|

VN-Index Faces a Challenging Afternoon Session

Source: VietstockFinance

|

The market witnessed 372 declining stocks, slightly higher than the 353 advancing stocks. However, the number of stocks that hit the ceiling price was four times higher than those that hit the floor price, with 28 and 7, respectively.

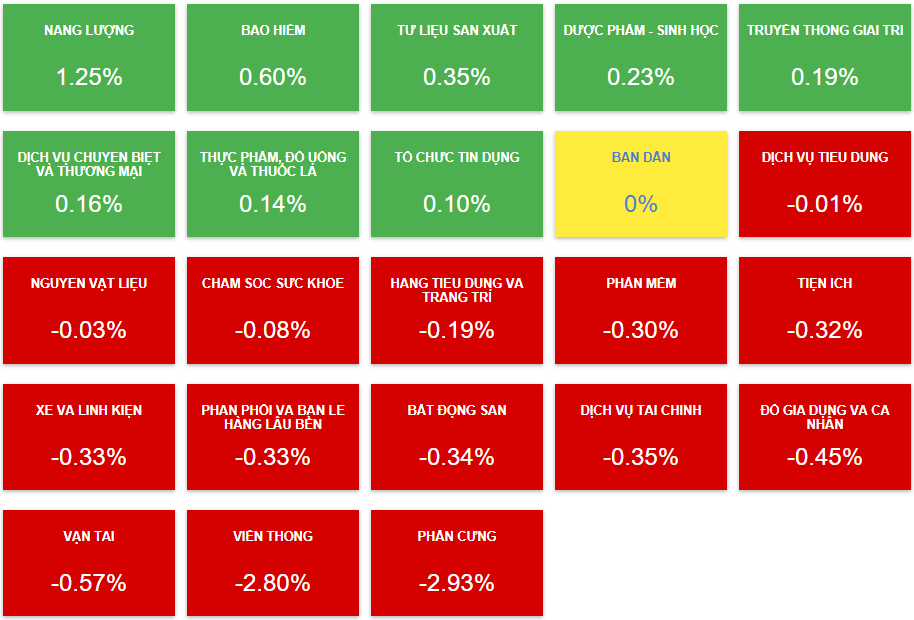

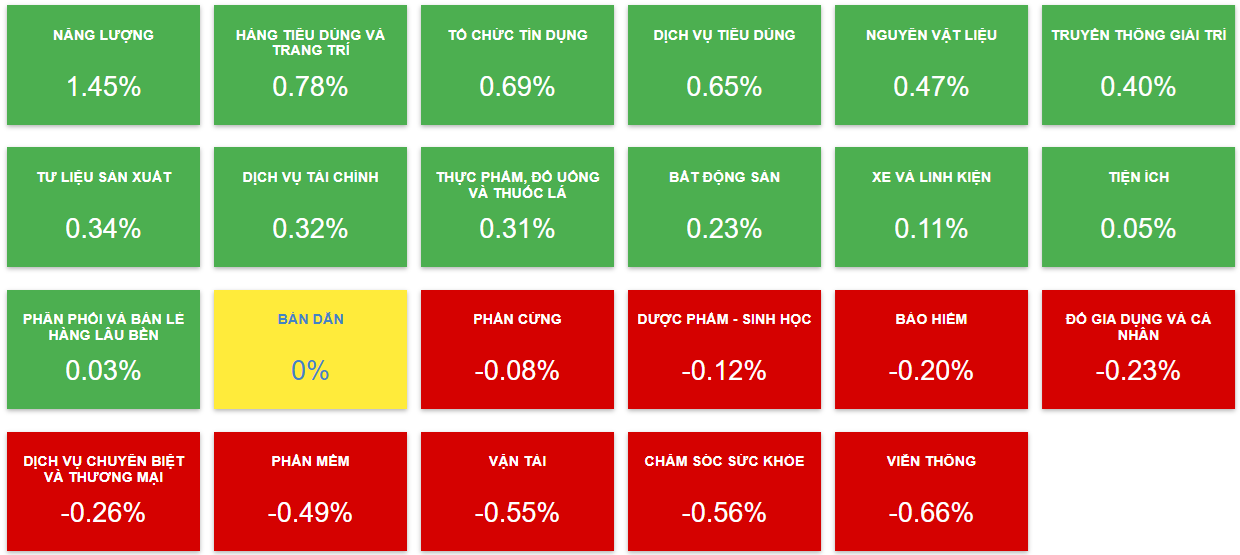

Declining sectors dominated the market with 14 out of 23 sectors in the red. The hardware sector experienced the steepest decline of 2.93%, mainly due to POT‘s nearly 7% drop. This was followed by the telecommunications sector, which fell by 2.8% due to VGI‘s 3.13% decline, FOX‘s 1.72% loss, and CTR‘s 0.81% decrease.

Among the remaining declining sectors, large-cap sectors such as financial services, real estate, and materials also contributed significantly to today’s decline, falling by 0.35%, 0.34%, and 0.03%, respectively.

On the other hand, the energy sector was the best-performing sector, although it only rose by 1.25%. This was supported by gains in BSR (1.9%), PVD (0.84%), TMB (2.94%), CLM (0.97%), and HLC, which surged by nearly 10% to hit the ceiling price. Within this sector, some notable decliners included POS (-3.05%), AAH (-2.7%), NBC (-1.05%), and PVS (-0.58%).

|

Declining Sectors Outnumbered the Advancing Ones

Source: VietstockFinance

|

Market liquidity reached VND 15,162 billion, similar to the previous session but lower than the average of the last five sessions. As liquidity decreased, foreign investors also significantly reduced their trading volume, with net selling of over VND 380 billion, marking the fourth consecutive net selling session.

The stock that faced the strongest net selling today was FPT, with a net sell value of nearly VND 125 billion. This was followed by MSN (nearly VND 48 billion), FRT (over VND 45 billion), and MWG (nearly VND 43 billion). On the buying side, TCB and HDB were the most prominent, with net buying values of nearly VND 94 billion and VND 71 billion, respectively.

| Foreign Investors Net Sold for the Fourth Consecutive Session |

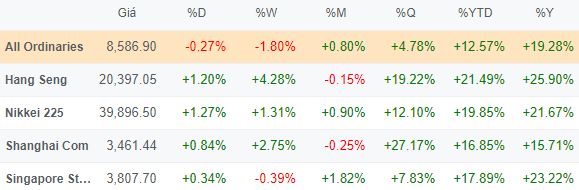

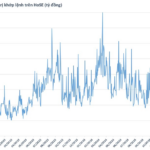

Turning to other Asian markets, most of them maintained their gains from the morning session, unlike Vietnam, which faced selling pressure in the afternoon. The majority of the major indices closed in positive territory.

|

Most Asian Markets Maintained Their Gains

Source: VietstockFinance

|

14:00: VN-Index Drops to Reference Level Amid Selling Pressure in the Afternoon Session

Within just one hour of the afternoon session, the index continuously faced selling pressure and dropped to the reference level, erasing all the gains made during the morning session.

Source: VietstockFinance

|

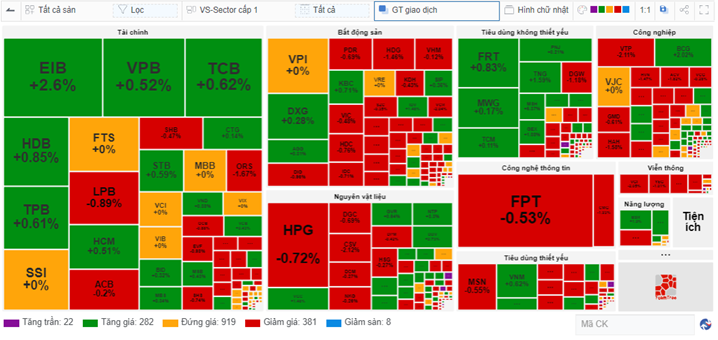

As of 14:00, the VN-Index had decreased to 1,268.86, a drop of about 6 points from the morning session’s peak. The number of declining stocks quickly increased to 389, outnumbering the 304 advancing stocks.

In the large-cap sectors, many stocks turned red, notably in real estate, with stocks such as HDG, PDR, DIG, VIC, VHM, HDC, and KDH… In the materials sector, stocks like HPG, DGC, CSV, and HSG turned red… In the information technology sector, FPT and CMG also faced selling pressure…

Compared to the morning session, the market witnessed one sector declining by more than 1%, which was telecommunications (down 1.85%) due to VGI‘s 2.05% drop, FOX‘s 1.12% loss, CTR‘s 0.73% decrease, and others…

|

Many Large-Cap Stocks Turned Red in the Afternoon Session

Source: VietstockFinance

|

Liquidity continued to increase, reaching VND 11,395 billion, higher than the previous session. In this context, foreign investors also intensified their net selling, increasing the net sell value to approximately VND 290 billion.

Morning Session: Bank Stocks Support the Market’s Uptrend

Despite facing increased pressure, the VN-Index maintained its upward momentum, forming a “sideway up” pattern and ending the morning session at 1,273.81, a gain of 4.95 points. The HNX-Index also increased by 0.34 points to 228.52, while the UPCoM-Index edged slightly lower to 92.64.

Source: VietstockFinance

|

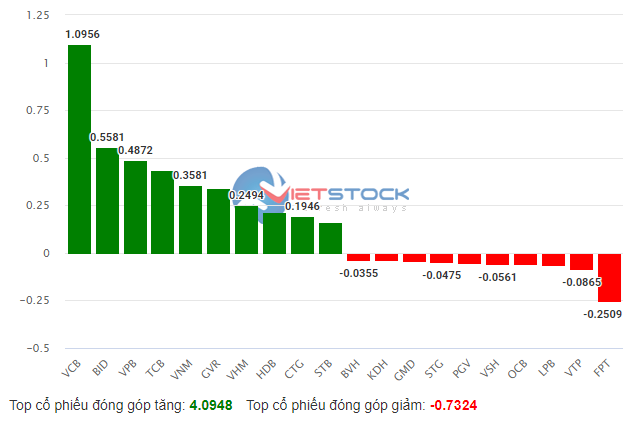

While the market gained nearly 5 points, VCB alone contributed more than 1 point to this increase. Other bank stocks, such as BID (nearly 0.6 points), VPB (nearly 0.5 points), and TCB (over 0.4 points), also provided significant support. The top 10 stocks with the most positive impact on the VN-Index contributed a total of nearly 4.1 points, almost equal to the index’s gain.

|

Bank Stocks Drive the Market’s Uptrend

Source: VietstockFinance

|

It is evident that the market heavily relied on large-cap stocks, especially bank stocks. Meanwhile, when looking at the broader market, the number of advancing and declining sectors was relatively balanced, with most sectors experiencing only mild fluctuations.

The energy sector was the top-performing sector, with a gain of 1.45%. This was driven by BSR‘s 1.9% increase, PVS‘s 0.29% rise, PVD‘s 1.05% gain, TMB‘s 3.36% surge, and even HLC‘s ceiling-hitting 10% jump. On the declining side, no sector recorded a decline of more than 1%.

|

The Number of Advancing and Declining Sectors Was Relatively Balanced

Source: VietstockFinance

|

Foreign investors slightly increased their net selling to nearly VND 147 billion. This morning’s trading activity was mainly focused on FPT, which faced net selling of nearly VND 100 billion, and TCB, which enjoyed net buying of nearly VND 94 billion. These two stocks far outpaced the others in terms of net buy and sell values.

10:40: Continuous Fluctuations

After the initial upward surge at the opening, the market encountered more challenges and experienced mild fluctuations, with the UPCoM-Index turning red.

As of 10:30, the VN-Index had increased by 4.19 points to 1,273.05, the HNX-Index had risen by 0.2 points to 228.37, while the UPCoM-Index had dipped slightly by 0.07 points to 92.67. The market breadth remained in favor of advancing stocks.

Looking at the market map, large-cap sectors such as banking, real estate, and materials did not witness strong gains. The energy sector was the top performer, driven by BSR‘s 2.37% increase, PVD‘s 0.63% rise, TMB‘s 2.94% surge, and others…

Foreign investors were net sellers, with a net sell value of nearly VND 40 billion. Notably, the buying and selling pressure was concentrated on TCB (net buying of nearly VND 94 billion) and FPT (net selling of nearly VND 50 billion).

Opening: Following Global Markets, All Three Indices Open in Positive Territory

The market started the day on a positive note, with all three indices opening higher, led by the VN-Index‘s gain of over 3 points. This opening reflected the positive sentiment from the opening of Asian markets and Wall Street’s performance overnight.

As of 9:30, the VN-Index had risen by over 3 points to approach the 1,272 level, while the HNX-Index and UPCoM-Index also edged slightly higher to 228.71 and nearly 92.78, respectively. Liquidity was not particularly impressive, with over 39 million shares traded, equivalent to a value of over VND 811 billion.

Overall, the market breadth favored advancing stocks, with 283 stocks increasing, including 8 stocks hitting the ceiling price. Notably, VCA, the stock of Vietnam Steel Corporation – VNSTEEL, temporarily recorded its 11th consecutive ceiling-hitting session. In contrast, only 140 stocks declined.

Looking at other Asian markets, they also opened with similar positive sentiment, with major indices such as Nikkei 225, Hang Seng, and Shanghai Composite all trading in positive territory, except for Australia’s All Ordinaries, which was slightly in the red.

On Wall Street overnight, the Nasdaq Composite Index surged after the November inflation report met economists’ expectations, paving the way for the Federal Reserve (Fed) to cut interest rates once again at the December meeting next week.

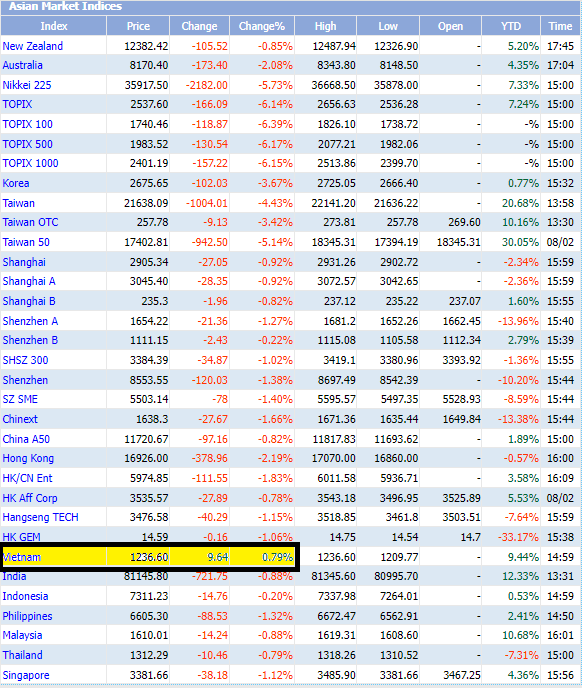

At the close of the trading session on December 11, the Nasdaq Composite Index rose 1.77% to 20,034.89 points, reaching an all-time high. The S&P 500 index added 0.82% to 6,084.19 points. Meanwhile, the Dow Jones Industrial Average lost 99.27 points (equivalent to 0.22%) to 44,148.56 points.

|

Nasdaq Composite Surges After November Inflation Report

Source: VietstockFinance

|

“Steering Through the Storm: Navigating Investment Strategies for 2025 and Beyond”

In less than a month, the stock market will close out an unpredictable 2024. As we transition into the new year, investors are seeking answers to the question: What’s in store for 2025? To provide insights and guidance, VPBankS Talk 04, themed “Navigating Through the Storm,” will be held on December 16.

The Stock Market Soars Unexpectedly by 27 Points: What’s Behind the Surge?

The standout feature of this report is the HOSE matching liquidity, which surged over 60% from the previous session to 19.2 trillion dong – the highest level in the past 2 months.

The Vietnamese Stock Market Soars: A Surprising Rise to the Top in Asia

The Vietnamese stock market witnessed an unexpected surge in trading activity, with the VN-Index leading gains across Asia. This rally was characterized by a significant jump in trading volume and a return to net buying by foreign investors, setting the stage for a potential shift in market dynamics and investor sentiment.