Selling pressure to lower prices increased this afternoon compared to the morning session, along with persistent buy orders placed at deeper prices, causing a significant deterioration in the market. However, the two-floor matching liquidity for the day was just over 10,100 billion VND, the lowest in 12 sessions, indicating that selling demand has not spiked.

VN-Index fell to its intraday low at 2:04 pm, losing 6.87 points (-0.54%), with a breadth of only 76 gainers/304 losers. Bottom-fishing began to intensify, lifting stock prices. The VN-Index closed with a loss of 4.78 points (-0.38%) and 105 gainers/280 losers.

Thus, the number of stocks that recovered and closed above the reference price was quite limited (over 30). This somewhat reflected the cautious and passive buying strategy still prevailing in the market. However, looking at individual stocks, the recovery capacity was not too bad. Specifically, about 70% of stocks did not close at their intraday lows, with about 29% rebounding by 1% or more from their lows. This recovery range can be understood as the price-pulling capacity of bottom-fishing funds.

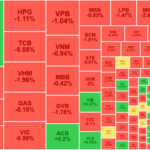

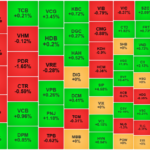

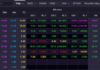

The underperformance of the VN-Index was due to the weakness of large-cap stocks. For example, VCB only recovered 2 price steps from its intraday low, closing down 0.43%. HPG also inched up 2 price steps, losing 1.09%. MSN closed at its intraday low, shedding 1.39%. Other large-caps such as BID, FPT, VHM, VIC, and GAS were also in the red. Stocks that recovered positively included BCM, which rebounded 1.5% from its low, closing up 0.3%; VRE, which recovered 0.9%, ending up 0.29%; BVH, which bounced back 1.92%, closing up 0.57%; and MWG, which climbed 2.35%, finishing up 1.67%… but had a limited impact on the index. The VN30-Index, representing the large-cap group, also witnessed a minor recovery, narrowing its loss to 0.3% from its intraday low of 0.5%.

However, today’s market also demonstrated the presence of bottom-fishing demand. This reaction emerged as the VN-Index dipped towards the 1,260-point level. Today marked the fourth consecutive corrective session and the fourth decline in five trading days this week. The slow and mild decline accurately reflected the short-term profit-taking activities, which were also gradual and on a small scale. In fact, except for the first session of the week when the HoSE matching value reached 12,815 billion VND, the liquidity in the following four sessions gradually decreased, with today’s value at 9,455 billion VND.

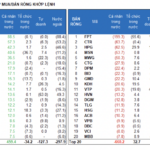

Among the 280 stocks in the red at the end of today’s session for the VN-Index, 113 declined by more than 1%. Quite a few stocks witnessed high liquidity, such as HPG, MSN, CMG, DGC, and DXG, with matching values all exceeding 100 billion VND. This group exhibited very weak recovery from their intraday lows, reflecting the overwhelming selling pressure. Stocks with lower liquidity, such as DBD, OCB, TCH, NHA, PVD, KHG, and DC4, also fell sharply but recovered much better. This is understandable because limited liquidity implies a lower selling volume. If bottom-fishing demand is strong enough, it can easily balance the market.

The group of stocks that advanced against the downtrend today did not have many notable names, as buyers mostly targeted low-priced stocks. MWG stood out in the last 30 minutes of the continuous matching period, surging by up to 2.51% and reversing to a peak of 2.17% above the reference price before retreating in the ATC period. Ultimately, MWG closed up 1.67%. The liquidity of this stock was impressive, with nearly 338 billion VND in matching value in a session that mostly saw very small transactions. VTP also attracted buying interest, especially in the afternoon session, climbing by up to 3.09% from the reference price and closing up 2.79%. VTP’s liquidity reached approximately 120.1 billion VND.

Apart from these two stocks, the remaining gainers were less prominent, either due to extremely low or poor liquidity. YEG, ANV, KDC, PAC, NTL, CSM, and PVP were the only other stocks that increased by more than 1% with a minimum liquidity of 10 billion VND.

Foreign investors also traded more balanced in the afternoon session, even turning to net buying on the HoSE with a net value of about 89 billion VND, compared to net selling of 113.3 billion VND in the morning session. There were no significant transactions. On the buying side, HDB (+58.1 billion VND), CTG (+38.3 billion VND), SSI (-34.4 billion VND), PVD (+32.4 billion VND), and PDR (+24.5 billion VND) stood out. On the net selling side, VCB (-54.2 billion VND), HPG (-37.1 billion VND), CMG (-32.1 billion VND), VPB (-20.8 billion VND), and EIB (-20.6 billion VND) were notable.

Market Beat: VN-Index Retreats to 1,240-Point Mark

The market closed with the VN-Index down 9.42 points (-0.75%) to 1,240.41, and the HNX-Index falling 0.67 points (-0.3%) to 224.62. The market breadth tilted towards decliners with 438 losers and 260 gainers. Meanwhile, the large-cap basket VN30-Index showed a dominance of red ticks as 25 stocks dropped, and only five added points.

Market Beat 05/12: Overcoming Multiple Pressures, VN-Index Surges Over 6 Points

The VN-Index faced significant pressure in the first half of the morning session, briefly dipping below the 1,240-point mark. However, a swift turnaround saw the index recover and surge past its challenges, ultimately closing 6.41 points higher at 1,246.82.

The Battle for Points: VCB and SAB Struggle, Broad Market Adjustments, and Foreigners Withdraw 690 Billion

Finally, a true correction session has arrived for investors who were sitting on the sidelines with cash in hand. The selling pressure intensified during the afternoon session, leading to a broad-based adjustment in stock prices. The VN-Index shed 9.42 points, with the number of declining stocks doubling those that advanced.

Drip Feed Selling, VN-Index Turns Green at the Last Minute, Foreigners Dump Again

Selling pressure mounted slightly in the afternoon session, pushing the VN-Index briefly into negative territory with a sea of red on the screen. However, the extremely low trading volume indicated that buyers were mostly sitting on the sidelines, and the market was quick to rebound as bottom-fishers jumped in.

Foreign Investors Net Buy for the 6th Straight Session, Heavily Buying FPT Shares

The market continues to rally despite uncertain cash flows, with today’s liquidity not exceptionally high as the three exchanges traded nearly VND 15,000 billion, including net foreign purchases of VND 359.7 billion, and matched transactions of VND 226.9 billion.