The Economist Intelligence Unit (EIU) has developed an index to assess the exposure of individual countries to the Trump presidency. The Trump Risk Index (TRI) employs quantitative indicators to measure the extensive impact on America’s 70 largest trading partners. The TRI’s overall risk score is based on assessments of vulnerability across three domains of trade, immigration, and security, where significant policy changes are anticipated under Trump.

Higher Tariffs and Trade Restrictions (Index Weighting 40%): With some exemptions and exceptions, the EIU believes Trump will follow through on his stated intention to impose blanket tariffs on US imports; he has proposed a flat 10% tax, although the EIU thinks this will eventually be watered down. There are likely to be additional punitive measures on politically sensitive imports.

Security Burden Sharing (Index Weighting 40%): US military aid will come with more conditions, and Trump will seek to rebalance critical defense relationships. The Trump administration will increase pressure on defense allies to contribute more financially and materially.

Tighter Border Control and Security (Index Weighting 20%): The EIU expects the Trump administration to increase funding for border wall protection and other deterrence strategies. There will be a stronger focus on deporting immigrants and imposing some additional restrictions on channels for international labor migration and legal study.

The EIU assigns higher weightings in the TRI to the trade and security pillars and a lower weighting to immigration to reflect the relative importance of these indicators in determining the broad impact of these changes on a country’s economy.

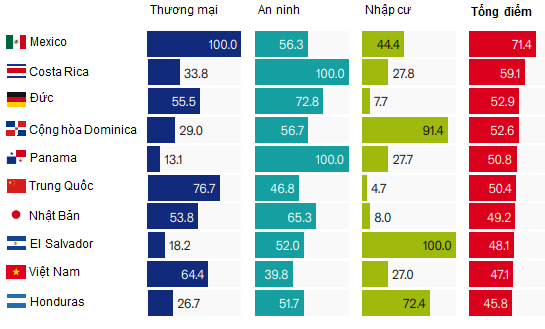

America’s allies and partners have the most reason to be concerned.

America’s allies and partners have the highest overall exposure to Trump’s policy shifts due to their deep trade, security, and cultural ties with the US. This higher interdependence also makes them more susceptible to significant shifts in US policy direction. Mexico is ranked as the most affected country with an index score of 71.4, due to its high dependence on trade and immigration.

Several other Latin American nations are among the top ten most affected because of their economic and cultural links with the US. NATO allies (or equivalents) Germany and Japan are also among the more affected nations (ranking third and seventh, respectively). In addition to achieving large bilateral trade surpluses with the US—a significant concern for Trump—each country also relies on US security arrangements and contributes a relatively small proportion of their GDP to defense.

Vietnam is also in the top ten most affected countries under President Trump. However, Vietnam’s primary challenge stems from trade, while other issues such as security and immigration are less significant.

Countries Most Affected by President Trump

Source: Economist Intelligence Unit (EIU)

(*) Note: Higher scores indicate greater impact.

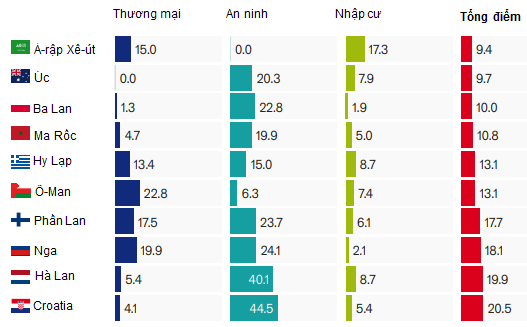

Countries with lower exposure to the expected changes under Trump tend to be those with more distant or less interdependent relationships with the US. Australia is an exception and is ranked as the second-least affected country in the EIU’s index, as it combines weak trade links with the US and a balanced security relationship.

Saudi Arabia (ranked 70th) is the least affected country with a TRI score of 9.4. Its trade links with the US have diminished in importance as the US has emerged as a significant energy exporter and heavy defense spender (including on US weapons). The relationship between the US and Saudi Arabia has been warmer under the first Trump administration compared to the Biden era. With the US in a difficult position following the invasion of Ukraine, Russia (ranked 63rd) also stands out among the lower-impact countries.

Countries Least Affected by President Trump

Source: Economist Intelligence Unit (EIU)

Trade – Tariffs and Protectionism

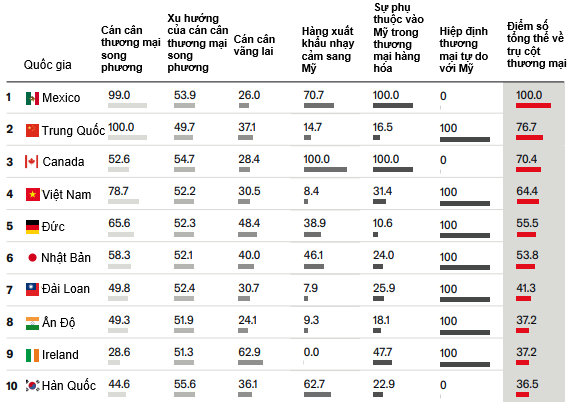

Protectionism under Trump will create uncertainty in the global trade landscape. The US goods trade deficit is Trump’s primary economic concern, and he has outlined plans to address this if he wins the presidential election, including using punitive tariffs, which he frequently employed during his previous term. A country’s method of balancing trade with the US is taken seriously in the TRI’s sub-index to assess tension, along with compliance with US-guided balancing and shipments of politically sensitive items like steel, aluminum, and automobiles, which are more likely to be taxed.

Free Trade Agreements (FTAs) with the US are included as a counter-indicator: FTAs will offer some protection by making it more difficult to impose higher tariffs, although this doesn’t always act as a deterrent, as evidenced by Trump pressuring South Korea to renegotiate its trade deal with the US in 2018.

America’s Major Trading Partners Most Vulnerable to Trump’s Trade Policy Changes

Source: Economist Intelligence Unit (EIU)

Mexico and Canada are among the most vulnerable economies. China’s presence is no surprise, as it still holds the largest bilateral trade surplus with the US over any other economy. Trump has threatened to revoke China’s most-favored-nation status (or, more specifically, in the US context, to withdraw “Permanent Normal Trade Relations” status).

The high impact of India and Vietnam reflects the larger role they now play in the US-centric supply chain. Germany and Ireland are assessed as the most affected in Europe.