Overcoming Year-End Business Cost Challenges

The lead-up to Tết is a bustling shopping period, especially for consumer goods, gifts, food, and decorations. This surge in production and consumption can put pressure on input costs, impacting production costs and product prices. This is especially true when the market faces adverse events such as the impact of Storm No. 3 (Yagi), which caused damage to the property and business operations of many enterprises.

“Besides racing to gather capital for production recovery after natural disasters, our company also has to carefully recalculate our production and business plans for this period to ensure cost efficiency and stimulate shopping demand from customers. Because nowadays, in addition to product quality, consumers are increasingly concerned about price and promotions when making purchasing decisions,” said Mr. V.T.T., a representative of a confectionery import and manufacturing company in Hanoi.

In addition to capital planning for production activities, this is also the peak period for enterprises to pay Tet bonuses, overtime pay, and welfare benefits to their employees, as well as expenses for internal events and festivals. Therefore, the challenge for business owners is to efficiently plan their finances to adequately reward their employees’ contributions while ensuring sufficient working capital for production and business operations.

Banks Join Hands with Businesses to Optimize Costs

Understanding the difficulties businesses face during this critical year-end business period, banks have been introducing attractive loan packages with preferential interest rates and promotional programs to support enterprises in preparing resources and stabilizing costs for accelerated business growth.

For example, to accompany customers in restoring production and business activities after storms and floods, Sacombank has implemented several programs, including reducing interest rates by up to 2% per year for existing loans, launching a VND 10,000 billion package with a minimum interest rate of 4% for new loans, and reducing service fees by up to 50% with a waiver of prepayment fees for all loans.

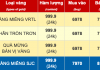

Recently, Sacombank has also launched a short-term credit package of VND 30,000 billion to help businesses boost production and business activities and stimulate the economy in Q4/2024 with preferential interest rates starting from just 4.5%.

In addition, Sacombank is offering a promotion called “Soaring Advantages – Striding towards Success” for corporate customers from now until December 31, 2024. Specifically, new corporate customers and those who resume transactions during the program period will enjoy a waiver of 9 types of fees in the Business-Plus account package for 6 consecutive months.

For new corporate customers or those who have temporarily stopped using the salary payment service, Sacombank offers a 3-year free salary payment period for businesses, along with a series of benefits for business owners and employees receiving salaries. At the same time, the bank waives the first-year annual fee for all corporate customers opening new business cards and provides a free preferred account number when customers open a payment account.

Also, in celebration of its 33rd anniversary, throughout December 2024, Sacombank is offering nearly 1,500 Bamboo Airways business-class air tickets to VIP corporate customers who meet the conditions, providing a comfortable, convenient, and classy travel experience during the busy holiday season. In addition, 330 corporate customers will receive a premium business bag when opening a new Sacombank business card (including payment cards and credit cards) and reaching the minimum eligible transaction turnover earliest. Exclusively, the top 33 customers with the highest payment card transaction turnover (minimum of VND 33 million) in the program will receive a 1-chi SBJ gold coin as a gift.

Thus, business owners can take full advantage of these bank offers and gifts to reduce costs and create a solid foundation to boost their business performance during the busiest and most vibrant season of the year.

“Eximbank Launches Exclusive Credit Package for Import-Export Businesses”

Eximbank has just launched an exceptional credit promotion program tailored for import-export businesses, featuring an attractive interest rate starting from 3.7% per year and a range of service fee waivers. This program is specially designed for SMEs and customers who have not previously had a credit relationship with Eximbank.

Helping Hands for Flood Victims: MSB Offers Reduced Interest Rates on Loans

Marine Bank Vietnam (MSB) is committed to supporting small businesses and households affected by natural disasters. We are pleased to announce a 1% reduction in interest rates on loans for eligible businesses, as we stand united in overcoming challenges and rebuilding livelihoods in the aftermath of storms and floods.

“SeABank: Elevating Sustainable Value with Exclusive Financial Privileges for Businesses”

“Putting Our Customers’ Experience First” is the guiding principle that drives SeABank’s commitment to delivering a diverse range of financial services that meet the needs of its customers. By offering a comprehensive suite of financial privileges, SeABank strives to empower both individuals and businesses, fostering sustainable growth and building strong partnerships along the way.