Manufacturing operations at an FDI enterprise in Vietnam. (Photo: Tuan Anh/VNA)

|

In the latest edition of the Asian Development Outlook (ADO) report released on December 11, the Asian Development Bank (ADB) forecasts stable economic growth for Asia and the Pacific this and next year. However, anticipated policy changes in the US are likely to impact the region’s long-term prospects.

“Against a backdrop of rising external challenges, boosting public investment and supportive fiscal and monetary policies are necessary to further stimulate domestic demand,” the ADB report advised Vietnam.

On the international front, ADB analyzed that changes in US trade, fiscal, and immigration policies could dampen growth and fuel inflation in Asia and the Pacific.

As these significant policy shifts are expected to take time and be implemented gradually, their impact on the region is likely to be felt from 2026 onwards. The impact could be noticed earlier if the policies are enacted sooner and faster than anticipated or if US-based companies engage in advance imports to circumvent potential tariffs.

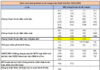

According to the report, developing Asian and Pacific economies are expected to grow by 4.9% in 2024, slightly lower than ADB’s previous forecast of 5.0% in September. The growth forecast for next year was revised down from 4.9% to 4.8%, mainly due to weaker domestic demand prospects in South Asia. Inflation projections for the region were lowered from 2.8% to 2.7% this year and from 2.9% to 2.6% next year, partly due to expected modest oil price declines.

ADB Chief Economist Albert Park commented, “Strong domestic demand and robust exports continue to drive economic growth in this region. However, policies expected to be implemented by the new US administration could slow growth and fuel inflation to some extent in China, likely beyond next year, while impacting other economies in Asia and the Pacific.”

In a high-risk scenario, ADB predicts that aggressive US policy changes could slightly dampen global economic growth by 0.5 percentage points cumulatively over the next four years. Broad-based tariffs could affect international trade and investment, leading to a shift towards more costly domestic production.

At the same time, tighter immigration controls could reduce the US labor supply. Combined with a potentially more expansionary fiscal policy stance under the upcoming Trump administration, tariffs and reduced immigration could rekindle inflationary pressures in the US. Despite the magnitude of the anticipated US policy changes, particularly on tariffs, the impact on developing Asia and the Pacific is limited in this high-risk scenario. Even without additional policy support, China’s gross domestic product growth could fall by only 0.3 percentage points on average per year through 2028. Negative spillover effects across the region, through trade and other linkages, are likely to be offset by trade diversion and production shifts from China to other economies.

In the short term, the outlook for most economies in the region remains relatively stable. China’s growth forecast was maintained at 4.8% this year and 4.5% next year. India’s outlook was revised down from 7.0% to 6.5% this year and from 7.2% to 7.0% next year due to lower-than-expected private investment growth and housing demand.

The growth outlook for Southeast Asia this year was raised to 4.7% from 4.5% previously, thanks to stronger manufacturing exports and public investment spending. The forecast for next year remains unchanged at 4.7%.

The growth outlook for Central Asia and the Pacific was raised from 4.7% to 4.9% this year and from 5.2% to 5.3% next year, while the projection for the Pacific remains unchanged at 3.4% this year and 4.1% next year.

Apart from the uncertainty surrounding US policy changes, risks to growth and inflation outlook for developing Asia and the Pacific include escalating geopolitical tensions and continued fragility in China’s real estate sector.

Prime Minister Requests SBV to Implement Stronger Measures to Reduce Lending Rates

Prime Minister Pham Minh Chinh has issued Official Dispatch No. 135/CD-TTg on December 16, 2022, emphasizing the continued strengthening of measures to regulate interest rates and credit.

Unlocking the Potential: Rediscovering Dong Trieu’s Real Estate Renaissance

Nestled in the province of Quang Ninh, Dong Trieu is blossoming like a “seed of potential”, emerging as a shining star in the economic development landscape of Northern Vietnam. Having only recently gained city status on November 1, 2024, Dong Trieu has already proven its allure, attracting astute investors who are eager to explore the opportunities that this burgeoning city has to offer.