left intent:

Entering the Top 10 Largest Capitalized Companies on the Stock Exchange

At the close of the December 4, 2024 session, MCH shares closed around 222,000 VND. Thus, in 2024, MCH has had an impressive rally of more than 240% from the 89,200 level on January 2. This price increase has made MCH the focus of the UpCOM floor, both in terms of price steps and trading volume.

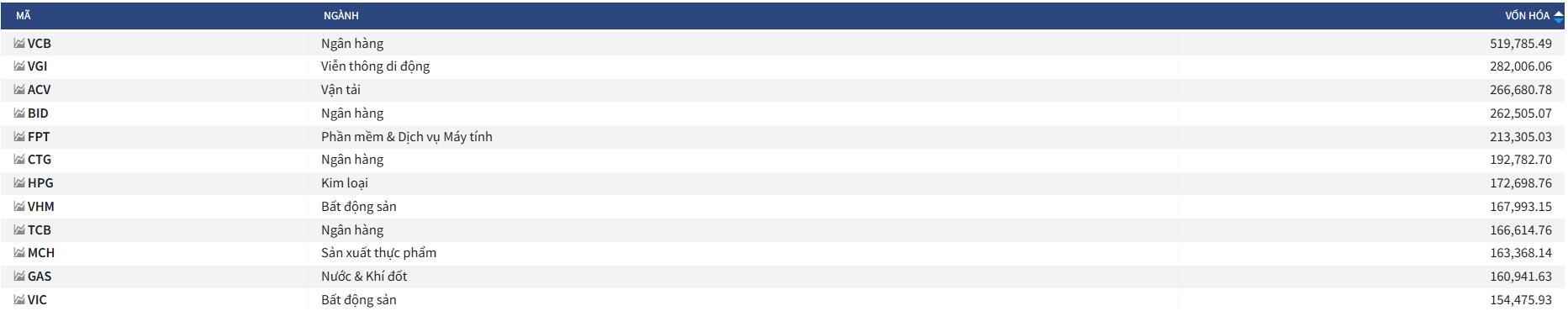

With the strong price increase in the past, based on the December 4, 2024 price, MCH has a corresponding capitalization of over VND 161 trillion. Although listed on the UpCOM exchange, this capitalization has helped MCH step into the top capitalized companies on the stock exchange. The current capitalization of MCH is higher than many “big caps” on the HOSE floor such as Vinamilk (VNM), Sabeco (SAB), Military Bank (MBB), The Gioi Di Dong (MWG), and Vincom Retail (VRE).

Own the “power brands”

The reason for MCH’s price increase may be due to the recent positive information, including business results and the ability to raise additional capital, IPO on the HOSE floor that the leaders of this enterprise have just announced at the 2024 Annual General Meeting of Shareholders.

Masan Consumer currently owns 5 “power brands” of consumer goods. Each brand generates annual revenue of about $150-250 million with a large “coverage”. They are brands that have become familiar to millions of Vietnamese consumers such as CHIN-SU, Nam Ngu, Omachi, Kokomi, and Wake-Up 247, accounting for 80% of MCH’s domestic revenue over the past 7 years. With a growth rate of 2.2 times the market rate from 2017 to 2023, more than 98% of Vietnamese households now own at least one MCH product.

According to Kantar, Chin-Su and Nam Ngu are the most chosen brands in urban areas; while in rural areas, there are 4 brands: Nam Ngu, Chin-Su, Kokomi, and Tam Thai Tu. In both rural and urban areas, MCH has a loyal customer base that is willing to experience new products and help increase sales in multiple categories.

In addition to investing in marketing and promotion activities, MCH pays special attention to R&D to continuously launch new products to the market at a rapid pace. Through the Consumer Innovation Center to chat and exchange with the “Consumers in love” community – consumers who love to use the products, to find great ideas, unmet needs, and develop suitable products. In the first nine months of 2024, 125 new products generated VND 1,518 billion in revenue, contributing 7% to MCH’s total revenue and growing by 47% over the same period last year.

According to the enterprise’s financial report, MCH achieved a revenue growth rate of 10.4% over the same period in Q3 2024, reaching VND 7,987 billion. This positive figure was contributed by the premiumization strategy implemented in the Convenience Food and Spices sectors, achieving growth of 11% and 6.7%, respectively, over the same period; and innovations in the Beverage, Home & Personal Care, and Instant Coffee sectors, achieving growth of 18.8%, 12.4%, and 11.3%, respectively, over the same period.

IPO in 2025

On October 2, 2024, Masan Consumer announced the resolution of the Board of Directors to approve the transfer of MCH shares from the UPCoM exchange to the Ho Chi Minh City Stock Exchange (HOSE). At the same time, it sought shareholder approval for the interim dividend for 2024 from the company’s retained earnings, with a maximum interim dividend of 100% (i.e., 1 share will receive a maximum interim dividend of VND 10,000 for 2024).

Given the shareholders’ approval of the plan to list MCH on the HOSE, it can be seen that the enterprise’s strategic move is on the right track. Moreover, the successful IPO of Masan Consumer will help improve the valuation of Masan-affiliated stocks such as MCH and MSN, and this roadmap is becoming clearer with positive information from the enterprise and the market.

In Q4 2024, Masan Consumer accelerated revenue growth by continuing to implement the premiumization strategy in the Spices and Convenience Food sectors, implementing innovations in the Beverage, Home & Personal Care, and Instant Coffee sectors, and streamlining the product portfolio to optimize profits.

Cleared for Takeoff: CHIN-SU Phở Story Soars with Vietjet Airways

On December 4th, Masan Consumer Holdings and Vietjet Airlines signed a strategic partnership agreement to bring CHIN-SU Phở Story, a Masan Consumer brand, and the essence of Vietnamese cuisine to Vietjet’s domestic and international flights. This collaboration aims to promote Vietnamese culture to the world by offering delicious and authentic culinary experiences to passengers and tourists alike.

Masan: Confident to Achieve 2024 Profit Plan of $86 Million

In Q3 2024, Masan reported a staggering 701 billion VND in profit, an astonishing nearly 14-fold increase compared to the same period last year, and surpassing its quarterly profit plan by 130% in the base-case scenario. The company is now focused on the final quarter, aiming to get closer to its ambitious 2,000 billion VND profit goal for the year.

The $75 Billion Bill Gates Charity Fund is About to Buy 458,000 More Shares in Vietnamese Billionaire’s Company

Bill Gates’ investment fund has long had an indirect presence in Vietnam, particularly in the stock market. The fund’s involvement in the country’s economy dates back several years, and its impact has been significant. With strategic investments in various sectors, the fund has played a pivotal role in shaping Vietnam’s economic landscape. The fund’s interest in the country underscores its potential as an emerging market and a promising destination for global investors.