requires specialized skills, market knowledge, and dedicated research time. At the workshop organized by the SSC in collaboration with Dragon Capital, effective solutions were recommended for individual investors, especially those new to the stock market (F0). These included determining risk appetite, learning about the stock market, adopting a long-term investment horizon, diversifying investment portfolios, and adhering to investment discipline.

In reality, with the vast and ever-growing amount of information available, anyone can present themselves as an “expert” on social media, making it challenging for investors to filter reliable sources. “Knowledge is important, but practice and discipline are also crucial. Investors need to have a specific plan, clear goals, and high discipline to expect success,” shared Ms. Luong Thi My Hanh, Director of Domestic Asset Management at Dragon Capital.

Instead of relying on amateurish research, unverified information, and online groups that fuel FOMO, investors should turn to reputable investment funds for advice. These funds operate under the supervision of the Securities Commission and are managed by top experts with well-defined investment strategies, ensuring transparent and reliable information.

For individuals who don’t have the time to invest directly, entrusting their capital to reputable fund management companies or investing in open-ended funds, ETFs, etc., is an effective solution. A team of experienced professionals will help investors significantly reduce market risks while maintaining profitable returns.

“Investors should consider investing in funds managed by professional fund management companies such as Dragon Capital… These funds operate within the legal framework and are managed by experts with extensive experience,” advised Mr. Bui Dinh Hoa, a representative from the SSC, to F0 investors.

Additionally, the market offers other investment options, such as bond investing and investing in indices, which can be attractive in terms of returns. However, individual investors cannot pursue these options on their own and need the support of professional organizations. These reasons compel investors to turn to the leading investment funds in the market.

Is Investing in Gold, Real Estate or Stocks the Most Profitable?

The year 2025 is set to be a period of significant change, but also a time of opportunity for investors to reap success. While real estate, stocks, bonds, and savings accounts remain the dominant investment avenues, a strategic capital allocation is key. Notably, gold is expected to be the least attractive investment option among these traditional avenues.

Housing for All: A Call to Action for 3,800 Social Housing Units in Ho Chi Minh City

The vibrant city of Ho Chi Minh is gearing up to boost investments in seven land projects, spanning over 27 hectares. With a vision to construct more than 3,800 social housing units, the city is taking proactive steps to cater to the housing needs of its growing population. This initiative underscores the city’s commitment to providing affordable and quality living options for its residents, ensuring that everyone has a chance to call Ho Chi Minh City their home.

The Housing Prospect: 70,000 Social Homes

With the support and collaboration of businesses, Ho Chi Minh City has the opportunity to meet its social housing development targets by 2030. This ambitious goal is within reach, and with the right strategies and partnerships, the city can provide much-needed affordable housing for its residents, creating a brighter and more inclusive future for all.