SCIC plans to sell a single lot of shares comprising 235,053 units, accounting for over 3% of DKP‘s charter capital. The starting price is set at approximately 4.6 billion VND (around 19,700 VND per share), with a bid increment of 1 million VND per lot. Eligible bidders include investors who meet the requirements specified in the regulations for the auction of DKP shares owned by SCIC and PetroVietnam Securities ( PSI), the consulting firm.

A 10% deposit of the starting price, amounting to roughly 460 million VND, is required for participation. The auction is scheduled to take place at 10:00 AM on December 27, 2024, at PSI‘s headquarters in the Hanoitourist building, 18 Ly Thuong Kiet, Hoan Kiem District, Hanoi.

In the event of a successful bid, the winning bidder must settle the payment between December 27, 2024, and January 3, 2025. Qualified bidders will also have their deposits refunded during this period.

Notably, DKP, headquartered in Nguyen Cong Tru, Hai Ba Trung District, Hanoi, has a charter capital of 67 billion VND (approximately 6.7 million shares) and owns the DK Pharma pharmacy chain. The company was previously traded on the UPCoM exchange but delisted in mid-2020.

Since 2020, SCIC has been divesting its holdings, having sold all of its previously held shares of over 180,000 units (equivalent to 6.06% when DKP‘s charter capital was more than 30 billion VND). SCIC also announced auction plans for DKP share purchase rights in 2021 and 2024, but both attempts were unsuccessful due to a lack of registered participants, with only one investor registering to buy.

In terms of financial performance, DKP has maintained a steady growth trajectory in revenue from 2018 to 2023, although profits have been relatively modest, typically ranging from 2 billion to just under 3 billion VND. However, the company made significant strides in 2023, achieving 152 billion VND in net revenue, a 20% increase year-over-year, and posting an after-tax profit of 8 billion VND, nearly triple the previous year’s figure.

The Reluctant Dividend: A State-Owned Enterprise’s Eight-Year Itch and Delisting Woes

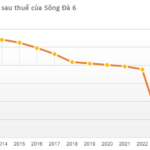

Thus, even after more than 8 years, SD6 is yet to pay dividends from 2016. A lingering issue that raises questions about the company’s financial health and stability.