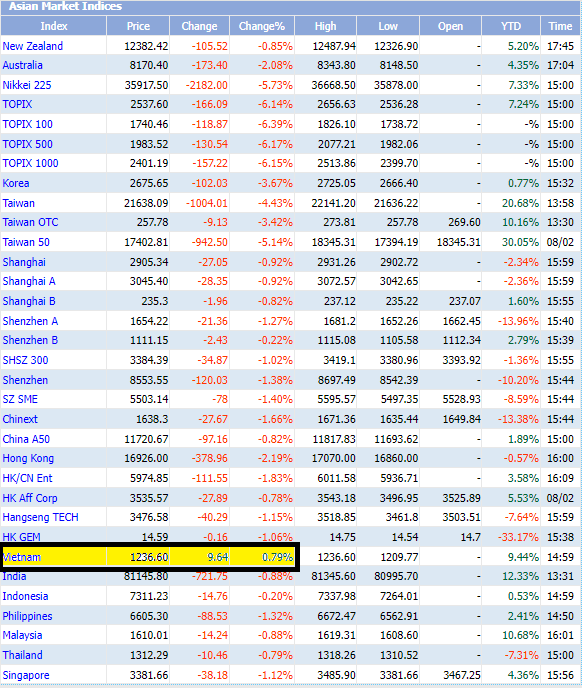

With just over a week left to officially wrap up the 2024 trading year, the VN-Index has ended the year on a positive note, recording a growth of approximately 10% compared to the end of 2023. Despite facing various risks related to exchange rates and external factors, as well as record foreign investor net selling, the market capitalization of the stock market has increased by about 15.8% from the previous year, equivalent to 67.2% of the 2023 GDP.

According to Ms. Tran Anh Dao, Deputy General Director in charge of the Management Board of the Ho Chi Minh City Stock Exchange (HoSE), this achievement can be attributed to several fundamental factors.

Firstly, the stability of the macroeconomic environment played a crucial role. The government has implemented various appropriate macroeconomic policies, including fiscal and monetary policies, such as boosting public investment, reducing taxes, maintaining stable exchange rates, lowering lending interest rates, and skillfully managing the open market.

Secondly, the recovery of the Vietnamese economy in 2024, with key sectors such as real estate, finance, information technology, and consumer goods gradually rebounding from the pandemic, along with support from newly issued mechanisms.

All sector indices on HoSE recorded significant growth, with the information technology sector index increasing by 84.8%, the consumer goods sector by 56.9%, and the financial sector by 31.1% compared to the same period in 2023. The total after-tax profit of listed companies on HoSE in the first nine months of 2024 grew by 13.97% year-on-year. Liquidity in the first nine months of 2024 on HoSE also improved, with a total trading value of over $144 billion, an increase of more than 33% compared to the same period in 2023.

Thirdly, the implementation of positive policies in the securities industry. In 2024, the focus was on enhancing the quality of listed products and supervision, ensuring transparency, and improving compliance among listed companies, investors, and the market as a whole. The quality of new listing applications and the management of listed companies were also prioritized to maintain the high standard of listed products on HoSE.

Additionally, the Ministry of Finance issued Circular No. 68/2024/TT-BTC dated September 18, 2024, amending and supplementing a number of articles of the Circulars regulating securities trading on the securities trading system, securities clearing and settlement, securities business activities, and information disclosure in the securities market. This circular addressed the prefunding issue for foreign investors and enhanced English disclosure requirements for listed and large public companies.

Overall, the VN-Index had more favorable conditions for development in 2024 compared to 2023. These factors collectively contributed to the recovery of the economy, providing a solid foundation for the growth of Vietnam’s stock market.

According to Ms. Dao, there has been a positive shift in compliance with legal information disclosure regulations by listed companies. In 2023, 175 companies were in violation and were reminded 216 times, while in 2024, the number decreased to 104 companies with 125 public reminders on the HoSE website.

HoSE, in collaboration with regulatory agencies, has implemented synchronized solutions to enhance the capacity for information disclosure of listed companies, ensuring transparency, equality, and fairness in Vietnam’s stock market. This includes the official implementation of a single-channel reporting and information disclosure system with the State Securities Commission.

Looking ahead to 2025, HoSE has outlined a strategy to drive the development of the stock market and achieve the goals set by the Government and the Ministry of Finance. This strategy encompasses five key aspects:

Firstly, ensuring the smooth, safe, and efficient operation of the information technology system, in line with the roadmap for market upgrading and reorganization as required by the regulatory body.

Secondly, accelerating digital transformation within HoSE to cater to the needs of market members and align with the Ministry of Finance’s goals and orientations for the digital transformation plan until 2025 and toward 2030.

Thirdly, enhancing the capacity and quality of supervision, maintaining market transparency, and providing support to listed companies in their information disclosure and transparency efforts.

Fourthly, promoting awareness and practices related to environmental, social, and governance (ESG) factors at HoSE and among market members, aiming for sustainable development.

Fifthly, continuing to standardize internal governance and enhancing the professional competence of business units for improved efficiency and professionalism.

The Bottom-Fishers’ Cash Flow at the 1260-point Mark, VN-Index Successfully Reversed

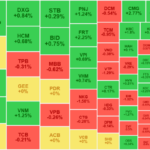

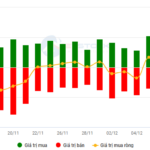

A brisk sell-off occurred at the open of the afternoon session, sending the VN-Index to an intraday low of 1,258.65 points at 1:52 pm. Bottom-fishers emerged and actively bought stocks, lifting the market and individual stocks. Turnover rose over 33% compared to the morning session.

The Little Engine That Could: Small-Cap Stocks Attracting Big Money, Liquidity Dries Up After 30 Sessions

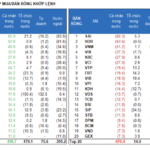

The small-cap stock group was the only gainer in terms of liquidity on the HoSE today, while the overall market traded at a 30-session low. Even the blue-chip VN30 group witnessed record-low liquidity since the beginning of the year.

The Ultimate Headline: “The Looming Threat of Market Correction: Navigating the Storm”

The VN-Index witnessed another day of decline, with a tug-of-war session accompanied by below-average trading volume. This cautious investor sentiment persists following the recent strong rally. Notably, the Stochastic Oscillator is now venturing deeper into overbought territory. Investors are advised to exercise caution in the coming days if the indicator flashes a sell signal once again.