The bond with the code ECFCH2425001 was issued on December 5, 2024, with a 12-month term and a maturity date of December 5, 2025. This bond has a fixed interest rate of 9% per annum, payable semi-annually, while the principal will be repaid in a lump sum at maturity.

According to data from the Hanoi Stock Exchange (HNX), this is the only bond issue currently in circulation from Encapital.

The bonds are non-convertible and do not come with warrants. They are secured by initial and supplementary collateral. The initial collateral consists of over 9.3 million common shares of a securities company listed on the HOSE. These shares have been issued, fully paid, are in circulation, and freely transferable.

The value of the collateral at any given time will be calculated as a minimum of 220% of the total face value of the bonds (VND 100 million per bond) in circulation at that time.

Encapital Financial Technology Joint Stock Company was established on August 9, 2018, mainly operating in the field of software publishing, and is headquartered at 46 Ngo Quyen Street, Hang Bai Ward, Hoan Kiem District, Hanoi.

Encapital initially had a chartered capital of VND 10 billion with 7 founding shareholders, with the majority of shares held by Mr. Nguyen Hoang Giang (CEO and legal representative) and Capella Group Joint Stock Company, each holding 40%. The remaining shares were held by Mr. Le Anh Tuan (10%), and Mr. Hoang Van Hung, Mr. Vu Hoang Viet, Mr. Nguyen Viet Tien, and Mr. Hoang Minh Chau, each holding 2.5%.

Encapital subsequently increased its capital to over VND 11 billion and nearly VND 78 billion in May and June 2020, respectively, before soaring to nearly VND 624 billion in July 2021 and reaching nearly VND 1,924 billion in April 2022.

According to sources, during the capital increase in July 2021, CEO Nguyen Hoang Giang stated that the additional funds would enhance the company’s financial capacity, invest in technology development, and expand the customer base for a securities trading platform owned by Encapital.

Moreover, the CEO and legal representative of Encapital also hold similar positions at Encapital Holdings Joint Stock Company, which was established on May 29, 2020. Encapital Holdings operates primarily in the management consulting field and shares the same headquarters address as Encapital.

The connection between Encapital and Encapital Holdings is further evident in their shareholder structures, as the same 6 individuals who are founding shareholders of Encapital are also founding shareholders of Encapital Holdings. Mr. Nguyen Hoang Giang holds 72.9% of the capital, Mr. Le Anh Tuan holds 13.6%, and the remaining 4 individuals each hold 3.4%, totaling a chartered capital of nearly VND 7.4 billion.

Encapital Holdings later underwent two capital increases, reaching nearly VND 41 billion in June 2020 and nearly VND 614 billion in July 2021.

Notably, Encapital Holdings previously issued two bond lots, ECHCH2324001 with a scale of VND 120 billion and ECHCH2223001 with a scale of VND 130 billion, both of which matured not long ago, in March and May 2024, respectively.

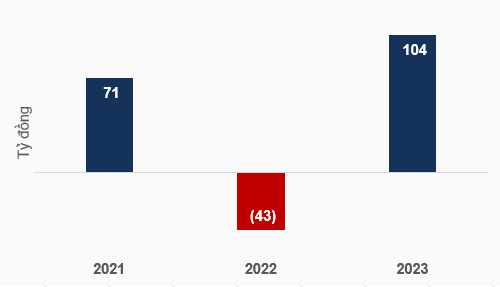

In recent years, Encapital Holdings’ business performance has been volatile, shifting from a loss of over VND 43 billion in 2022 to a profit of nearly VND 71 billion in 2021, and then to a profit of nearly VND 104 billion in 2023.

As of the end of 2023, Encapital Holdings had total assets of nearly VND 9,125 billion, with liabilities of over VND 6,652 billion, equivalent to 2.7 times its owner’s equity.

|

Encapital Holdings’ after-tax profit for 3 years

Source: VietstockFinance

|

A Shark Lien-Backed Water Company Raises Over $38 Million in 20-Year Bonds

Peace Clean Water Company – Xuan Mai has successfully raised over VND 875 billion through a bond offering, with a fixed interest rate of 5.75% per annum for 20 years. The offering was underwritten by a reputable organization based in an African tax haven, providing assurance to investors.